Zico Beverage Brand Founder Buys Company Back From Coca-Cola

14 Januar 2021 - 1:59PM

Dow Jones News

By Isaac Taylor

Zico Beverages LLC founder Mark Rampolla is bringing his

beverage baby back home after seven years apart.

PowerPlant Ventures, a venture-capital firm co-founded by Mr.

Rampolla that backs emerging plant-based products and brands,

acquired coconut water-based beverage brand Zico from the Coca-Cola

Co. and will rename it Zico Rising.

The deal reunites Mr. Rampolla with a beverage brand he created

in 2004 after discovering the benefits of coconut water while

serving in Central America with the Peace Corps.

He ultimately sold the brand to Coca-Cola in 2013, several years

after the beverage giant's corporate venturing arm invested in

Zico.

But last year, when Coca-Cola announced it would scrap nearly

200 brands, including Zico, Mr. Rampolla saw an opportunity to

rebuild the brand he had created.

"2021 is going to be about making sure we've got the right

foundation," Mr. Rampolla said, adding that he plans to

re-establish partnerships with retailers and ensure Zico's supply

chain is ready to scale.

Although he said he believes Coca-Cola is an amazing

organization, he added that he thought the beverage giant's skill

set is probably better suited to supporting large, core brands

rather than smaller emerging ones.

In the years since he sold Zico, Mr. Rampolla and his firm

PowerPlant have gotten plenty of experience nurturing up-and-coming

new brands in the plant-based food sector.

"I've had the good fortune over the last seven years to

personally invest in [over 40 companies]," Mr. Rampolla said. "We

look at about 600 deals a year. What has helped is my pattern

recognition...Staying ahead of trends, not only just with products

but ways to communicate with consumers."

PowerPlant raised around $42 million for its first fund in 2015

from previous investors in Zico as well as large family offices and

institutions. The firm backed 17 companies out of that fund, taking

relatively small positions. At least four of those brands have

grown into companies valued at more than $1 billion, including

plant-based alternative meat brand Beyond Meat Inc., online food

retailer Thrive Market and Eat JUST Inc., which produces

plant-based egg substitute brand JUST.

The firm's success with its early fund helped it raise a much

larger second fund, which closed in 2019.

"Our second fund [closed at] $167 million and that was much more

growth capital-like," Mr. Rampolla said. "We're investing out of

that fund right now. We'll only make 10 to 12 investments out of

that fund."

The firm plans to take more concentrated positions out of its

second fund -- typically 20% to 100% stakes -- which is what it has

done with Zico, according to Mr. Rampolla.

The fund targets companies with annual revenue ranging from $5

million to $25 million. So far it has backed 10 companies from the

second fund, including Zico.

Write to Isaac Taylor at issac.taylor@wsj.com

(END) Dow Jones Newswires

January 14, 2021 07:44 ET (12:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

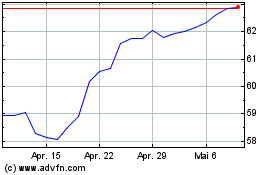

Coca Cola (NYSE:KO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

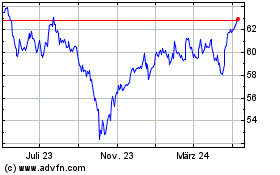

Coca Cola (NYSE:KO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024