Take-Two, Occidental Petroleum, Moderna: What to Watch When the Stock Market Opens Today

15 Dezember 2020 - 3:15PM

Dow Jones News

By Mischa Frankl-Duval

Here's what we are watching as markets kick into gear Tuesday.

-- U.S. stock futures edged higher as investors cautiously welcomed

signs of progress in negotiations over an economic relief package

in Washington.

Futures tied to the S&P 500 rose 0.7%, suggesting the

benchmark index may open higher after falling for a fourth

consecutive day on Monday. Futures for the technology-heavy

Nasdaq-100 index ticked up 0.6%.

Read our full market wrap here.

What's Coming Up

-- Nordson, which makes dispensing equipment for adhesives,

sealants and coatings, reports its quarterly earnings after markets

close. -- Data released at 9:15 a.m. ET are expected to show that

U.S. industrial production rose in November on the back of strong

demand for autos.

Market Movers to Watch

-- Take-Two Interactive Software rose 0.4% premarket, having

earlier fallen as much as 2%. Rival videogame publisher Electronic

Arts Inc. said Monday it reached a $1.25 billion deal to acquire

Codemasters, which, had been evaluating an earlier offer from

Take-Two. -- Occidental Petroleum ticked 1.5% higher before the

bell, after falling more than 8% yesterday. Tesla is set to replace

the oil major in the S&P 100 index.

-- Apartment Investment & Management tumbled more than 82%

premarket. The company today said it had separated its businesses

into two distinct, publicly traded companies, with some assets

trading under the same ticker, AIV.

-- Shares of Moderna rose 0.9% premarket. The Food and Drug

Administration said Tuesday that its Covid-19 vaccine is " highly

effective," suggesting it could soon be added to the arsenal

against the pandemic.

Market Fact

-- The best performing stock in the Stoxx Europe 600 index this

year is Sinch AB, which links up businesses and consumers on

smartphones. Its shares are up 332% as of Tuesday, handily besting

the second-best performer in Europe, meal-kit delivery service

HelloFresh SE, up a mere 214%.

Chart of the Day

Stock buyers have been scooping up shares of real-estate

companies that are beaten down but stand to benefit from the

economy's eventual reopening.

Must Reads Since You Went to Bed

High-Frequency Traders Push Closer to Light Speed With

Cutting-Edge Cables

China's Economy Continues Broad Recovery Despite Covid-19 Surge

Elsewhere

Twitter Fined $546,000 in First Cross-Border GDPR Case for U.S

Tech Firm

Fannie, Freddie Privatization Decisions Likely to Be Left to

Biden Administration

Real Estate's Biggest Losers Enjoy a One-Month Bounce

(END) Dow Jones Newswires

December 15, 2020 09:00 ET (14:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

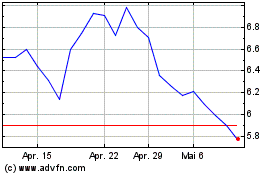

HelloFresh (TG:HFG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

HelloFresh (TG:HFG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024