UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

x Filed by the Registrant ¨ Filed by a party other than the Registrant

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to 240.14a-12

M.D.C. Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

M.D.C. HOLDINGS, INC.

4350 South Monaco Street, Suite 500

Denver, Colorado 80237

March 2, 2021

Dear Fellow Shareholders,

On behalf of the Board of Directors we would like to express our appreciation for your continued investment in the Company.

The year 2020 was challenging for our nation and the world. The COVID-19 pandemic began impacting the U.S. economy in the latter part of March, and we quickly adapted our operations to serve our customers, employees, subcontractors and shareholders in the best way possible, tapping into the seasoned business judgment that has sustained us through turbulent economic periods of the past. We began experiencing a resurgence in demand in May that continued through year-end and resulted in a remarkable year for our Company. The housing industry has emerged as one of the few bright spots in our economy, and MDC enters 2021 in a position of strength thanks to our sizable backlog, our strong margin profile and our considerable liquidity position.

In 2020, the Company continued to build on more than four decades of operations during which it has become one of the leading homebuilding companies in the nation. We have grown from a net worth of $50,000 in 1972 to over $2.1 billion at the 2020 fiscal year end by providing quality homes to over 210,000 families – all while persevering through housing cycles over the years. Highlights of the Company’s financial and operational performance include:

|

|

|

|

|

|

|

|

|

DEDICATED TO SHAREHOLDER RETURNS

•Total shareholder return for 2020 exceeded 30% as we approach the 50th anniversary of our founding;

•Continuous and uninterrupted cash dividend since 1994 (unequaled by any member of our peer group);

•Increased cash dividend by 21% in October 2020;

•Declared an 8% stock dividend in January 2021.

|

|

|

REMARKABLE OPERATING RESULTS

•Home sale revenues of $3.77 billion, which was $560 million higher than 2019 (+17%);

◦Unit deliveries grew 17% to 8,158 from 6,974;

•Gross margin from home sales increased 200 basis points to 20.8% from 18.8%;

•Pretax income of $457.5 million was $152.5 million higher than 2019 (+50%);

•Dollar value of net new orders increased 56% to $5.46 billion from $3.50 billion.

|

|

|

POSITIONED FOR CONTINUED GROWTH

•Backlog value of homes sold but not closed at the end of 2020 grew to $3.26 billion (+87%);

◦Highest year-end backlog dollar value ever;

•Active subdivision count grew by 5% year-over-year to 194;

•Total lot supply to end 2020 was 8% higher than 2019

•Approval of 154 land transactions covering more than 13,000 lots (approximately 68% are approved for our more affordable product offerings).

|

STEADFAST FOCUS ON BALANCE SHEET STRENGTH

•Expanded our homebuilding line of credit by $200 million to $1.2 billion (+20%);

•Issued $350 million of 10-year senior notes in January 2021 at a record-low 2.5% interest rate;

•Rating outlook raised to positive from stable by S&P Global Ratings in October 2020;

•Upgraded Corporate Family Rating raised to Ba1 from Ba2 by Moody's Investors Services in November 2020.

ONGOING COMMITMENT TO SOUND GOVERNANCE AND SUSTAINABLE BUSINESS PRACTICES

As we enter 2021, we seek to leverage the core principles and practices that we attribute to past achievements, while welcoming new perspectives that allow our organization to evolve with a changing environmental and economic landscape. We are excited about the opportunities available to our Company, and we will maintain our longstanding focus on balancing environmental and social concerns with business fundamentals. Striking this balance is not only a matter of conscience, but key to maximizing long-term shareholder success. Growing and maintaining a sustainable business goes hand in hand with fostering an environment where that business can flourish.

PROMOTING DIVERSITY IN LEADERSHIP

One major way to build a solid foundation for continued success is through a commitment to advancing leadership and increasing diversity. In October, we announced many exciting promotions designed to leverage new perspectives and position us for growth. David Viger, now an experienced executive after starting as a superintendent many years ago, was named Chief Operating Officer for our homebuilding operations. Other promotions included Staci Woolsey’s step up to Chief Accounting Officer and Rebecca Givens’ move to Senior Vice President and General Counsel of MDC. Dawn Huth was also promoted to Senior Vice President of National Finance and Anthony Berris is now President of Financial Services.

Strong, diverse leaders are only one piece of the puzzle. Our corporate governance and sustainable business practices are vital to creating an environment where we can effectively achieve long-term financial success. With climate concerns on the forefront, an investment in the environment is an investment back into our company, employees and shareholders. Richmond American is dedicated to developments that are sensitive to maintaining the integrity of our environment by designing neighborhoods that include generous open spaces, greenbelts and newly planted trees and foliage. Every one of our homes comes standard with energy-efficient features that help cut down energy usage. Since the introduction of our Energy Wise program in 2009, we have offered both standard and optional features that help cut down on energy usage, reduce waste and promote a healthy environment.

SUPPORTING OUR LOCAL COMMUNITIES

On the philanthropic side, the MDC/Richmond American Homes Foundation was created more than twenty years ago and is committed to building stronger communities near and far. We believe that our history of success translates to a responsibility to make a difference in the regions where we operate. What we contribute to the greater economy when we build new homes and neighborhoods coincides with what we do to build up a broader community in which our employees and homebuyers can thrive. Nonprofit endeavors that the MDC/Richmond American Homes Foundation supports are wide-ranging in scope, selected to promote diversity, education, mental health and so much more.

COMMITTED TO SUPPORTING OUR EMPLOYEES

While we have always prioritized the health and welfare of our employees, we would be remiss not to mention the additional measures taken in 2020 to help limit the spread of COVID-19, both in the field and at the corporate office. The safety and comfort of home has become more important than ever before and we do not take our increased responsibility as homebuilders lightly.

We are confident that our shareholders are aligned with our vision for long-term growth, success and contribution to a greater community. On behalf of the full Board of Directors, we strongly encourage you to vote your shares – your vote and support are valuable elements in our passion to succeed.

|

|

|

|

|

|

|

|

|

Larry A. Mizel

Executive Chairman

M.D.C. Holdings, Inc.

|

M.D.C. HOLDINGS, INC.

4350 South Monaco Street, Suite 500

Denver, Colorado 80237

|

|

|

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

To Our Shareholders:

The 2021 Annual Meeting of Shareholders (the "Meeting") of M.D.C. Holdings, Inc. (the "Company") will be held virtually by live audio webcast, on Monday, April 26, 2021, at 10:00 a.m., Mountain Time. Only shareholders of record at the close of business on February 26, 2021, the record date, will be entitled to vote. At the Meeting, we plan to consider and act upon the following matters:

1.The election of Raymond T. Baker, David E. Blackford and Courtney L. Mizel as Class III Directors for three-year terms expiring in 2024;

2.A non-binding advisory vote to approve the compensation of our named executive officers disclosed in this proxy statement (Say on Pay);

3.Approval of the M.D.C. Holdings, Inc. 2021 Equity Incentive Plan; and

4.Ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the 2021 fiscal year.

And such other business as properly may come before the Meeting and any postponements or adjournments thereof.

Our Board of Directors recommends that you vote FOR all Proposals.

