Qualtrics Shares Jump in Trading Debut

28 Januar 2021 - 9:29PM

Dow Jones News

By Matt Grossman

Shares of Qualtrics International Inc., a spinoff from SAP SE,

rose roughly 38% in its public-markets debut amid a surge of

investor interest in the enterprise-software sector.

Qualtrics, which makes software for businesses to track customer

interactions, brands and employees, opened at $41.85 Thursday

afternoon, compared with its initial public offering price of $30 a

share. The opening price values the company at approximately $24.5

billion. Qualtrics is trading on the Nasdaq under ticker symbol

"XM."

The company arrives on the public market during a pandemic that

has amplified a digital transition many businesses are undertaking

as they adopt tools to boost interaction with customers online and

to better run internal processes. That focus on digital operations

has heightened the importance of Qualtrics's products, the

company's chief executive, Zig Serafin, told The Wall Street

Journal.

Investors have rewarded companies that support digital commerce.

Shares of companies such as Salesforce.com Inc., whose software

helps businesses manage customer relationships, and Square Inc., a

digital-payments company, have surged over the last 12 months.

Others such as Snowflake Inc., a data-warehousing company, have

preceded Qualtrics in launching successful pandemic-era IPOs.

SAP, based in Germany, maintains a controlling stake in

Qualtrics following Thursday's offering, owning 84% of the

company's common stock and 98% of its voting rights. SAP acquired

Provo, Utah-based Qualtrics for roughly $8 billion in early 2019.

Qualtrics had been on the verge of going public by itself at the

time.

The two years under SAP's ownership lifted Qualtrics's

international reach, Mr. Serafin said. The company's sales coming

from international markets amounted to 28% in the first nine months

of 2020, compared with 23% in all of 2018.

The IPO will help Qualtrics better pursue business opportunities

outside of SAP, Christian Klein, SAP's chief executive, has

said.

Qualtrics's revenue through the first nine months of 2020 was

$550 million, with an adjusted loss of $24.9 million. Qualtrics's

revenue in 2019 was $591.2 million, and it posted an adjusted

operating loss of $49.5 million that year.

The company said its software platform was used by more than

12,000 customers, including 85% of Fortune 100 companies, as of the

end of September. The number of large customers has grown in recent

years: As of September, Qualtrics had about 1,200 customers that

were responsible for at least $100,000 each in annual recurring

revenue, compared with 720 such customers at the end of 2018.

Sixty-four customers' spending accounted for at least $1 million

each in annual revenue as of September.

Ryan Smith, the company's founder and executive chairman, said

that growth reflected customers integrating Qualtrics's platform

more deeply with their operations.

Other tech companies have come to public markets in recent

months while posting losses. Palantir Technologies Inc. went public

through a direct listing in September after posting a net loss of

$164 million in the first half of 2020. Snowflake was unprofitable

at the time of its IPO in September and remained so in the latest

quarter.

Still, shares of Snowflake traded around $279 Thursday, up from

an IPO price of $120. Palantir traded near $36 a share Thursday, up

by about 53% year to date. Salesforce shares have gained roughly

25% over the last 12 months.

Beyond software for businesses, the tech IPO market in general

has soared in recent months as investors prove eager to pile into

shares of newly listed companies.

Poshmark Inc., a consumer marketplace that uses a

social-media-like platform, more than doubled on its first day of

trading earlier this month, and now trades around $73, up from an

IPO price of $42. Affirm Holdings Inc., a financial-technology

company, saw its shares close their first day of trading two weeks

ago at $97.24, up from an initial offering price of $49.

Mr. Smith said that external market considerations didn't play a

major role in the timing of the company's IPO.

"Our job is to go out and help the world compete in every

market," Mr. Smith said. "We just want to go ring the bell, go

public and go back to work."

Write to Matt Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

January 28, 2021 15:14 ET (20:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

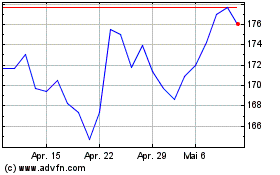

Sap (TG:SAP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

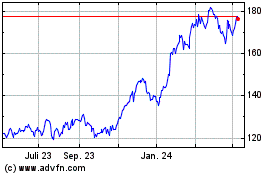

Sap (TG:SAP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024