- The negative organic growth1 in consolidated revenue was

limited to 4.8%. The Covid‑19 pandemic and the October 2020

cyberattack had a negative impact on business activity estimated at

around 10 points of growth

- Adaptation measures helped limit the decline in operating

margin on business activity to 1 point (7.0% vs 8.0% in

2019)

- The net profit attributable to the Group came to €106.8m

(€160.3m in 2019)

- Free cash flow was highly resilient, at €203.5m (€229.3m in

2019); the cash conversion rate2 with respect to operating profit

on business activity remained stable at 51%

- Net financial debt decreased by 17.2% to €425.6m, equal to

29% of the Group’s equity

- Confirmation of a continued rise in ESG scores: for the

fourth year in a row, the Group was included on CDP’s A

List3

- Proposed 2020 dividend of €2.0 per share

- Medium-term growth driven by digital transformation

Regulatory News:

Sopra Steria (Paris:SOP):

At its meeting on 25 February 2021 chaired by Pierre

Pasquier, Sopra Steria Group’s Board of Directors approved the

financial statements for the financial year ended 31 December

20204.

Sopra Steria: 2020 Full-year results

2020

2019

Amount Margin Change Amount

Margin Key income statement items Revenue €m

4,262.9

-3.9%

4,434.0

Organic growth %

- 4.8%

Operating profit on business activity €m

300.2

7.0%

-15.3%

354.3

8.0%

Profit from recurring operations €m

261.2

6.1%

-16.9%

314.2

7.1%

Operating profit €m

202.3

4.7%

-28.5%

283.2

6.4%

Net profit attributable to the Group €m

106.8

2.5%

-33.4%

160.3

3.6%

Weighted average number of shares in issue excl. treasury

shares m

20.25

20.23

Basic earnings per share €

5.27

-33.5%

7.92

Recurring earnings per share €

7.42

-17.3%

8.97

Key balance sheet items 12/31/2020

12/31/2019 Net financial debt €m

425.6

-17.2%

513.9

Equity attributable to the Group €m

1,397.8

1.8%

1,372.7

General comments on business activity in financial year

2020

2020 was marked by two exceptional events: the Covid-19

pandemic starting in March, and a cyberattack in October. These two

events had a significant impact on the Group’s business activity.

Measures imposing lockdowns and restricting people’s movement led

to a decline in business under existing contracts and new orders.

The aeronautics and transport industries, in particular, contracted

between 20% and 30% starting in the second quarter. The response to

the cyberattack involved information and production systems being

unavailable to varying degrees over a period of several weeks in

the fourth quarter. The negative impact on 2020 business activity

of these two events is estimated at around 10 points of growth. The

cyberattack itself had a negative 1 point impact on revenue and a

negative 0.2 point impact on the operating margin on business

activity.

In spite of this challenging context, Sopra Steria was

highly resilient. The negative organic growth in revenue was

limited to 4.8%. The decline in the operating margin on business

activity was limited to 1 point and free cash flow was highly

resilient, at €203.5 million, although it was boosted by the

favourable impact of around €50 million in non-recurring items. In

addition, at 31 December 2020, average consultant downtime had

returned to normal levels.

The resilience the Group has shown is due to several

factors. First of all, recurring activities (business process

services, IT infrastructure management, application maintenance and

software maintenance) make up around 40% of revenue. Next, the

Group’s sales strategy focuses on clients it has identified as

strategic, which are mainly large accounts and public authorities

(the public sector makes up around 30% of revenue). Lastly, the

Group’s team spirit and entrepreneurial culture facilitated rapid

decision-making and measures to adapt to a changing environment.

Cost-saving plans, for example, were rapidly launched.

Particular attention was paid to human resource

management. Keeping staff informed and social dialogue were a

fundamental priority. The use of state aid programmes was limited

and responsible. The Group’s priority was preserving skills and

jobs, especially in the sectors most affected by declines in

business activity, thanks to training and internal mobility.

In parallel, Sopra Steria continued to implement its

strategic plan: product development for Sopra Financing

Platform and Sopra Banking Platform, shifting activities in the

United Kingdom to a platform-based model, building up the Sopra

Steria Next consulting brand, industrialisation, and targeted

acquisitions to reinforce insurance activities in France and in

digital banking for Sopra Banking Software. A plan aimed at

achieving zero net emissions by 2028 was also announced.