In light of COVID-19 and for the safety of our shareholders, employees, and other members of the community, our 2021 Annual Shareholders' Meeting will be held in a virtual format only. Shareholders can attend from any geographic location with Internet connectivity. We believe this is an important step to enhancing accessibility to our Meeting for all of our shareholders and reducing the carbon footprint of our activities, and is particularly important this year in light of public health and safety considerations posed by COVID-19. Shareholders may attend the live audio webcast of the Meeting and submit questions digitally during the meeting at www.virtualshareholdermeeting.com/MDC2021. Please refer to the "Who is entitled to vote at or attend the Meeting" section of the Proxy Statement for more details.

Management and the Board of Directors desire to have maximum representation at the Meeting and request that you vote promptly, even if you plan to attend the virtual meeting.

|

|

|

|

|

BY ORDER OF THE BOARD OF DIRECTORS,

|

|

|

|

Joseph H. Fretz

Secretary

|

Denver, Colorado

March 2, 2021

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to Be Held on April 26, 2021:

The Proxy Statement and the Annual Report on Form 10-K are available at:

https://mdc-holdings-inc.ir.rdgfilings.com/

Important Voting Information

Under New York Stock Exchange rules, unless you provide specific instructions, your broker is not permitted to vote on your behalf on the election of Directors or on proposals other than ratification of the selection of the Company’s auditors. It is important that you provide specific instructions by completing and returning the broker’s Voting Instruction Form or following the instructions provided to you to vote your shares by telephone or the Internet.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPENDIX A – M.D.C. HOLDINGS, INC. 2021 EQUITY INCENTIVE PLAN

|

|

M.D.C. HOLDINGS, INC.

4350 South Monaco Street, Suite 500

Denver, Colorado 80237

_____________

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

April 26, 2021

___________

COMMITMENT TO SOUND ENVIRONMENTAL, SOCIAL AND GOVERNANCE PRACTICES

|

|

|

|

|

|

|

|

|

|

|

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) HIGHLIGHTS

|

|

Environment and Climate Change

ir.richmondamerican.com/environmental

|

|

Every Richmond American home comes standard with energy efficient features that help cut down on energy usage.

|

|

|

In 2020, our average HERS rating improved by 8% to 55, 75 percent more energy efficient than a typical resale home.

|

|

|

Goal of decreasing our average HERS rating to 50 or less within the next five years. Longer term, we are evaluating the implementation of a net-zero ready home strategy.

|

|

Human Capital

ir.richmondamerican.com/socialoutreach

|

|

Committed to fostering and promoting a diverse and inclusive work environment.

|

|

|

Diverse employee base comprising 24% non-white employees and 47% female employees; 43% of employees in a position of manager and above are female.

|

|

|

Competitive benefits package including medical coverage, paid time off and 401(k) match.

|

|

Social Responsibility

ir.richmondamerican.com/socialoutreach

|

|

The Company has donated nearly $10 million to the MDC/Richmond American Homes Foundation in the last five years.

|

|

|

In 2020, 56% of the new homes we delivered were from one of our more affordable homes series. Since, 2017 we have increased the number of more affordable homes delivered by nearly 200%.

|

|

Governance

ir.richmondamerican.com/corporategovernance

|

|

Engaged and experienced Board of Directors actively participate in 12 regular meetings per year. Our non-management directors have an average tenure of 11.9 years.

|

|

|

Our Code of Conduct training takes place for all employees at the time of hire, as well as for all employees and directors on an annual basis. Topics covered include business ethics, conflicts of interest and appropriate standards of workplace conduct.

|

|

|

Focus on succession planning, including recent promotions of an increasingly diverse senior leadership team.

|

|

|

Formal procedure in place for confidential reporting of any suspected violations of law.

|

As a leader in the homebuilding industry, we have a responsibility to conduct our operations in a socially and environmentally acceptable manner. Not only is this an obligation, but it is also sound business that drives long-term value creation. In order to maintain our tradition of building attractive, affordable and desirable homes, we must be focused on preserving the integrity and quality of our local neighborhoods. To illustrate that effort, select areas of environmental and social emphasis by the Company’s Board of Directors and management team are briefly summarized below. Our Board is committed to further study and develop a set of additional initiatives to better assure the sustainability of our communities and the environment in which we operate.

|

|

|

|

The approximate date on which this Proxy Statement and the form of Proxy

are first being sent to shareholders is March 5, 2021.

|

Environment and Climate Change

We promote energy efficiency, water conservation, healthier indoor environments and waste reduction. We are proud to be an industry leader in working to protect the quality of our environment through our efforts to reduce energy consumption. Our homes are designed with standard energy efficient features as described below.

|

|

|

|

|

Energy efficiency features

Every Richmond American home comes standard with energy-efficient features that help cut down energy usage. Since the introduction of our Energy Wise program in 2009, the Richmond American companies in each region have offered both standard and optional features that help cut down on energy usage, reduce waste, and promote a healthy environment. National features include:

|

Our homes are rated for energy efficiency using the Home Energy Rating System (“HERS”). In 2020 alone, our average HERS Index rating improved by 8% to 55, 75 percent more energy efficient than a typical resale home. Further, our offering of high-efficiency solar power systems, in select markets, generate much of a home’s annual expected energy needs. We have and will continue to use our nationwide purchasing power to explore offering low cost solar and other alternative energy options to our home buyers. We continue to expand our use of high energy efficient appliances and low chemical carpeting and floor coverings. We have a goal of decreasing our average HERS rating to 50 or less within the next five (5) years. Longer term, we are evaluating the implementation of a net-zero ready home strategy.

|

|

|

|

|

How our homes are rated

Working toward greater home energy efficiency starts with measuring energy performance, making improvements and continuing to rate and adjust. The Richmond American companies use the HERS® Index to gauge a home's comparative energy efficiency. HERS stands for Home Energy Rating System, a system created by The Residential Energy Services Network (RESNET®), an industry standard for rating home energy efficiency. A third-party RESNET-certified home energy rater assesses the energy efficiency of every new Richmond American home, assigning it a relative performance score.

|

|

|

|

|

|

Our HERS scores

The current average HERS score for homes built by Richmond American Homes companies in 2020 is 55, a much lower score than a typical resale home. In fact, our current homes are on average 75% more efficient than typical resale homes according to the HERS Index. We lowered our national average HERS rating by 10 points between 2013 and 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

National Average HERS Index by Year

|

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

|

65

|

62

|

61

|

60

|

62

|

63

|

60

|

55

|

Additionally, MDC, like other homebuilders, also plays an important role in the conservation of protected animal and plant species, including those listed under the Endangered Species Act (ESA). We cause to be performed biological impact and other ecological studies to determine the proximity of endangered species to our communities and take precautions to prevent or minimize adverse impacts to any species identified in such studies. We also are committed to preserving or replacing any wetlands that may be impacted by our construction activities, and to expanding green space available to our homebuyers.

Sustainable Forestry

As a major purchaser of wood, MDC specifies wood products that are not only cost-effective for our homebuyers, but which primarily are from new and high-growth forests or harvested from specific tree farms used by the building industry. Our wood varieties typically are new softwoods and firs, which most often come from inland areas of the western U.S., not the coastal areas that are populated by the endangered redwoods and other old growth species.

+ This information is presented for educational and illustration purposes only.

++ Typical resale home is based on the U.S. Department of Energy definition with a HERS® index of 130.

