By Dave Michaels and Thomas Gryta

General Electric Co. agreed to pay a $200 million penalty to

settle federal claims that it misled investors by failing to

disclose problems in its gas-turbine power and insurance

businesses, capping an investigation into what went wrong inside

the conglomerate.

The Securities and Exchange Commission, after a multiyear probe

into how GE recognized some costs and profits, said the company

misrepresented how its power business was making money and didn't

inform investors of the rising risk in its legacy insurance

portfolio that would eventually require more than $15 billion to

boost its reserves.

"GE's repeated disclosure failures across multiple businesses

materially misled investors about how it was generating reported

earnings and cash growth as well as latent risks in its insurance

business," said Stephanie Avakian, director of the SEC's Division

of Enforcement.

GE settled the claims without admitting or denying the SEC's

allegations, and the settlement order didn't allege GE violated

U.S. accounting rules or the most serious antifraud laws. Under the

resolution, the company also must report to the SEC for a one-year

period on its policies and controls related to accounting and

disclosure.

GE said no changes to prior financial statements are required.

"We are pleased to have reached an agreement that puts the matter

behind us," the company said. "Under the current leadership team,

we have significantly enhanced our disclosures and internal

controls and are a stronger company today."

The SEC said in announcing the deal that it continues to

investigate the claims, which often means regulators are still

probing whether individuals should be formally accused of

wrongdoing.

The SEC said GE's misconduct spanned from 2015 to 2017 and

involved accounting maneuvers that boosted GE's earnings by

billions of dollars and improved a key measure of its cash flow.

The moves to increase industrial cash flow, by about $1.9 billion

in 2016 and 2017, involved selling receivables, or money GE was

owed from customers, to GE Capital. The company didn't disclose its

increased reliance on selling receivables to goose its industrial

cash flow, the SEC said in the settlement order.

The SEC and the Justice Department have been investigating GE's

accounting for about two years after the company disclosed large

write-downs tied to its insurance business and its power business.

The SEC had warned GE in September that it was preparing civil

charges, and GE said it had set aside $100 million to resolve the

matter.

The terms of GE's settlement with the SEC make it less likely

the Justice Department will pursue a case against GE or its former

executives. Prosecutors typically have to prove knowledge and

intent to commit fraud in order to indict individuals or charge a

company.

Accounting problems surfaced in late 2017 as GE was struggling

with declining profits and cash flow following the departure of

former Chief Executive Jeff Immelt. The company later disclosed, in

January 2018, that it needed to bolster its insurance reserves by

$15 billion and booked a $6 billion charge.

GE's stock tumbled in 2017 and 2018, erasing more than $200

billion in market value. The company slashed its dividend to a

token penny a share. It also sold off various business units, cut

jobs and twice switched leaders, installing Larry Culp as CEO in

October 2018. GE also decided to change auditors after more than a

century with KPMG, hiring Deloitte starting in 2021.

The SEC's investigation found that GE executives boosted the

company's reported profits by lowering the estimated cost of

fulfilling long-term GE Power service contracts. The change

resulted in higher profits when the adjustment was made but didn't

bring in cash.

As the gap between reported profits and cash flow widened, Wall

Street analysts and investors raised concerns, prompting GE to

generate cash by selling receivables to GE's finance division, a

practice referred to as "deferred monetization."

The practice "was described internally as a 'drug' because the

company needed to continue to do more deferred monetization to

achieve equivalent effects period after period," according to the

SEC order. The practice was also costly for GE, as it involved

offering discounts to customers and paying interest to GE

Capital.

Profits in GE's power business, which was once the company's

largest in terms of revenue, tumbled after falling demand from

utilities left GE stuck with excess supply of turbines and parts.

GE also booked a $22 billion charge in 2018 tied to acquisitions in

the unit.

The SEC said executives "misled GE's investors about the

company's earnings quality by making it appear as if GE Power was

converting earnings to cash in the present period, when in fact GE

Power was pulling forward cash from future periods."

The insurance problem was a hangover from GE's one-time reliance

on financial services to drive its profits. At its height, GE

Capital accounted for more than half of GE's profits.

GE spun off most of its insurance holdings into Genworth

Financial Inc. in 2004 and sold much of the rest to Swiss

Reinsurance Co. two years later. But GE kept the risk for some

long-term-care insurance policies. Such policies pay for nursing

homes and assisted-living facilities. They proved to be an

expensive problem for the insurance industry, which underestimated

how much the policies would need to pay out.

The SEC said executives in GE's insurance business and GE

Capital knew the insurance losses were growing and posed a risk,

but they made actuarial or accounting changes to avoid having to

recognize losses. Reversing the losses also avoided a deeper

examination of the insurance reserves.

For example, in August 2016, GE's actuaries concluded an annual

test of the policies that would have resulted in GE taking a $178

million hit to earnings. In response, executives in the insurance

unit employed a new approach, referred to as the "rollforward,"

which eliminated the potential loss, the SEC found.

Instead of using 2016 claims data to estimate costs, GE took

assumptions for the end of 2015 and projected them forward nine

months. The rollforward raised questions from internal auditors,

the SEC said, but not until mid-2017 did actuaries determine that

GE faced an even bigger problem, and the company began reviewing

its insurance reserves.

Write to Dave Michaels at dave.michaels@wsj.com and Thomas Gryta

at thomas.gryta@wsj.com

(END) Dow Jones Newswires

December 09, 2020 21:23 ET (02:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

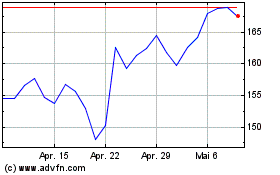

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024