Current Report Filing (8-k)

09 Dezember 2020 - 11:10PM

Edgar (US Regulatory)

0000040545false00000405452020-12-092020-12-090000040545us-gaap:CommonStockMember2020-12-092020-12-090000040545ge:A0.375NotesDue2022Member2020-12-092020-12-090000040545ge:A1.250NotesDue2023Member2020-12-092020-12-090000040545ge:A0.875NotesDue2025Member2020-12-092020-12-090000040545ge:A1.875NotesDue2027Member2020-12-092020-12-090000040545ge:A1.500NotesDue2029Member2020-12-092020-12-090000040545ge:A7.5GuaranteedSubordinatedNotesDue2035Member2020-12-092020-12-090000040545ge:A2.125NotesDue2037Member2020-12-092020-12-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 9, 2020

General Electric Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York

|

|

001-00035

|

|

14-0689340

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

5 Necco Street

|

Boston,

|

MA

|

|

|

|

02210

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

|

|

|

|

|

|

|

(Registrant’s telephone number, including area code) (617) 443-3000

_______________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

|

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.06 per share

|

GE

|

New York Stock Exchange

|

|

0.375% Notes due 2022

|

GE 22A

|

New York Stock Exchange

|

|

1.250% Notes due 2023

|

GE 23E

|

New York Stock Exchange

|

|

0.875% Notes due 2025

|

GE 25

|

New York Stock Exchange

|

|

1.875% Notes due 2027

|

GE 27E

|

New York Stock Exchange

|

|

1.500% Notes due 2029

|

GE 29

|

New York Stock Exchange

|

|

7 1/2% Guaranteed Subordinated Notes due 2035

|

GE /35

|

New York Stock Exchange

|

|

2.125% Notes due 2037

|

GE 37

|

New York Stock Exchange

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

|

|

|

|

Emerging growth company

|

☐

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act.

|

☐

|

Item 8.01 Other Events.

On December 9, 2020, General Electric Company (“GE”) announced that it had reached a settlement with the Securities and Exchange Commission (“SEC”) in connection with the SEC investigation that we have previously disclosed. Consistent with common SEC practice, GE neither admits nor denies the findings in the administrative order that the SEC issued today. Under the terms of the settlement, GE consented to the entry of an order requiring it to pay a civil penalty of $200 million and to cease and desist from violations of specified provisions of the federal securities laws and rules promulgated thereunder. In addition, GE agreed to cooperation obligations and to report during a one-year period to the SEC about compliance related to its Power business and GE Capital’s run-off insurance operations. We have concluded that it is in the best interests of GE and its shareholders to resolve this matter and put it behind us on the basis announced today.

The order that the SEC issued today contains findings related to disclosures with respect to GE’s Power business during the 2015–2017 time period and disclosures and internal controls with respect to GE Capital’s run-off insurance operations during the third quarter of 2015 through the first quarter of 2017. The settlement concludes and resolves the SEC investigation of GE in its entirety.

The SEC’s order makes no allegation that prior period financial statements were misstated. This settlement does not require corrections or restatements of GE’s previously reported financial statements, and GE stands behind its financial reporting.

GE cooperated with the SEC over the course of its investigation. As noted in the order, GE has taken a number of steps since the time periods covered by the investigation to enhance its investor disclosures regarding power and insurance trends and risks, as well as enhancing internal controls on its insurance premium deficiency testing (also known as loss recognition testing) process and adding disclosure controls and procedures concerning its insurance liabilities.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Electric Company

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date: December 9, 2020

|

|

/s/ Christoph A. Pereira

|

|

|

|

|

Christoph A. Pereira

Vice President, Chief Risk Officer and Chief Corporate Counsel

|

|

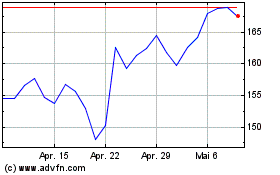

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024