By Thomas Gryta

General Electric Co.'s board won't claw back compensation from

former CEO Jeff Immelt and other executives over GE's accounting

issues or Mr. Immelt's use of a backup corporate jet, ending a

three-year probe into allegations of misconduct at the

conglomerate.

The investigation didn't find evidence to support shareholders'

claims of fraud and abuse, and pursuing litigation against former

leaders wasn't in the company's interest, according to the law firm

that GE's board hired to run the process.

"The company does not have a sound legal claim to bring against

any current or former officer, director or employee of the company,

or against KPMG," lawyers at Cravath Swaine & Moore LLP said in

a letter dated Dec. 31 and reviewed by The Wall Street Journal.

Since November 2017, GE's board received 11 formal requests from

shareholders with allegations for the board to investigate,

including that executives and directors breached their fiduciary

duties and violated securities laws, according to Cravath's

letter.

A GE spokeswoman confirmed the board's conclusions and said, "We

have significantly enhanced our disclosures and internal controls

and are a stronger company today." A representative for Mr. Immelt

declined to comment. Lawyers representing some of the shareholders

didn't immediately respond to requests for comment.

It is relatively rare for corporate boards to claw back

compensation from former executives. Wells Fargo & Co.'s board

took back $69 million from former CEO John Stumpf because of a

sales scandal during his tenure. McDonald's Corp. sued to claw back

severance paid to former CEO Steve Easterbrook, who left after a

probe into sexual relationships with employees. Mr. Easterbrook is

fighting in court, saying the company knew about his relationships

when it negotiated his severance.

Mr. Immelt didn't receive any severance when he left GE in the

middle of 2017, a year when his compensation totaled $8.1 million.

He received $21.3 million in compensation in 2016, his last full

year as chairman and CEO.

The manufacturing giant also faced an accounting probe by the

Securities and Exchange Commission, which it recently settled for

$200 million without admitting or denying the SEC's claims. GE and

its former executives have denied allegations by shareholders that

fraud or wrongdoing were responsible for large write-downs and the

collapse in its profits and stock price.

The Justice Department opened a criminal investigation into GE's

accounting more than two years ago but that probe has gone quiet,

according to people familiar with the matter. GE hasn't heard from

investigators in a long time, the people said.

The SEC probe and shareholders' allegations mainly related to

GE's long-term-care insurance portfolio and deterioration of its

power business around the time of Mr. Immelt's departure in

mid-2017. KPMG, the company's auditor at the time, was also named

in some of the shareholder letters as aiding and abetting the

purported misbehavior. A KPMG spokesman declined to comment.

The shareholders asked the board to investigate and potentially

sue individuals to recover damages and claw back compensation.

Under a shareholder derivative complaint, any recovered damages are

typically returned to the company.

The Journal reported in October 2017 that for much of Mr.

Immelt's 16-year tenure as CEO the company had a spare aircraft

follow Mr. Immelt's corporate jet to destinations around the globe,

according to people familiar with the matter. GE had received an

internal complaint about the practice years before it was ended,

the Journal reported.

In 2017, Mr. Immelt told the Journal the practice wasn't

something he had requested or approved.

In December 2017, GE's board formed a special committee to

investigate claims about the backup jet and other allegations

raised by shareholders. Cravath's letter said it reviewed thousands

of documents and conducted dozens of interviews, including with Mr.

Immelt and other former executives. Most of the members of GE's

board have changed since 2017.

GE's board concluded there is no "sound legal basis" to bring

claims against current or former employees or directors. Even if

there were such a basis, the board decided that "any such

litigation would not be in the best interest of the company and its

stockholders," the letter states.

The board's Dec. 11 decision came days after GE agreed to settle

the SEC's claims.

No changes to GE's prior financial statements were required by

the SEC. "We are pleased to have reached an agreement that puts the

matter behind us," the company said last month.

When the accounting issues came to light, GE's stock tumbled in

2017 and 2018, erasing more than $200 billion in market value. The

company slashed its dividend to a token penny a share and twice

switched leaders, installing Larry Culp as CEO in October 2018. GE

also decided to change auditors after more than a century with

KPMG, hiring Deloitte starting in 2021.

Shareholder lawsuits continue, including a complaint charging

that GE's risk disclosures and accounting practices amounted to

fraud on the part of former executives. Plaintiffs in that case

asked a federal judge to consider the SEC complaint as the two

sides argued over a motion from GE and the former executives to

dismiss the three-year-old case.

In a letter last month to U.S. District Judge Jesse Furman of

New York, lawyers representing GE and the former executives said

the court shouldn't take the SEC's findings into account, and that

even if it did, "nothing in the SEC Order supports any inference"

of intentional wrongdoing.

Ted Mann contributed to this article.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

January 05, 2021 15:47 ET (20:47 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

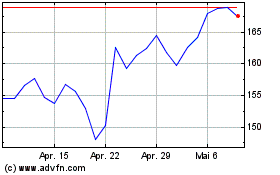

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024