Details on 2020 operating performance

Consolidated revenue totalled €4,262.9 million, down

3.9%. Changes in scope had a positive impact of €76.1 million, and

currency fluctuations had a negative impact of €33.5 million. The

negative organic growth in revenue came to 4.8%. Excluding

exceptional items, Q3 and Q4 showed an improvement in business

activity compared with the low point observed in Q2.

Operating profit on business activity came to €300.2

million (€354.3 million in 2019), equating to a margin of 7.0%

(8.0% in 2019).

The France reporting unit (39% of the

Group’s revenue) generated revenue of €1,655.6 million,

representing negative organic growth of 10.2%. It was particularly

affected by external factors (pandemic and cyberattack) due to the

structure of its activity and the significance of the aeronautics

sector (20% of the reporting unit’s revenue in Q1 2020; revenue

down 20% year-on-year). Conversely, the public sector was highly

resilient: the defence and government vertical markets showed

strong gains while social services (job centres, health insurance,

etc.) contracted slightly. Against this backdrop, operating profit

on business activity came to 6.8% in 2020 (9.7% in 2019). Excluding

exceptional items, the second half of the financial year showed an

improvement in business activity, suggesting a gradual recovery in

performance may be expected in 2021. The aeronautics sector showed

signs of stabilising. Consultant downtime returned to normal

levels. Hiring resumed.

The United Kingdom (16% of the Group’s revenue)

was highly resilient, with revenue of €699.8 million, representing

positive organic growth of 1.9%. This growth was driven by the

strong performance achieved by the two joint ventures specialising

in business process services for the public sector (NHS SBS and

SSCL). They posted revenue of €339.3 million, representing average

organic growth of 16.0%. The defence & security and government

sectors proved fairly resilient. The private sector, on the other

hand, was under pressure, although new promising contracts were

won, in particular in the banking sector. The operating margin on

business activity improved to 8.0% (7.3% in 2019).

The Other Europe reporting unit (29% of Group revenue)

posted organic revenue growth of 2.3% to €1,249.0 million. Growth

was brisk in Scandinavia and Belgium, while the other countries saw

slightly negative growth. In addition, revenue generated by Sopra

Financial Technology (€204.9 million) for operating the information

system of the Sparda banks in Germany was up 16.9%. The operating

margin on business activity improved in virtually every country in

the reporting unit, totalling 8.1% compared with 6.7% in 2019.

Revenue for Sopra Banking Software (10% of Group revenue)

came to €421.6 million, an organic contraction of 9.1%. Licence

sales proved highly resilient while services saw a deterioration,

particularly during the lockdown period in the first half of the

year. The second half of the year (-7.3%) showed a relative

improvement with more limited negative growth than in the first

half (-10.9%). The year was especially noteworthy for the Group’s

adherence to its product development plan (for both Sopra Banking

Platform and Sopra Financing Platform) and the first signs of

improvement in project margins, in line with the goal of gradually

returning to a double-digit margin. Operating profit on business

activity came to €10.5 million (versus €4.9 million in 2019),

equating to a margin of 2.5%.

The Other Solutions reporting unit (6% of Group revenue)

posted revenue of €236.9 million, representing negative organic

growth of 8.9%. This change resulted from a decline in licence

sales and the postponement of certain project launches. Following a

significant improvement in the second half of the year (12.7%

versus 5.0% in the first half), the operating margin on business

activity for the full year came to 8.8% (versus 15.7% in 2019).

Comments on the components of net profit attributable to the

Group in financial year 2020

Profit from recurring operations totalled €261.2 million.

It included a €4.2 million share-based payment expense and a €34.8

million amortisation expense on allocated intangible assets.

Operating profit was €202.3 million after a net expense

of €58.9 million for other operating income and expenses (compared

with a net expense of €31.0 million in 2019), including expenses of

€15.6 million attributable to additional costs arising from

Covid-19 and €5.3 million related to the impact of the

cyberattack.

The tax expense totalled €60.4 million, for an effective

tax rate of 34.1%.