+++ Standard new home is based on the RESNET® Reference Home definition with a HERS® index of 100 (based on the 2006 International Energy Conservation Code). The Vendor registered trademark set forth above is the property of the owner, who is not affiliated with, connected to or sponsored by the Richmond American Homes companies. The vendor listed has provided consideration to Richmond American Homes Corporation for marketing services.

3

Health and Safety

MDC has an excellent safety record that underscores the Company’s commitment to worker safety. Examples of our safety practices include:

•MDC maintains a job site Safety Policy. We encourage our superintendents to be trained on this policy in order to guard against infractions on his or her job site. If an incident does occur, the superintendent is required to report it to the appropriate authorities in the Company.

•In addition to job sites, our Company has a policy to provide for the safety and security of all employees, customers, visitors, and Company property. Acts or threats of violence, including intimidation, harassment, or coercion, which involve or affect the Company or which occur on Company property or during the course of the Company's business are not tolerated.

•In order to perform tasks for the Company, subcontractors must supply us with evidence of their written safety program before becoming an approved vendor, and they must adhere to all health and safety policies of the Company, including but not limited to standards set by OSHA.

•In response to the COVID-19 pandemic, we implemented safety protocols and procedures to protect our employees, our subcontractors and our customers. These protocols include complying with social distancing and other health and safety standards as mandated by state and local government agencies, taking into consideration guidance from the Centers for Disease Control and Prevention and other public health authorities.

Increasingly Diverse Senior Management Team as a Part of Succession Planning

A dedication to diversifying leadership means women are rising in the ranks. Not only were the last two board members women, but women are in key leadership roles across the organization. The promotions highlighted below, in addition to the appointment of Larry A. Mizel as Executive Chairman and David D. Mandarich as President and Chief Executive Officer, were a part of the reorganization of the Company's senior leadership in connection with succession planning.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rebecca Givens

Senior Vice President and General Counsel

|

|

Staci Woolsey

Chief Accounting Officer

|

|

David Viger

Chief Operating Officer, Richmond American Homes

|

|

|

|

Anthony Berris

President of Financial Services

|

|

Dawn Huth

Senior Vice President of National Finance

|

|

Community

The Company takes seriously its responsibility to fortify the communities in which its homebuilding subsidiaries operate. Since 2015 alone, the Company has donated nearly $10 million to the MDC/Richmond American Homes Foundation, a Delaware not-for-profit corporation. The Foundation has supported numerous charitable efforts in communities served by the Richmond American Homes companies, which support survivors of domestic violence, support arts and culture, promote quality healthcare, support youth, assist foster children, fight hunger, support public servants, help the homeless and others in need, and promote wellness.

Affordability

Affordable home ownership is an increasing challenge throughout the United States and in the areas in which we operate. Our Company is among the leaders in building more affordable homes. Indeed, providing more affordable homes is a major part of our business strategy. For example:

•A majority of the lots we own or control are targeted for the construction of more affordable homes.

•In 2020, 56% of the new homes we delivered were from one of our more affordable homes series. Since 2017, we have increased the number of more affordable homes delivered by nearly 200%.

GENERAL INFORMATION

Why am I receiving these materials?

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the "Board of Directors" or the "Board") of M.D.C. Holdings, Inc. (the "Company") to be used at the Annual Meeting of Shareholders of the Company (the "Meeting") to be held virtually by audio webcast, on Monday, April 26, 2021, at 10:00 a.m., Mountain Time and at www.virtualshareholdermeeting.com/MDC2021, including any postponements or adjournments thereof. The record date for determining shareholders entitled to vote at the Meeting is February 26, 2021 (the “Record Date”). The Meeting is being held for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. Our shareholders are invited to attend the Meeting and are encouraged to vote on the matters described in this Proxy Statement.

What proxy materials are being delivered?

We are utilizing the rules of the Securities and Exchange Commission ("SEC") that allow us to deliver proxy materials to our shareholders on the Internet. Under these rules, we are sending many of our shareholders a Notice of Internet Availability of Proxy Materials (the "Notice") instead of a full set of proxy materials. If you receive the Notice, you will not receive printed copies of the proxy materials unless you specifically request them. Instead, the Notice tells you how to access and review on the Internet all of the important information contained in the proxy materials. The Notice also tells you how to vote your proxy card on the Internet and how to request a printed copy of our proxy materials. We expect to mail, or provide the Notice and electronic delivery of, this Proxy Statement, the proxy card and the Notice of Annual Meeting (the "Proxy Materials") on or about March 5, 2021.

The Company's 2020 Annual Report on Form 10-K, which includes the Company's 2020 audited financial statements, will accompany these Proxy Materials. Except to the extent expressly referenced in this Proxy Statement, the Annual Report is not incorporated into this Proxy Statement.

Who is paying for this proxy solicitation?

The Company will pay the cost of solicitation. The Company also will reimburse bankers, brokers and others holding shares in their names or in the names of nominees or otherwise for reasonable out-of-pocket expenses incurred in sending the Proxy Materials to the beneficial owners of such shares. In addition to the original solicitation of proxies, solicitations may be made in person, by telephone or by other means of communication by directors, officers and employees of the Company, who will not be paid any additional compensation for these activities.

We have retained the services of Alliance Advisors, LLC to solicit proxies. We will pay all reasonable costs associated with such firm, which we anticipate will cost approximately $10,000 plus costs and expenses.

Who is entitled to vote at or attend the Meeting?

Holders of shares of the Company's common stock, $.01 par value, at the close of business on the Record Date are entitled to notice of, and to vote at, the Meeting. We are conducting a Meeting so our shareholders can attend from any geographic location with Internet connectivity. To attend the Meeting, including to vote and to view the list of registered shareholders as of the record date during the meeting, you must access the meeting website at www.virtualshareholdermeeting.com/MDC2021 and enter the 16-digit control number found on the Notice of Internet Availability of Proxy Materials or on the proxy card or voting instruction form provided to you. A shareholder list is available in advance of the Meeting by contacting investor relations at IR@mdch.com.

Whether or not you plan to attend the Meeting, it is important that your shares be represented and voted. We encourage you to vote your shares in advance of the Meeting.

Shareholders will be able to submit questions for the question and answer session following the meeting through www.virtualshareholdermeeting.com/MDC2021. Additional information regarding the rules and procedures for participating in the Meeting will be set forth in our meeting rules of conduct, which shareholders can view during the meeting at the meeting website.

We encourage you to access the Meeting website before the meeting begins. Online check-in will be available at www.virtualshareholdermeeting.com/MDC2021 approximately 15 minutes before the meeting starts on April 26, 2021. If you have difficulty accessing the meeting, please call the technical support number on the meeting page.

Shareholders will have sufficient time immediately following the Meeting to ask questions of and have a dialogue with the Company’s Executive Chairman, President and Chief Executive Officer, Chief Financial Officer and each of the members of the Board of Directors in attendance.

Shareholders of Record. If, on the Record Date, your shares were registered directly in your name with the Company's transfer agent, Continental Stock Transfer & Trust Company, then you are a shareholder of record. As a shareholder of record, you may vote at the Meeting or vote by proxy.

Beneficial Owners. If, on the Record Date, your shares were not held in your name, but rather were held in an account at a brokerage firm, bank or other nominee (commonly referred to as being held in "street name"), or through our 401(k) savings plan, you are the beneficial owner of those shares. The organization holding your account is considered to be the shareholder of record for purposes of voting at the Meeting. As a beneficial owner, you have the right to direct your broker or other nominee regarding how to vote the shares held in your account. You are also invited to attend the Meeting. However, since you are not the shareholder of record, you may not vote your shares in person at the Meeting unless you make arrangements with your broker or other nominee to do so. (For shares held through our 401(k) savings plan, you must vote those shares as provided below.) If you want to attend the Meeting, but not vote at the Meeting, please see the information provided above.

