TIDMTSCO

RNS Number : 6290L

Tesco PLC

14 January 2021

A MARKET-LEADING CHRISTMAS PERFORMANCE - UK LFL SALES GROWTH UP

8.1%

19 weeks 3Q + Christmas Trading = 19 week period

Sales Total LFL sales Total LFL sales Total LFL sales

GBPm sales change sales change sales change

change change change

(constant (constant (constant

rates) rates) rates)

------------------ --------- ---------- ---------- ----------

UK & ROI 18,182 8.5% 6.1% 8.4% 6.3% 8.5% 6.1%

--------- ---------- --------- ---------- --------- ---------- ---------

UK 14,696 7.2% 6.7% 8.4% 8.1% 7.6% 7.2%

ROI 1,013 11.7% 11.8% 12.4% 12.7% 12.0% 12.1%

Booker 2,473 15.1% 0.1% 6.7% (8.3)% 12.4% (2.5)%

--------- ---------- --------- ---------- --------- ---------- ---------

Central Europe 1,464 0.7% 0.9% (4.0)% (4.2)% (1.0)% (1.0)%

--------- ---------- --------- ---------- --------- ---------- ---------

Group Retail 19,646 7.9% 5.7% 7.3% 5.4% 7.7% 5.6%

--------- ---------- --------- ---------- --------- ---------- ---------

Tesco Bank 261 (28.5)% n/a (25.7)% n/a (27.7)% n/a

--------- ---------- --------- ---------- --------- ---------- ---------

Group 19,908 7.1% 5.7% 6.8% 5.4% 7.0% 5.6%

--------- ---------- --------- ---------- --------- ---------- ---------

Ken Murphy, Chief Executive:

"Our focus on looking after our customers, including delivering

record availability, robust safety measures and great value has

enabled us to maintain strong momentum through the Christmas

period, outperforming the market every week.

We delivered a record Christmas across all of our formats and

channels. In response to unprecedented demand for online groceries,

colleagues delivered over seven million orders containing more than

400 million individual items over the Christmas period. We're now

supporting 786,000 vulnerable customers with priority access to

online slots and, as lockdown measures continue, we'll keep doing

everything we can to ensure everyone can safely get the food and

essentials they need.

Our colleagues went above and beyond, rising to every challenge

in the most exceptional of circumstances and I thank every one of

them for this. We're in great shape to keep delivering in 2021 and

beyond."

Trading update (3Q: 13 weeks to 28 November 2020; Christmas

Trading: 6 weeks to 9 January 2021)

A strong UK sales performance was sustained into the third

quarter with like-for-like growth of +6.7%, accelerating to +8.1%

at Christmas following improved customer metrics across all areas.

Our performance was market-leading for every week of the Christmas

period with our simple, great value offer and focus on safety

resonating well with customers.

UK sales grew across all formats, channels and categories.

Online sales growth was particularly marked at over +80% which

equates to nearly GBP1 billion extra sales over the 19-week period.

Order numbers after Christmas continued to grow, and we exceeded

our all-time records for both home deliveries and click &

collect last week. Our performance included the benefit of

attracting nearly 100,000 new Delivery Saver subscribers taking the

total to over 680,000. Large store sales also grew strongly as

customers favoured larger, less frequent shopping trips.

UK sales performance over Christmas was driven by food including

a +14% increase in sales of Finest* products as customers looked

for more opportunities to treat themselves as part of their festive

shop. We supported customers with timely promotions including our

festive 5 vegetable offer, '3 for 2' party food and 25% off 6+

bottles of wine. We catered for all diets with our largest ever

festive range of free-from, vegan and vegetarian products. Sales of

plant-based products increased strongly including growth of more

than +90% in our Plant Chef range in the run up to Christmas.

General merchandise sales grew by +4% driven by strong performance

in toys, home and electrical items.

We are committed to delivering great value at a time when our

customers need us most. Since we launched Aldi Price Match in

March, our value perception has increased by +450 basis points and

we are now the most competitive we have been against the entire

market in nearly a decade. Following the launch of Clubcard Prices

in September, Clubcard penetration has increased by +10% pts to

over 80% of sales in Large stores and the Clubcard app has nearly

two million more active users. We continue to strengthen our

overall relative price position and are gaining customers from all

key competitors.

Our response to COVID-19 continues to be guided by doing the

right thing for all our stakeholders. In the period, we thanked

front-line colleagues with a 10% Christmas bonus, shielded our

extremely clinically vulnerable colleagues and welcomed nearly

35,000 additional temporary colleagues. We've continued to support

our communities, in total providing more than GBP60m in support to

help charities feed people in need during the pandemic. We were

also delighted to achieve our UK target of removing one billion

pieces of plastic from products sold, including removal of shrink

wrap from multipacks, covers from greeting cards and plastic gifts

from our Christmas crackers.

Our comprehensive preparations and our strong relationships with

suppliers have enabled us to maintain strong levels of availability

through the initial Brexit transition period.