The share of profit from equity-accounted companies

(mainly Axway Software) was €2.3 million (€1.8 million in

2019).

After deducting €12.2 million in minority interests,

net profit attributable to the Group came to €106.8 million

(€160.3 million in 2019).

Basic earnings per share came to €5.27 (€7.92 in

2019).

Proposed dividend in respect of financial year 2020

At the next General Meeting of Shareholders, Sopra Steria will

propose the payment of a dividend5 of €2.0 per share.

Financial position at 31 December 2020

Free cash flow was very strong, at €203.5 million (€229.3

million in 2019). The free cash flow conversion rate6 with respect

to operating profit on business activity, remained stable at

51%.

Net financial debt totalled €425.6 million, down 17.2%

from its level at 31 December 2019. It was equal to 29.4% of equity

(36.1% at 31/12/2019) and 1.1x pro forma EBITDA for 2020 before the

impact of IFRS 16 (with the financial covenant stipulating a

maximum of 3x).

Acquisition and external growth transactions

- On 7 August 2020, the remaining 30% stake in SAB not yet held

by the Group was acquired by Sopra Steria from SAB’s minority

shareholders.

- On 16 September 2020, Sodifrance was added to Sopra Steria’s

scope of consolidation. Following the acquisition of a 94.03%

controlling interest in the share capital, a public tender offer

and compulsory delisting were carried out at the price of €18 per

share7. The Sodifrance shares were delisted from Euronext Paris on

18 November 2020.

- On 31 December 2020, Fidor Solutions was added to Sopra

Steria’s scope of consolidation. Fidor Solutions was the software

subsidiary of next-generation bank Fidor Bank specialising in

digital banking solutions. This acquisition will significantly

accelerate the pace of development and marketing of Sopra Banking

Software’s digital solutions, in particular by augmenting the user

features offered to banks through its Digital Banking Engagement

Platform (DBEP) solutions.

Workforce

At 31 December 2020, the Group’s workforce totalled 45,960

people (46,245 at 31/12/2019), with 17.6% working in X-Shore

zones.

Social and environmental footprint

Sopra Steria sees its contribution to society as sustainable,

human-focused and purposeful, guided by the firm belief that making

digital work for people is a source of opportunity and

progress.

On 8 December 2020, CDP confirmed that Sopra Steria had made its

A List – recognising the world’s most transparent and most

proactive companies in the fight against climate change – for the

fourth year in a row. The Group stepped up its ongoing climate

commitments in 2020 with the announcement of its target of

achieving zero net emissions by 2028. Since 2015, Sopra Steria’s

annual reduction in its greenhouse gas emissions has been aligned

with this trajectory.

The Group also continued to increase the number of women in its

workforce in 2020. The proportion of women, excluding the impact of

acquisitions during the year, went from 32.0% to 32.5% thanks to an

increase in women among new recruits (34.0% of new hires versus

33.1% in 2019). This change should be viewed within the context of

the proactive policy aimed at gradually increasing the number of

women in senior management positions and the target set to have

women make up 30% of the Executive Committee by 2025.

Strategy

Sopra Steria’s strategy is built around its independent

corporate plan focused on sustainable value creation for its

stakeholders. This European plan is underpinned by expansion

through organic and acquisition-led growth. Its goal is to generate

substantial added value by harnessing a comprehensive range of

powerful consulting and software solutions deployed using an

end-to-end approach and capitalising on our combined technology and

sector-specific expertise.

This plan is set within an upbeat market for digital services,

which have been boosted for several years now by demand for digital

transformation on the part of businesses and institutions looking

to increase their resilience.

Within this context, over the medium term, Sopra Steria is

targeting compound annual organic revenue growth of between 4% and

6%, an operating margin on business activity of around 10%, and

free cash flow of between 5% and 7% of revenue.

Targets for 2021

Although the situation is improving, the overall environment is

still beset with many uncertainties. Based on the information

available at end-February 2021, Sopra Steria has set the following

targets for the year:

- Organic revenue growth of between 3% and 5%, including a first

quarter in which growth remains negative;

- Operating margin on business activity of between 7.5% and

8.0%;

- Free cash flow of around €150 million.