How do I vote my shares?

By Telephone or the Internet. Shareholders can vote their shares via telephone or the Internet as instructed in the Notice of Internet Availability of Proxy Materials. The telephone and Internet procedures are designed to authenticate a shareholder's identity, allow shareholders to vote their shares and confirm that their instructions have been properly recorded. The telephone and Internet voting facilities will close at 11:59 p.m., Eastern Time, on April 25, 2021. (Participants in our 401(k) savings plan have an earlier deadline – see below.)

By Mail. Shareholders who receive a paper proxy card may vote by mail and should complete, sign and date their proxy card and mail it in the pre-addressed envelope that accompanied the delivery of the paper proxy card. Proxy cards submitted by mail must be received by the time of the Meeting in order for your shares to be voted. Beneficial shareholders (shares held in street name) may vote by mail by requesting a paper proxy card according to the instructions received from their broker or other agent, and then completing, signing and dating the voting instruction card provided by the broker or other agent and mailing it in the pre-addressed envelope provided.

401(k) Savings Plan. If your shares are held through our 401(k) savings plan, you will receive the Notice of Internet Availability of Proxy Materials, or copies of the Proxy Materials, and you are entitled to instruct the plan trustee how to vote the shares allocated to your account following the instructions described above. You must provide your instructions no later than 11:59 p.m., Eastern Time, on April 21, 2021.

At the Meeting. Shares held in your name as the shareholder of record may be voted by you online during the Meeting at www.virtualshareholdermeeting.com/MDC2021. Shares held beneficially in street name may be voted by you in person at the Meeting only if you make prior arrangements with the broker or other agent that holds your shares, giving you the ability to vote the shares.

What if I receive more than one Notice of Internet Availability of Proxy Materials?

If you receive more than one Notice, you hold shares in more than one name or shares in different accounts. To ensure that all of your shares are voted, you will need to vote separately by telephone or the Internet using the specific control number contained in each Notice that you receive.

Can I change my vote or revoke my proxy?

You can change your vote or revoke your proxy before the Meeting. You can do this by casting a later proxy through any of the available methods described above. If you are a shareholder of record, you can also revoke your proxy by delivering written notice of revocation to the Secretary of the Company, by presenting to the Company a later‑dated proxy card executed by the person executing the prior proxy card or by attending the Meeting and voting. If you are a beneficial owner, you can revoke your proxy by following the instructions sent to you by your broker, bank or other agent.

How are votes counted?

Shares of common stock represented by properly executed proxy cards, or voted by proxy, by telephone or the Internet, and received in time for the Meeting will be voted in accordance with the instructions specified in the proxies. Unless contrary instructions are indicated in a proxy, the shares of common stock represented by such proxy will be voted FOR the election as directors of the nominees named in this Proxy Statement and FOR all of the other proposals. If you grant a proxy (other than for shares held in our 401(k) savings plan), either of the officers named as proxy holders, Rebecca B. Givens and Joseph H. Fretz, or their nominees or substitutes, will have the discretion to vote your shares on any additional matters that are properly presented for a vote at the Meeting or at any adjournment or postponement that may take place. If, for any unforeseen reason, any of our nominees is not available as a candidate for director, the persons named as the proxy holder may vote your proxy for another candidate or other candidates nominated by our Board.

The trustee of the 401(k) savings plan will vote the number of shares of common stock allocated to each participant’s accounts as directed by the participant if the direction is received in time to be processed. The trustee will vote any shares with respect to which it does not receive timely directions so that the proportion of the shares voted in any particular manner on any matter is the same as the proportion of the shares with respect to which the trustee has received timely directions, unless contrary to ERISA.

The inspector of elections designated by the Company will use procedures consistent with Delaware law concerning the voting of shares, the determination of the presence of a quorum and the determination of the outcome of each matter submitted for a vote.

What are the voting entitlements and requirements?

Each share of common stock issued and outstanding on the Record Date, other than shares held by the Company or a subsidiary, is entitled to one vote on each matter presented at the Meeting. As of the Record Date, approximately 65,072,429 shares of common stock were issued, outstanding and entitled to vote.

The Company's By-Laws provide that the holders of one-third of the shares of common stock issued and outstanding and entitled to vote, present in person or represented by proxy, constitute a quorum for transacting business at the Meeting. Shareholders who are present in person or represented by proxy, whether they vote for, against or abstain from voting on any matter, will be counted for purposes of determining whether a quorum exists. Broker non-votes, described below, also will be counted as present for purposes of determining whether a quorum exists.

The affirmative vote of the holders of a plurality of the shares of common stock present in person or represented by proxy and entitled to vote at the Meeting will be required for the election of a nominee to the Board of Directors (which means that the three nominees who receive the most votes will be elected).

The affirmative vote of the holders of a majority of the shares of Common Stock represented and entitled to vote at the Meeting is necessary to (1) approve, on an advisory basis, the executive compensation practices disclosed in this proxy statement; (2) approve the 2021 Equity Incentive Plan; and (3) ratify the appointment of the Company’s auditor. Because your vote on executive compensation is advisory, it will not be binding upon the Company.

Rules of the New York Stock Exchange (“NYSE”) determine whether NYSE member organizations ("brokers") holding shares for an owner in street name may vote on a proposal without specific voting instructions from the owner. For certain types of proposals, the NYSE has ruled that the “broker may vote” without specific instructions and on other types of proposals the “broker may not vote” without specific client instructions. A "broker non-vote" occurs when a proxy is received from a broker and the broker has not voted with respect to a particular proposal. The proposal to ratify the selection of the auditor is a “broker may vote” matter under the rules of the NYSE. As a result, brokers holding shares for an owner in street name may vote on the proposal even if no voting instructions are provided by the beneficial owner. The other proposals are “broker may not vote” matters. As a result, brokers holding shares for an owner in street name may vote on these proposals only if voting instructions are provided by the beneficial owner.

The following table reflects the vote required for the proposals and the effect of broker non-votes, withhold votes and abstentions on the vote, assuming a quorum is present at the Meeting:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal

|

|

Vote Required

|

|

Effect of Broker Non-Votes, Withhold Votes and Abstentions

|

|

1.

|

Election of Directors

|

|

The three nominees who receive the most votes will be elected.

|

|

Broker non-votes and withhold votes have no effect.

|

|

2.

|

Advisory vote to approve executive compensation (Say on Pay)

|

|

Affirmative vote of the holders of a majority of the shares of common stock represented and entitled to vote at the Meeting.

|

|

Broker non-votes have no effect; abstentions have the same effect as a vote against the proposal.

|

|

3.

|

Approval of the 2021 Equity Incentive Plan

|

|

Affirmative vote of the holders of a majority of the shares of common stock represented and entitled to vote at the Meeting.

|

|

Broker non-votes have no effect; abstentions have the same effect as a vote against the proposal.

|

|

4.

|

Selection of Auditor

|

|

Affirmative vote of the holders of a majority of the shares of common stock represented and entitled to vote at the Meeting.

|

|

Abstentions have the same effect as a vote against the proposal.

|

Management and the Board of Directors of the Company know of no other matters to be brought before the Meeting. If any other proposals are properly presented to the shareholders at the Meeting, the number of votes required for approval will depend on the nature of the proposal. Generally, under Delaware law and our By-Laws, the number of votes required to approve a proposal is the affirmative vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote at the Meeting. The proxy card gives discretionary authority to the proxy holders to vote on any matter not included in this Proxy Statement that is properly presented to the shareholders at the Meeting and any adjournments or postponements thereof. The persons named as proxies on the proxy card are Rebecca B. Givens, the Company's Senior Vice President and General Counsel, and Joseph H. Fretz, the Company’s Secretary and Corporate Counsel.

