GE to Pay $200 Million to Settle SEC Accounting Probe

10 Dezember 2020 - 12:12AM

Dow Jones News

By Dave Michaels and Thomas Gryta

General Electric Co. agreed to pay a $200 million penalty to

settle federal claims that it misled investors by failing to

disclose problems in its gas-turbine power and insurance

businesses, capping an investigation into what went wrong inside

the conglomerate.

The Securities and Exchange Commission, after a multiyear probe

into how GE recognized some costs and profits, said the company

misrepresented how its power business was making money and didn't

inform investors of the rising risk in its legacy insurance

portfolio that would eventually require more than $15 billion to

boost its reserves.

"GE's repeated disclosure failures across multiple businesses

materially misled investors about how it was generating reported

earnings and cash growth as well as latent risks in its insurance

business," Stephanie Avakian, director of the SEC's Division of

Enforcement, said.

GE settled the claims without admitting or denying the SEC's

allegations, and the settlement order didn't allege GE violated the

most serious antifraud laws. Under the resolution, the company also

must report to the SEC for a one-year period on its policies and

controls related to accounting and disclosure.

GE said no changes to prior financial statements are required.

"We are pleased to have reached an agreement that puts the matter

behind us," the company said. "Under the current leadership team,

we have significantly enhanced our disclosures and internal

controls and are a stronger company today."

(END) Dow Jones Newswires

December 09, 2020 17:57 ET (22:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

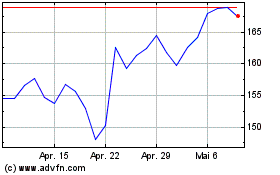

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024