2020 annual results presentation meeting

The annual results for 2020 will be presented to financial

analysts and investors in a French/English webcast on Friday, 26

February 2021 at 9:00 a.m. CET.

- Register for the French-language webcast

here - Register for the English-language webcast here

Or by phone:

- French-language phone number: +33 (0)1 70

71 1 59 – PIN: 41663318# - English-language access number: +44 207

194 37 59 – PIN: 82835072#

Practical information about the presentation and webcast can be

found in the ‘Investors’ section of the Group’s website:

https://www.soprasteria.com/investors

Upcoming financial publications

Wednesday, 28 April 2021 (before market open): Publication of Q1

2021 revenue

Wednesday, 26 May 2021 at 2:30 p.m.: General Meeting of

Shareholders

Thursday, 29 July 2021 (before market open): Publication of H1

2021 results

Friday, 29 October 2021 (before market open): Publication of Q3

2021 revenue.

Glossary

- Restated revenue: Revenue

for the prior year, expressed on the basis of the scope and

exchange rates for the current year.

- Organic revenue growth:

Increase in revenue between the period under review and restated

revenue for the same period in the prior financial year.

- EBITDA: This measure, as

defined in the Universal Registration Document, is equal to

consolidated operating profit on business activity after adding

back depreciation, amortisation and provisions included in

operating profit on business activity.

- Operating profit on business

activity: This measure, as defined in the Universal

Registration Document, is equal to profit from recurring operations

adjusted to exclude the share-based payment expense for stock

options and free shares and charges to amortisation of allocated

intangible assets.

- Profit from recurring

operations: This measure is equal to operating profit

before other operating incomeand expenses, which includes any

particularly significant items of operating income and expense that

are unusual, abnormal, infrequent or not foreseeable, presented

separately in order to give a clearer picture of performance based

on ordinary activities.

- Basic recurring earnings per

share: This measure is equal to basic earnings per share

before other operating income and expenses net of tax.

- Free cash flow: Free cash

flow is defined as the net cash from operating activities; less

investments (net of disposals) in property, plant and equipment,

and intangible assets; less lease payments; less net interest paid;

and less additional contributions in respect of retirement benefit

obligations to address any deficits in defined-benefit pension

plans.

- Downtime: Number of days

between two contracts (excluding training, sick leave, other leave

and pre-sale) divided by the total number of business days

Disclaimer

This document contains forward-looking information subject to

certain risks and uncertainties that may affect the Group’s future

growth and financial results. Readers are reminded that licence

agreements, which often represent investments for clients, are

signed in greater numbers in the second half of the year, with

varying impacts on end-of-year performance. Actual outcomes and

results may differ from those described in this document due to

operational risks and uncertainties. More detailed information on

the potential risks that may affect the Group’s financial results

can be found in the 2019 Universal Registration Document filed with

the Autorité des Marchés Financiers (AMF) on 10 April 2020 (see

pages 35 to 52 and 27 to 275 in particular). Sopra Steria does not

undertake any obligation to update the forward-looking information

contained in this document beyond what is required by current laws

and regulations. The distribution of this document in certain

countries may be subject to the laws and regulations in force.

Persons physically present in countries where this document is

released, published or distributed should enquire as to any

applicable restrictions and should comply with those

restrictions.

About Sopra Steria

Sopra Steria, a European leader in consulting, digital services

and software development, helps its clients drive their digital

transformation and obtain tangible and sustainable benefits. It

provides end-to-end solutions to make large companies and

organisations more competitive by combining in-depth knowledge of a

wide range of business sectors and innovative technologies with a

fully collaborative approach. Sopra Steria places people at the

heart of everything it does and is committed to putting digital to

work for its clients in order to build a positive future for all.

