Initial Statement of Beneficial Ownership (3)

31 Dezember 2020 - 11:04PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

von Blucher Sheryl G. |

2. Date of Event Requiring Statement (MM/DD/YYYY)

12/30/2020

|

3. Issuer Name and Ticker or Trading Symbol

CLARIVATE Plc [CCC]

|

|

(Last)

(First)

(Middle)

C/O CLARIVATE PLC, FRIARS HOUSE, 160 BLACKFRIARS ROAD |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Street)

LONDON, X0 SE1 8EZ

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Ordinary Shares | 3290826 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Warrants (right to buy) | (1) | (2) | Ordinary Shares | 274000.0 | $11.5 | D | |

| Explanation of Responses: |

| (1) | Refer to Section 3.3 of the Warrant Agreement available at: https://www.sec.gov/Archives/edgar/data/1744895/000157104918000445/tv498383_ex4-4.htm |

| (2) | Refer to Section 3.2 of the Warrant Agreement available at: https://www.sec.gov/Archives/edgar/data/1744895/000157104918000445/tv498383_ex4-4.htm |

Remarks:

Clarivate Plc currently qualifies as a foreign private issuer ("FPI") and the directors, officers and shareholders of Clarivate Plc are currently exempt from Section 16 of the Securities Exchange Act of 1934 pursuant to Rule 3a12-3(b) thereunder. As such, this is an informational and voluntary report only, which shall not be deemed an admission that the filing person is required to report beneficial ownership of and transactions in Clarivate Plc securities, or that the filing person is subject to any liabilities or duties under Section 16. Clarivate Plc anticipates that it will no longer retain FPI status after December 31, 2020. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

von Blucher Sheryl G.

C/O CLARIVATE PLC

FRIARS HOUSE, 160 BLACKFRIARS ROAD

LONDON, X0 SE1 8EZ | X |

|

|

|

Signatures

|

| /s/ Stephen Hartman, attorney-in-fact | | 12/30/2020 |

| **Signature of Reporting Person | Date |

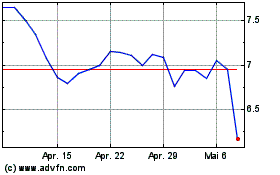

Clarivate (NYSE:CLVT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

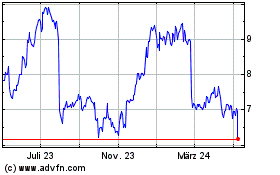

Clarivate (NYSE:CLVT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024