Booker sales over the 19-week period grew by +12.4% including a

c.14% contribution from Best Food Logistics which was acquired in

early March. Retail continued to perform well throughout the period

with sales up +14%. Catering performance has been strongly

correlated to the severity of UK COVID-19 restrictions including a

recovery following the 'Eat Out to Help Out' scheme leading into

the start of the third quarter. As restrictions have tightened, the

severity of the decline in the hospitality sector overall led to a

fall in our catering sales of (49)% on a like-for-like basis over

the Christmas period, compared to around (30)% for the third

quarter. We continue to outperform the catering industry as a

whole.

In ROI, like-for-like sales over the 19-week period grew by

+12.1% with the strongest contribution from our large stores. We

remain the clear online grocery market leader with sales growing by

nearly +70% as we increased capacity in response to record demand.

In the third quarter, we achieved our highest recorded customer NPS

scores as service, value and quality perceptions all stepped

forward.

Like-for-like sales in Central Europe grew by +0.9% in the third

quarter, as we continued to strengthen our value proposition and

traded over a weaker comparable period due to the re-sizing and

simplifying of our businesses last year. Since then, the tightening

of COVID-19 restrictions - including curfews preventing evening

trading, temporary Sunday trading bans, and restrictions on the

sale of non-food - have affected all of our markets in the region.

In particular, this had a significant impact on our large stores

and contributed to a (4.2)% decline in like-for-like sales over the

Christmas period.

Tesco Bank sales fell (27.7)% across the 19-week period as

activity across banking and money services continued to reflect the

ongoing impact of COVID-19.

Sale of our businesses in Thailand and Malaysia

We completed the GBP8.2bn sale of our businesses in Thailand and

Malaysia on 18 December 2020. We have already made a one-off

contribution of GBP2.5bn to the Tesco PLC Pension Scheme and,

conditional on obtaining shareholder approval at the General

Meeting, we will return c.GBP5bn to shareholders via a special

dividend followed by a share consolidation on or around 26 February

2021.

A circular containing further details of the special dividend

and the share consolidation ratio will be sent to Tesco

shareholders on or around 25 January 2021.

Looking ahead

We will continue to be guided by our four key priorities in

response to the COVID-19 crisis: providing food for all, safety for

everyone, supporting our colleagues and supporting our communities.

We also remain committed to delivering great value to help

customers in increasingly challenging times.

The strong momentum in the business and the benefits of

sustained elevated sales are enabling us to offset the additional

COVID-19 costs we are now expecting to incur as a result of the

increasing severity of the pandemic since we updated the market in

October. These incremental costs, such as increased colleague

absence, take our current total full year estimate for the UK to

GBP(810)m - an increase of GBP(85)m since our previous estimate of

GBP(725)m.

As a result, our guidance for the 2020/21 financial year is

unchanged: we remain confident that retail operating profit is

likely to be at least at the same level as in 2019/20, excluding

the repayment of business rates relief.

We continue to expect to report a loss for Tesco Bank of between

GBP(175)m and GBP(200)m for the 2020/21 financial year.

Contacts

Investor Relations: Chris Griffith 01707 940 900

Sarah Titterington 01707 940 693

Media: Christine Heffernan 0330 678 0639

Philip Gawith, Teneo 0207 420 3143

A call for investors and analysts will be held today at

09:00am.

Dial in number: 0800 279 6619 (toll free) / +44 (0) 207 192

8338

Access Code: 4998880

All materials, including a transcript and playback facility,

will be made available on our website.

We will report our full year results on Wednesday 14 April

2021.

Notes

1. All sales shown on exc. VAT, exc. fuel basis. Sales change

shown at constant rates, unless otherwise stated

2. These results have been reported on a continuing operations

basis and exclude the results from our business in Poland. We

completed the sale of our businesses in Thailand and Malaysia on 18

December 2020

3. Sales change at actual rates:

3Q Christmas 19 week period

period

--------------

UK & ROI +8.7% +8.7% +8.7%

------- --------- --------------

Central

Europe (0.7)% (3.2)% (1.6)%

------- --------- --------------

Group Retail +7.9% +7.7% +7.8%

------- --------- --------------

4. Booker total sales includes Best Food Logistics which was acquired in March 2020

5. In order to ensure the best comparability across the festive

season year-on-year, sales for the 19 weeks to 9 January 2021 have

been reported against sales for the 19 weeks to 11 January 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTUOAORAUUAAUR

(END) Dow Jones Newswires

January 14, 2021 02:00 ET (07:00 GMT)

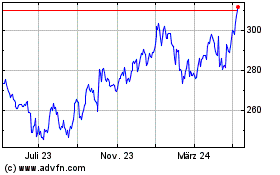

Tesco (LSE:TSCO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

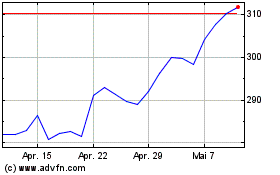

Tesco (LSE:TSCO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024