Exxon Slashes Spending, Writes Down Assets

30 November 2020 - 11:38PM

Dow Jones News

By Christopher M. Matthews

Exxon Mobil Corp. is retreating from a plan to increase spending

to boost its oil and gas production by 2025 and preparing to slash

the book value of its assets by up to $20 billion, as the

struggling company reassesses its next decade.

The Texas oil giant, which has lost more than $2.3 billion over

the first three quarters of this year after the coronavirus wreaked

havoc on fossil fuel demand, released a reduced spending outlook

Monday for the next five years. It now plans to spend $19 billion

or less next year and $20 billion to $25 billion a year between

2022 and 2025. It had previously planned to spend more than $30

billion a year in capital expenditures through 2025.

Exxon also said it would stop investing in certain natural-gas

assets and telegraphed a massive write-down.

The cuts are a course correction for Chief Executive Darren

Woods, who laid out a plan in 2018 to spend $230 billion to double

profits and pump an additional one million barrels of oil and gas a

day by the middle of the next decade. That plan proved ill-timed,

especially after the pandemic caused oil prices to plummet this

spring.

Exxon cut its expectations for future oil prices for each of the

next seven years by 11% to 17% as part of a financial-planning

process conducted this fall, The Wall Street Journal reported last

week, citing internal documents. The sizable reduction suggests

Exxon expects the economic fallout from the pandemic to linger for

much of the next decade.

Write to Christopher M. Matthews at

christopher.matthews@wsj.com

(END) Dow Jones Newswires

November 30, 2020 17:23 ET (22:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

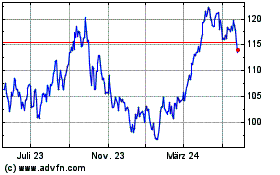

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

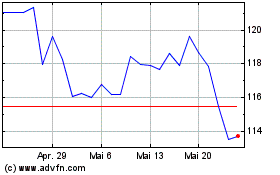

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024