With 46,000 employees in 25 countries, the Group generated revenue

of €4.3 billion in 2020. The world is how we shape it. Sopra

Steria (SOP) is listed on Euronext Paris (Compartment A) – ISIN:

FR0000050809 For more information, visit us at

www.soprasteria.com

Annexes

Sopra Steria: Impact on revenue of changes in scope and exchange

rates – FY 2020 €m

2020

2019

Growth

Revenue

4,262.9

4,434.0

-3.9%

Changes in exchange rates

-33.5

Revenue at constant exchange rates

4,262.9

4,400.4

-3.1%

Changes in scope

76.1

Revenue at constant scope and exchange rates

4,262.9

4,476.5

-4.8%

Sopra Steria: Changes in exchange rates – FY 2020 For €1

/ % Average rate2020 Average rate2019

Change Pound sterling

0.8897

0.8778

-1.3%

Norwegian krone

10.7228

9.8511

-8.1%

Swedish krona

10.4848

10.5891

+1.0% Danish krone

7.4542

7.4661

+0.2% Swiss franc

1.0705

1.1124

+3.9%

Sopra Steria: Revenue by reporting unit (€m / %) – Q4

2020

Q4 2020

Q4 2019 Restated*

Q4 2019

Organic growth

Total growth

France

425.6

498.1

470.5

-14.6%

-9.5%

United Kingdom

186.6

166.9

175.7

+11.8% +6.2% Other Europe

318.1

331.3

336.0

-4.0%

-5.3%

Sopra Banking Software

116.6

129.4

130.4

-9.9%

-10.6%

Other Solutions

61.7

75.3

75.3

-18.1%

-18.1%

Sopra Steria Group

1,108.6

1,201.1

1,187.9

-7.7%

-6.7%

* Revenue at 2020 scope and exchange rates

Sopra

Steria: Revenue by reporting unit (€m / %) – FY 2020

2020

2019 Restated*

2019

Organic growth

Total growth

France

1,655.6

1,844.6

1,813.1

-10.2%

-8.7%

United Kingdom

699.8

686.5

771.5

+1.9%

-9.3%

Other Europe

1,249.0

1,221.4

1,152.9

+2.3% +8.3% Sopra Banking Software

421.6

463.9

438.9

-9.1%

-3.9%

Other Solutions

236.9

260.1

257.5

-8.9%

-8.0%

Sopra Steria Group

4,262.9

4,476.5

4,434.0

-4.8%

-3.9%

* Revenue at 2020 scope and exchange rates

Sopra Steria:

Performance by reporting unit – FY 2020

2020

2019

€m % €m %

France Revenue

1,655.6

1,813.1

Operating profit on business activity

111.9

6.8%

175.5

9.7%

Profit from recurring operations

104.8

6.3%

167.2

9.2%

Operating profit

84.9

5.1%

156.9

8.7%

United Kingdom Revenue

699.8

771.5

Operating profit on business activity

56.0

8.0%

56.1

7.3%

Profit from recurring operations

44.1

6.3%

43.8

5.7%

Operating profit

27.7

4.0%

42.3

5.5%

Other Europe Revenue

1,249.0

1,152.9

Operating profit on business activity

101.0

8.1%

77.4

6.7%

Profit from recurring operations

96.5

7.7%

73.0

6.3%

Operating profit

82.4

6.6%

66.1

5.7%

Sopra Banking Software Revenue

421.6

438.9

Operating profit on business activity

10.5

2.5%

4.9

1.1%

Profit from recurring operations

-4.1

-1.0%

-8.9

-2.0%

Operating profit

-10.6

-2.5%

-18.0

-4.1%

Other Solutions Revenue

236.9

257.5

Operating profit on business activity

20.8

8.8%

40.3

15.7%

Profit from recurring operations

19.9

8.4%

39.1

15.2%

Operating profit

17.9

7.5%

35.9

13.9%

Sopra Steria: Consolidated income statement – FY 2020

2020

2019

€m % €m %

Revenue

4,262.9

4,434.0

Staff costs

-2,677.7

-2,668.5

Operating expenses

-1,096.1

-1,253.3

Depreciation, amortisation and provisions

-189.0

-157.9

Operating profit on business activity

300.2

7.0%

354.3

8.0%

Share-based payment expenses

-4.2

-11.1

Amortisation of allocated intangible assets

-34.8

-28.9

Profit from recurring operations

261.2

6.1%

314.2

7.1%

Other operating income and expenses

-58.9

-31.0

Operating profit

202.3

4.7%

283.2

6.4%

Cost of net financial debt

-9.9

-9.9

Other financial income and expenses

-15.4

-14.7

Tax expense

-60.4

-87.3

Share of net profit from equity-accounted companies

2.3

1.8

Net profit

118.9

2.8%

173.1

3.9%

Attributable to the Group

106.8

2.5%

160.3

3.6%

Non-controlling interests

12.2

12.7

Weighted average number of shares in issue excl. treasury shares

(m)