DELIVERY OF PROXY MATERIALS TO SHAREHOLDERS WITH SHARED ADDRESSES

The broker, bank or other nominee of any shareholder who is a beneficial owner, but not the record holder, of the Company's common stock may deliver only one copy of the proxy related materials to multiple shareholders sharing an address (a practice called "householding"), unless the broker, bank or nominee has received contrary instructions from one or more of the shareholders.

In addition, with respect to shareholders of record, in some cases, only one copy of the proxy related materials may be delivered to multiple shareholders sharing an address, unless the Company has received contrary instructions from one or more of the shareholders. Upon written or oral request, the Company will deliver free of charge a separate copy of each of the proxy related materials, as applicable, to a shareholder at a shared address to which a single copy was delivered. You can notify your broker, bank or other nominee (if you are not the record holder) or the Company (if you are the record holder) that you wish to receive a separate copy of such materials in the future, or alternatively, that you wish to receive a single copy of the materials instead of multiple copies. The Company's contact information for these purposes is: M.D.C. Holdings, Inc., telephone number: (303) 773-1100, Attn: Corporate Secretary, 4350 South Monaco Street, Suite 500, Denver, CO 80237.

ANNUAL REPORT ON FORM 10-K

The Company will provide without charge to each person solicited by this Proxy Statement, upon the request of that person, a copy of our Annual Report on Form 10-K (without exhibits) for our most recent fiscal year. Please direct that request in writing to Investor Relations, M.D.C. Holdings, Inc., 4350 S. Monaco Street, Denver, Colorado 80237.

|

|

|

|

|

|

|

|

PROPOSAL ONE

|

ELECTION OF DIRECTORS

|

The Company's Certificate of Incorporation provides for three classes of directors (“Directors”) with staggered terms of office, to be divided as equally as possible. Directors of each class serve for terms of three years until election and qualification of their successors or until their resignation, death, disqualification or removal from office.

Our Board has ten members, consisting of four Class I Directors whose terms expire in 2022, three Class II Directors whose terms expire in 2023 and three Class III Directors whose terms expire in 2021. At the Meeting, three Class III Directors are to be elected to three‑year terms expiring in 2024. The nominees for the Class III Directors are Raymond T. Baker, David E. Blackford and Courtney L. Mizel. All of the nominees presently serve on the Board of Directors of the Company. Based on the recommendation of the Corporate Governance/Nominating Committee, the Board approved the nomination of Mr. Baker, Mr. Blackford and Ms. Mizel for election as Class III Directors at the 2021 Annual Meeting.

Certain information, as of February 26, 2021, the Record Date, with respect to Mr. Baker, Mr. Blackford and Ms. Mizel, the nominees for election, and the continuing Directors of the Company, furnished in part by each such person, appears below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Age

|

Independent

|

Positions and Offices with the Company

and Other Principal Occupations

|

Committee Memberships

|

|

NOMINEES:

|

Audit

|

Compensation

|

Corporate

Governance /

Nominating

|

Legal

|

|

|

|

Class III: Terms Expire in 2021

|

|

|

|

|

|

Raymond T. Baker

|

70

|

ü

|

President of Gold Crown Management Company and Co-Director of the Gold Crown Foundation

|

|

C

|

|

|

|

David E. Blackford

|

71

|

ü

|

Executive Chairman of California Bank & Trust

|

|

|

M

|

M

|

|

Courtney L. Mizel

|

47

|

|

Attorney, Principal, Mizel Consulting and Community Philanthropy

|

|

|

|

M

|

|

CONTINUING DIRECTORS:

|

|

|

|

|

|

|

|

Class I: Terms Expire in 2022

|

|

|

|

|

|

Michael A. Berman

|

70

|

ü

|

Chairman, Applied Capital Management

|

M

|

|

|

|

|

Herbert T. Buchwald

|

89

|

ü

|

Principal in the law firm of Herbert T. Buchwald, P.A. and President and Chairman of the Board of Directors of BPR Management Corporation

|

M

|

M

|

M

|

C

|

|

Larry A. Mizel

|

78

|

|

Executive Chairman of the Company

|

|

|

|

|

|

Leslie B. Fox

|

62

|

ü

|

Real estate advisor and Community Philanthropy

|

M

|

|

|

|

|

|

|

Class II: Terms Expire in 2023

|

|

|

|

|

|

David D. Mandarich

|

73

|

|

President and Chief Executive Officer of the Company

|

|

|

|

|

|

Paris G. Reece III

|

66

|

ü

|

Private Investor and Community Philanthropy

|

C

|

|

|

|

|

David Siegel

|

64

|

ü

|

Private Investor and Former Partner, Irell & Manella LLP (retired)

|

|

|

C

|

M

|

C = Chair; M = Member

The following is a brief description of the business experience during at least the past five years of each nominee for the Board of Directors of the Company and each of the continuing members of the Board. Their experience, qualifications, attributes or skills, set forth below, have led to the conclusion that each person should serve as a Director, in light of the Company’s business and structure.

None of the business organizations identified below (excluding HomeAmerican Mortgage Corporation) are affiliates of the Company. Other than for Ms. Fox, who until January 2021 was a member of the Board of Directors of Front Yard Residential Corporation, a Maryland corporation (NYSE: RESI), none of the continuing Directors or Director nominees holds, or has held during the past five years, any directorship in any company with a class of securities registered pursuant to Section 12 of the Exchange Act, subject to the requirements of Section 15(d) of the Exchange Act or registered as an investment company under the Investment Company Act of 1940.

Class III Directors: Terms Expire in 2021

|

|

|

|

|

|

|

|

Raymond T. Baker

|

Raymond T. Baker has served as President of Gold Crown Management Company, a real estate asset management company, from 1978 to present. He is the founder and has served as Co-Director of the Gold Crown Foundation since 1986. He also is a member of the Board of Directors of Alpine Banks of Colorado and Land Title Guarantee Company. Mr. Baker is currently serving as Chairman of the Board of the Denver Metropolitan Major League Baseball Stadium District and Chairman of the Board of the Metropolitan Football Stadium District (Denver). From February 2004 until May 2007, he served as a director of Central Parking Corporation. He has over thirty-five years of experience in the real estate and banking industries. Mr. Baker became a member of the Company's Board of Directors in January 2012. His experience and knowledge of the real estate and banking industries directly complement and support the Company’s real estate activities and the financing of those activities.

|

|

|

|

Director Since: 2012

Committee Memberships:

●Compensation Committee Chairman

|

|

|

|

|

|

|

|

|

David E. Blackford

|

David E. Blackford has over thirty-five years experience in the banking industry. He is employed by California Bank & Trust (CB&T), a leading California banking institution and a division of Zions Bancorporation, National Association. Between 1998 and 2001, he was CB&T’s managing director, serving on the Board of Directors and the Senior Loan Committee for Real Estate Finance. In May 2001 he was appointed chairman, president and chief executive officer of CB&T, and currently serves as executive chairman. He also is an executive vice president of Zions Bancorporation, National Association. Prior to 1998, he served as an executive officer in several financial institutions, including Bank One and Valley National Bank. He joined the Company's Board of Directors in April 2001. His experience and knowledge of historic and current institutional real estate lending practices, the regulatory process and the volatility of the credit markets provide a unique perspective to the Board.

|

|

|

|

Director Since: 2001

Committee Memberships:

●Corporate Governance/

Nominating Committee

●Legal Committee

|

|

|

|

|

|

|

|

|

Courtney L. Mizel

|

Courtney L. Mizel is a Principal at Mizel Consulting where she has worked for over twenty years. In this role, Ms. Mizel consults with companies in various industries on matters relating to their business management and strategy, including operations, business development, marketing, as well as legal matters. She is also a Founding Director of The Counterterrorism Education Learning Lab, an organization dedicated to preventing terrorism through education, empowerment, and engagement. She is active in a number of other non-profit activities, including serving on the Boards of Directors of Zimmer Children’s Museum, Sharsheret National, and JQ International. Ms. Mizel received her Bachelor of Science in Economics with honors from The Wharton School of the University of Pennsylvania and her Juris Doctor from the University of Southern California Gould School of Law. Ms. Mizel became a member of the Company's Board of Directors in June 2017. She is the daughter of the Company’s Executive Chairman, Larry A. Mizel. Ms. Mizel’s professional and business achievements, intellect and diverse experiences contribute to the business, governance and legal perspectives of the Board.

|

|

|

Director Since: 2017

Committee Memberships:

●Legal Committee

|

Class I Directors: Terms Expire in 2022

|

|

|

|

|

|

|

|

Larry A. Mizel

Executive Chairman

|

Larry A. Mizel founded the Company in 1972 and has served as a Director since its inception. He was appointed Chairman of the Board in 1972 and Chief Executive Officer of the Company in 1988. Then, in October 2020, he was appointed as Executive Chairman. Mr. Mizel has provided the Company with leadership and judgment, previously serving as the Chief Executive Officer and Chairman of the Board of Directors, and now as Executive Chairman, while advancing the long-term interests of the Company's shareholders. One of the most experienced leaders in the homebuilding industry, his knowledge and foresight provide the Board with invaluable guidance.

|

|

|

|

Director Since: 1972

|

|

|

|

|

|

|

|

|

Herbert T. Buchwald

Lead Director

|

Herbert T. Buchwald is a principal in the law firm of Herbert T. Buchwald, P.A. and president and chairman of the Board of Directors of BPR Management Corporation, a property management company located in Denver, Colorado, positions he has held for more than the past five years. Mr. Buchwald has been engaged in the acquisition, development and management of residential and commercial real estate in Florida, New Jersey and Colorado, through both publicly and privately held ventures for more than forty years. As an attorney, he has been admitted to practice before federal and state trial and appellate courts in Florida and Colorado. In addition, he holds an accounting degree and formerly was a practicing Certified Public Accountant. He has been a member of the Company's Board of Directors since March 1994. The combination of his knowledge, experience and skills provide the Company with strong oversight of accounting, financial, regulatory and legal matters, as well as the operation of the Company's real estate businesses.

|

|

|

|

Director Since: 1994

Committee Memberships:

●Legal Committee Chairman

●Audit Committee

●Compensation Committee

●Corporate Governance/ Nominating Committee

|

|

|

|

|

|

|

|

|

Michael A. Berman

|

Michael A. Berman has over thirty-five years of experience in the financial services industry. He is a member of Applied Capital Management, a private investment management firm located in Scottsdale, Arizona, and has served as its chairman from 2002 to date. From 2005 to 2006, he also served as the chief executive officer of First Ascent Capital, a financial services firm located in New York. From July 2006 until December 2008, he served as president and Chief Executive Officer of Real Estate Equity Exchange, Inc. (Rex & Co.), a financial services firm located in San Francisco, California. From January 1990 to March 1999, Mr. Berman was employed by The Nomura Securities Co., Ltd. (Tokyo) group of companies, where he held several senior executive positions, including that of President and CEO of Nomura Holding America Inc. and Chairman of Capital America, Nomura's commercial real estate lending subsidiary. In April 2006, Mr. Berman became a Director of the Company. Since 2006, he has been a director of HomeAmerican Mortgage Corporation, the Company’s mortgage lending subsidiary. Mr. Berman’s experience as a senior executive in corporate finance, in general, and the residential mortgage market, in particular, provide the Company with a valuable resource.

|

|

|

Director Since: 2006

Committee Memberships:

●Audit Committee

|

|

|

|

|

|

|

|

|

Leslie B. Fox

|

Leslie B. Fox has served in an executive capacity at multiple companies in the real estate industry. She was the Chief Operating Officer of Invitation Homes LP, the largest owner/operator of single family housing rentals in the United States, from March 2014 to March 2016. Before that, Ms. Fox served as the Chief Operating Officer of American Residential Communities LLC, one of the largest manufactured home companies in the United States, and as the President of the affordable housing division at Equity Residential and as an Executive Vice President of that company. Ms. Fox also has served as an independent advisor in the real estate sector. Starting in October 2019, she began advising Discovery Land Company, assisting in the rebuilding of a resort in the Bahamas after Hurricane Dorian. From May 2019 until January 2021, Ms. Fox was a director of Front Yard Residential Corporation (RESI) and, currently, Ms. Fox is serving on the Endowment Board and the Finance Committee for Craig Hospital in Denver, Colorado. Ms. Fox holds a Juris Doctor/Master of Business Administration from the University of Denver. Ms. Fox became a member of the Company's Board of Directors in June 2018. Ms. Fox's experience as a senior executive in the real estate and housing industries, and her experience as an independent advisor in the real estate sector, provide the Company with a valuable resource and contribute to the business perspectives of the Board.

|

|

|

Director Since: 2018

Committee Memberships:

●Audit Committee

|

Class II Directors: Terms Expire in 2023

|

|

|

|

|

|

|

|

David D. Mandarich

|

David D. Mandarich has been associated with the Company since 1977. He was a Director from September 1980 until April 1989, and has been a Director continuously since March 1994. He was appointed President and Chief Operating Officer of the Company in June 1999. Then, in October 2020, he was appointed President and Chief Executive Officer. A skilled and experienced leader in the homebuilding industry, Mr. Mandarich provides the Board with the benefit of his judgment and his knowledge and understanding of the Company's homebuilding business and operations.

|

|

|

|

Director Since: 1994

|

|

|

|

|

|

|

|

|

Paris G. Reece III

|

Paris G. Reece III was formerly the Company’s Chief Financial Officer and Principal Accounting Officer, and retired on August 1, 2008. Since his retirement, Mr. Reece has performed consulting work and served in a volunteer position as the President of Cancer League of Colorado, a leading non-profit organization that was established over fifty years ago to raise money for cancer research and patient care. He joined the Company's Board of Directors in May 2013. As a Certified Public Accountant (Texas, non-practicing), a former Chief Financial Officer and a highly respected person within the homebuilding industry, Mr. Reece is uniquely qualified to provide the Company with strong oversight of accounting and financial matters, as well as the operation of the Company's homebuilding and financial services businesses.

