Intel to Cap Off Difficult Year Ahead of New Chief

21 Januar 2021 - 2:29PM

Dow Jones News

By Asa Fitch

Intel Corp. is poised to post full-year results that outline the

breadth of challenges awaiting the incoming chief executive as the

chip maker looks to fend off competitive pressures and rebuild its

technological leadership.

The earnings Thursday afternoon mark the end of a challenging

yet lucrative year for the semiconductor giant that saw it

surpassed in market valuation by rival Nvidia Corp., dropped by

Apple Inc. as a supplier for Mac chips, suffer market-share losses

and face activist investor Third Point LLC pushing for strategic

changes.

Wall Street expects the semiconductor giant to report record

full-year revenue of $75.4 billion, up from $72 billion the year

prior. But analysts surveyed by FactSet foresee lower sales this

year, in part reflecting a pair of divestitures and growing

competitive pressure. And while Intel has benefited from a boom in

demand for PCs in the work-from-home economy, much of the added

buying has focused on lower-cost laptops that aren't as profitable.

Net income for 2020 is expected to fall to $19.3 billion, from

$21.1 billion the year prior.

Intel's longer-term strategy around the outsourcing of chip

production is also in flux ahead of the arrival of Pat Gelsinger as

CEO. Bob Swan, the company's departing chief executive, said last

year that a decision was forthcoming by early this year on whether

to have the company's advanced chips made by a third party after

Intel fell behind Asian rivals in the development of the next

generation of superfast semiconductors.

The company is considering outsourcing production of some of its

most prized chips to those Asian rivals, and particularly to Taiwan

Semiconductor Manufacturing Co., the largest and most advanced

contract chip maker in the world, according to people familiar with

the matter.

Intel already has decided to send out production of coming

graphics-processing chips to TSMC, and the companies have been in

talks about deepening their relationship further. Mr. Swan visited

TSMC to discuss potential options in December, according to a

person familiar with the trip.

Intel declined to comment.

TSMC last year announced plans to build a chip factory in

Arizona, its second in the U.S. And the company last week said it

planned record capital expenditures of as much as $28 billion this

year, a huge increase from last year and an indication, in some

analysts' eyes, that new business from Intel is on the way.

Given the importance of that decision to Intel's long-term

future, a final verdict on outsourcing plans could be deferred

until Mr. Gelsinger takes over in mid-February, analysts say. The

selection of Mr. Gelsinger, the chief executive of VMware Inc., who

spent three decades at Intel earlier in his career, was widely

hailed. Intel's stock is up 10% since his naming. But analysts

expect the turnaround in an industry where product-development

cycles are measured in years, not months, to take time.

"It's a good thing to bring in someone new, and particularly

someone who has worked at Intel and has a tech background, but

whatever path they follow, it will take time to implement," Wedbush

Securities analyst Matthew Bryson said.

Third Point, the activist hedge fund led by Daniel Loeb, took a

position of about $1 billion in Intel's shares and advocated in a

December letter for the company to consider an even more

foundational change: splitting up its chip-design and manufacturing

operations. Such a move would end Intel's decadeslong run as the

leading U.S. integrated chip manufacturer. On Twitter, Mr. Loeb

praised Mr. Swan for stepping aside for Mr. Gelsinger.

Intel is facing other pressures, including from competitors such

as Nvidia and Advanced Micro Devices Inc. Amid Intel's

manufacturing setbacks, AMD has gained market share quickly in

central processors for PCs and servers.

When Intel announced Mr. Gelsinger's appointment last week, the

company pointed to strong progress on its next-generation chips,

which it previously disclosed were running a year behind their

initial schedule. The company also said it expected fourth-quarter

results to come in above guidance in October of about $17.4 billion

of revenue and $1.02 in earnings per share.

-- For more WSJ Technology analysis, reviews, advice and

headlines, sign up for our weekly newsletter.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

January 21, 2021 08:14 ET (13:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

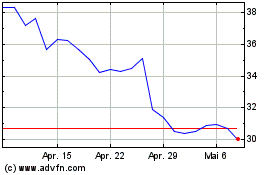

Intel (NASDAQ:INTC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

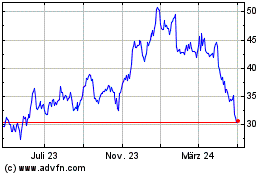

Intel (NASDAQ:INTC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024