20.25

20.23

Basic earnings per share (€)

5.27

7.92

Sopra Steria: Change in net financial debt (€m) – FY

2020

2020

2019

Operating profit on business activity

300.2

354.3

Depreciation, amortisation and provisions (excl. allocated

intangible assets)

187.4

159.3

EBITDA

487.6

513.6

Non-cash items

6.7

-3.0

Tax paid

-82.9

-81.0

Change in current operating working capital requirement

72.5

25.3

Reorganisation and restructuring costs

-82.2

-32.7

Net cash flow from operating activities

401.7

422.2

Lease payments

-109.4

-109.8

Change relating to investing activities

-53.2

-49.7

Net interest

-10.0

-9.3

Additional contributions related to defined-benefit pension plans

-25.5

-24.1

Free cash flow

203.5

229.3

Impact of changes in scope

-97.5

-89.5

Financial investments

-2.0

-2.6

Dividends paid

-4.3

-39.9

Dividends received from associated companies

0.0

2.9

Purchase and sale of treasury shares

-10.9

-2.8

Impact of changes in foreign exchange rates

-0.4

-7.3

Other changes

-

Impact of the initial application of IFRS16

-

16.9

Change in net financial debt

88.3

107.0

Net financial debt at beginning of period

513.9

620.9

Net financial debt at end of period

425.6

513.9

Sopra Steria: Simplified balance sheet (€m) – 31/12/2020

12/31/2020 12/31/2019 Goodwill

1,843.2

1,813.9

Allocated intangible assets

161.5

181.5

Other fixed assets

241.1

267.9

Right-of-use assets

290.3

320.4

Equity-accounted investments

193.4

195.0

Fixed assets

2,729.6

2,778.8

Net deferred tax

113.4

98.1

Trade accounts receivable (net)

954.6

1,074.3

Other assets and liabilities

-1,112.8

-1,256.1

Working capital requirement (WCR)

-158.2

-181.8

Assets + WCR

2,684.8

2,695.1

Equity

1,445.4

1,422.2

Provisions for post-employment benefits

380.1

339.7

Provisions for contingencies and losses

116.0

77.0

Lease liabilities

317.5

342.1

Net financial debt

425.6

513.9

Capital invested

2,684.8

2,695.1

Sopra Steria: Workforce breakdown – 31/12/2020

12/31/2020 12/31/2019 France

19,799

19,013

United Kingdom

6,646

6,407

Other Europe

10,885

10,095

Rest of the World

523

344

X-Shore

8,107

8,255

Total

45,960

46,245

1 Alternative performance measures are defined at the end of

this document 2 Restated for non-recurring and exceptional items 3

Every year, 9,617 companies and organisations around the world

provide details on their environmental performance to CDP for

independent assessment against its scoring methodology for the

benefit of investors, purchasers and other stakeholders 4 Audit

procedures have been carried out and the audit report is being

issued. 5 General Meeting to be held on Wednesday, 26 May 2021. The

ex-dividend date will be 1 June 2021, and the dividend will be

payable as from 3 June 2021. 6 Restated for non-recurring and

exceptional items, which represented a favourable net amount of

around €50 million in 2020 7 Enterprise value: Price of shares for

100% of the share capital of €63 million + Net financial debt of

€17.6 million at 15/09/2020

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210225006266/en/

Investor Relations Olivier Psaume

olivier.psaume@soprasteria.com +33 (0)1 40 67 68 16 Press

Relations Caroline Simon (Image 7) caroline.simon@image7.fr +33

(0)1 53 70 74 65

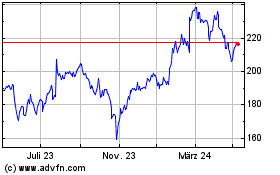

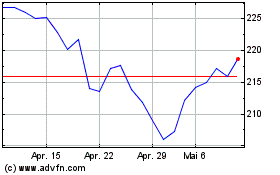

Sopra Steria (EU:SOP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Sopra Steria (EU:SOP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024