|

|

|

|

Director Since: 2013

Committee Memberships:

●Audit Committee Chairman

|

|

|

|

|

|

|

|

|

David Siegel

|

David Siegel was a partner in the law firm of Irell & Manella LLP for more than twenty-five years, where he led that firm's securities litigation practice and was the firm's Managing Partner. He retired from the active practice of law in 2019. Mr. Siegel's law practice, for which he is nationally recognized, was concentrated on securities class actions, corporate governance, risk management, SEC reporting standards and regulatory compliance. Mr. Siegel has chaired and has been a frequent speaker at various seminars on securities litigation, class actions, and trial techniques. He has been named by his peers as one of the "Best Lawyers in Commercial Litigation" in The Best Lawyers in America guide. Mr. Siegel has been a member of the Company's Board of Directors since June 2009. Mr. Siegel's knowledge and experience in corporate governance and litigation matters provide the Company with significant guidance and oversight.

|

|

|

|

Director Since: 2009

Committee Memberships:

●Corporate Governance/

Nominating Committee Chairman

●Legal Committee

|

|

|

|

|

|

|

|

|

|

|

|

NON-EMPLOYEE DIRECTOR

|

JOINED BOARD

|

TENURE1

|

|

Raymond T. Baker

|

2012

|

8.9 years

|

|

Michael A. Berman

|

2006

|

14.7 years

|

|

David E. Blackford

|

2001

|

19.8 years

|

|

Herbert T. Buchwald

|

1994

|

26.9 years

|

|

Leslie B. Fox

|

2018

|

2.5 years

|

|

Courtney L. Mizel

|

2017

|

3.6 years

|

|

Paris G. Reece III

|

2013

|

7.6 years

|

|

David Siegel

|

2009

|

11.5 years

|

1 As of December 31, 2020

|

|

|

|

|

Our Board is committed to active refreshment, and balancing fresh perspectives with continuity and institutional knowledge.

|

Unless otherwise specified, proxies will be voted FOR the election of Mr. Baker, Mr. Blackford and Ms. Mizel. Management and the Board of Directors are not aware of any reasons that would cause any of Mr. Baker, Mr. Blackford and Ms. Mizel to be unavailable to serve as Directors. If any of them become unavailable for election, discretionary authority may be exercised by the proxy holders named in the proxy to vote for a substitute candidate or candidates nominated by the Board of Directors. For additional information on our Board of Directors, see "Information Concerning the Board of Directors and its Committees" later in this document.

The Board of Directors recommends a vote FOR the election of Mr. Baker, Mr. Blackford and Ms. Mizel as Directors.

BENEFICIAL OWNERSHIP OF COMMON STOCK

Ownership of Directors and Officers

Certain information, as of February 26, 2021, the Record Date, with respect to common stock beneficially owned by the Company's named executive officers, the nominees for election as Directors and the current Directors of the Company, furnished in part by each such person, appears below (unless stated otherwise, the named beneficial owner possesses the sole voting and investment power with respect to such shares). None of the shares beneficially owned by the executive officers and Directors have been pledged as security.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Executive Officer/Director

|

Number of Shares of

Common Stock Owned

Beneficially 1

|

|

Percent

of Class 2

|

|

Raymond T. Baker

|

88,321

|

|

|

|

*

|

|

Michael A. Berman

|

27,040

|

|

|

|

*

|

|

David E. Blackford

|

22,796

|

|

|

|

*

|

|

Herbert T. Buchwald

|

30,773

|

|

|

|

*

|

|

Leslie B. Fox

|

19,636

|

|

|

|

*

|

|

Rebecca B. Givens

|

6,915

|

|

|

|

*

|

|

David D. Mandarich

|

5,653,838

|

|

|

|

8.5%

|

|

Robert N. Martin

|

135,888

|

|

|

|

*

|

|

Courtney L. Mizel

|

28,174

|

|

|

|

*

|

|

Larry A. Mizel

|

9,669,443

|

|

3

|

|

14.5%

|

|

Paris G. Reece III

|

53,807

|

|

3

|

|

*

|

|

David Siegel

|

41,913

|

|

3

|

|

*

|

|

Michael Touff (former officer)

|

206,537

|

|

|

|

*

|

|

All current executive officers and Directors as a group (12 persons)

|

15,778,544

|

|

|

|

23.1%

|

_______________

* Represents less than one percent of the shares of common stock outstanding and entitled to vote.

1 Includes, where applicable, shares of common stock owned by related individuals or entities over whose shares such person may be deemed to have beneficial ownership. Also includes the following shares of common stock subject to options that are exercisable or become exercisable within 60 days of the Record Date at prices ranging from $20.35 to $35.55 per share: Raymond T. Baker 57,618; David D. Mandarich 1,502,054; Robert N. Martin, 30,617; Larry A. Mizel 1,502,054; and Michael Touff 91,854. As a group, the executive officers and Directors had the right to acquire within 60 days of the Record Date by the exercise of options an aggregate of 3,184,197 shares of common stock.

2 The percentage shown is based on the number of shares of common stock outstanding and entitled to vote as of the Record Date. All shares of common stock that the person or group had the right to acquire within 60 days of the Record Date are deemed to be outstanding for the purpose of computing the percentage of shares of common stock owned by such person or group, but are not deemed to be outstanding for the purpose of computing the percentage of shares of common stock owned by any other person or group.

3 Mr. Mizel has sole voting power and sole investment power over 1,591,614 shares and shared voting power and shared investment power over 8,077,829 shares. Mr. Reece has sole voting power and sole investment power over 19,291 shares and shared voting power and shared investment power over 34,516 shares. Mr. Siegel has sole voting power and sole investment power over 32,362 shares and shared voting power and shared investment power over 9,551 shares.

Ownership of Certain Beneficial Owners

The table below sets forth information with respect to those persons (other than the officers/Directors listed above) known to the Company, as of the Record Date, to have owned beneficially 5% or more of the outstanding shares of common stock. The information as to beneficial ownership is based upon statements filed by such persons with the SEC under Section 13(d) or 13(g) of the Securities Exchange Act of 1934, as amended.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner

|

|

Number of Shares of

Common Stock

Owned Beneficially

|

|

Percent

of Class 1

|

|

BlackRock, Inc.

55 East 52nd Street

New York, NY 10055

|

|

9,988,492

|

|

2

|

|

15.4

|

%

|

The Vanguard Group

100 Vanguard Blvd.

Malvern, PA 19355

|

|

5,372,363

|

|

3

|

|

8.3

|

%

|

Dimensional Fund Advisors LP

6300 Bee Cave Road

Austin, TX 78746

|

|

4,625,443

|

|

4

|

|

7.1

|

%

|

___________________

1 The percentage shown is based on the number of shares outstanding and entitled to vote as of the Record Date.

2 Schedule 13G filed with the SEC on January 25, 2021 disclosed that: BlackRock, Inc. has sole voting power over 9,673,902 shares, shared voting power over no shares, sole dispositive power over 9,988,492 shares and shared dispositive power over no shares.

3 Schedule 13/A filed with the SEC on February 10, 2021 disclosed that: The Vanguard Group has sole voting power over no shares, shared voting power over 52,195 shares, sole dispositive power over 5,276,651 shares and shared dispositive power over 95,712 shares.

4 Schedule 13G/A filed with the SEC on February 12, 2021 disclosed that: the Dimensional Fund Advisors LP has sole voting power over 4,491,109 shares, shared voting power over no shares, sole dispositive power over 4,625,443 shares and shared dispositive power over no shares. Dimensional Fund Advisors LP and/or its subsidiaries disclaim beneficial ownership.

EXECUTIVE OFFICERS

Set forth below are the names and offices held by the executive officers of the Company as of the Record Date. The Board of Directors, after reviewing the functions performed by the Company's officers, has determined that, for purposes of Item 401 of SEC Regulation S-K, only these officers are deemed to be executive officers of the Company.

The executive officers of the Company hold office until their successors are duly elected and qualified or until their resignation, retirement, death or removal from office. Biographical information on Messrs. Mizel and Mandarich, who serve as Directors and executive officers of the Company, is set forth under "Election of Directors" above. Biographical information for Mr. Martin and Ms. Givens is set forth below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Offices Held

|

|

Larry A. Mizel

|

|

78

|

|

Executive Chairman, an Officer and a Director

|

|

David D. Mandarich

|

|

73

|

|

President, Chief Executive Officer and a Director

|

|

Robert N. Martin

|

|

42

|

|

Senior Vice President and Chief Financial Officer

|

|

Rebecca B. Givens

|

|

57

|

|

Senior Vice President and General Counsel

|

|

|

|

|

|

|

|

|

|

Robert N. Martin

SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

TENURE: 18 YEARS

|

|

|

REBECCA B. GIVENS

SENIOR VICE PRESIDENT AND GENERAL COUNSEL

TENURE: 8 YEARS

|

Robert N. Martin was appointed Senior Vice President and Chief Financial Officer in May 2015. He also served as Principal Accounting Officer from May 2015 until August 2020. He previously served as Vice President – Finance and Business Development. In April 2013, he was promoted to the position of Vice President of Finance and Corporate Controller. Over the last five years, Mr. Martin has had direct oversight of the Company's division and corporate accounting, tax, treasury, investor relations, information technology and finance, planning and analysis functions. Additionally, he has served on all of the Company’s AMCs and has performed a key role in the Company's capital markets activities. He is an officer, director or both of many of the Company’s subsidiaries. Mr. Martin received a bachelor’s degree in Accounting and Computer Applications from the University of Notre Dame and is both a Certified Public Accountant and a CFA charterholder.

Rebecca B. Givens joined the Company in July 2020 as Senior Vice President - Legal and was appointed Senior Vice President and General Counsel of the Company in November 2020. For over eight years preceding the start of her current employment with the Company, Ms. Givens was employed as an attorney by Spectrum Retirement Communities, LLC, most recently serving as that company’s Senior Vice President and General Counsel. Prior to her employment with Spectrum, Ms. Givens was employed as a real estate attorney with the Company for nearly eight years. Ms. Givens received a bachelor’s degree in Business Administration from the University of Nebraska – Lincoln and a J.D. degree from Creighton University.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (this “CD&A”) discusses the compensation of our Named Executive Officers (“NEOs”) for fiscal year 2020. The CD&A is organized as follows:

CD&A Table of Contents

Executive Summary

For fiscal 2020, our named executive officers were:

|

|

|

|

|

|

|

|

Named Executive Officers

|

|

Larry A. Mizel

|

Executive Chairman

|

|

David D. Mandarich

|

President and Chief Executive Officer (“CEO”)

|

|

Robert N. Martin

|

Senior Vice President, Chief Financial Officer (“CFO”)

|

|

Rebecca B. Givens1

|

Senior Vice President and General Counsel (“CLO”)

|

|

Michael Touff 1

|

Senior Vice President and General Counsel (“CLO”)

|

1Mr. Touff retired as General Counsel and as an executive officer of the Company, effective as of the close of business on October 30, 2020. Ms. Givens was appointed as Senior Vice President and General Counsel and designated as an executive officer and named executive officer of the Company effective as of November 1, 2020.

Over 40 Years of Shareholder Value Creation

Our Company is one of the leading homebuilders in the United States. Founded in 1972, we have delivered over 210,000 Richmond American homes to homebuyers across the nation.

Our business consists of two primary operations: homebuilding and financial services. The homebuilding operation is comprised of wholly-owned subsidiary companies that primarily construct and market single-family detached houses to first-time and first-time move-up homebuyers under the name “Richmond American Homes.” Our financial services operations support our homebuilding business.

We strive to generate sustainable long-term value for our shareholders, focusing on our core strength: designing, building and selling quality homes. Homebuilding is a cyclical, often unpredictable, industry. Our business strategy is distinctive among the publicly traded US homebuilders, maximizing risk-adjusted returns while minimizing the risks of excess leverage and land ownership – a strategy designed to outperform over the years.

|

|

|

|

|

|

|

|

|

|

|

HOW MDC IS DIFFERENT

|

|

WHY IT MATTERS

|

|

|

|

|

|

BUILT FOR SUCCESS THROUGH THE HOUSING CYCLE

ü Strong balance sheet

ü 2-3 years land supply

ü Limited amount of speculative inventory

ü Industry leading dividend

|

à

|

We’re focused on homebuilding, not land speculation, which positions us to withstand, and ultimately benefit from, downturns.

Allows us to reward shareholders with an industry leading cash dividend, which has remained consistent / increased each year since 1994.

|

|

DIVERSE PRODUCT MIX WITH A CONTINUED FOCUS ON THE MORE AFFORDABLE SEGMENT

ü Appeal to a number of buyer demographics

ü Benefiting from the increase in millennial homebuying

ü More affordable without sacrificing quality or design elements

|

à

|

Allows us to have faster cycle times, increase our absorption pace and improve our gross margin through better pricing power.

Attracts both new homebuyers and move down buyers focused on affordability.

Unique products help differentiate us from peers.

|

|

BUILD-TO-ORDER MODEL

ü Allows for personalization

ü Differentiates us in the market as more builders move to a spec strategy

ü "Build-to-order" strategy limits risk vs. speculative building of unsold homes by peer group

|

à

|

Allows us to manage the customer experience from end-to-end.

Personalization leads to higher margin sales. We’ve proven we can generate order rates above peer group average without the use of specs.

Model is consistent with our risk conscious operating philosophy.

|

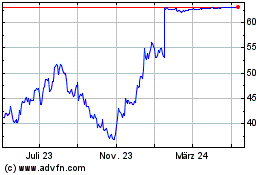

Strong execution of our strategic initiatives has resulted in a five-year total shareholder return of 181% (see comparison to peer group below) and positioned the Company for continued growth as we look forward to 2021, while the financial stability afforded by our operating strategy has enabled us to reward our shareholders with a consistent dividend program unmatched in the homebuilding industry.

COMPARISON OF CUMULATIVE TOTAL RETURN*

*It is assumed in the graph that $100 was invested (1) in our common stock; (2) in the stocks of the companies in the S&P500® Stock Index; and (3) in the stocks of the peer group companies (See Peer Data section for a list of peer group companies included above), just prior to the commencement of the period and that all dividends received within a quarter were reinvested in that quarter.

Business Performance Highlights

Fiscal year 2020 results (comparisons are to the prior year) and other highlights:

|

|

|

|

|