Turkey's Central Bank Lifts Key Rates Drastically

19 November 2020 - 9:30AM

RTTF2

In a bid to bolster the Turkish lira, the central bank lifted

its key rates drastically, as expected, on Thursday under the new

governorship.

At the first policy meeting of Naci Agbal as governor of the

Central Bank of the Republic of Turkey, the Monetary Policy

Committee raised the key one-week repo rate sharply by 475 basis

points to 10.25 percent from 15.00 percent.

All central bank funding will be provided through the one-week

repo rate, the bank said.

Early November, President Recep Tayyip Erdogan replaced TCMB

Governor Murat Uysal with former finance minister Agbal after the

Turkish lira fell to a record low this year. The latest hike was

the sharpest in more than two years. In September, the bank had

raised the rate from 8.25 percent, which was the first increase in

two years.

The decision to hike its one-week repo rate by 475 basis points

and pledge to provide all funding through this facility appears to

have done enough to convince investors that there really is a

positive shift in policymaking underway, Jason Tuvey, an economist

at Capital Economics, said.

The economist expects the repo rate to be left at 15 percent

until at least the end of 2021.

The bank said the lagged effects of depreciation in Turkish

lira, increasing international food prices and deterioration in

inflation expectations affect the inflation outlook adversely.

The committee decided to implement a transparent and strong

monetary tightening in order to eliminate risks to the inflation

outlook, contain inflation expectations and restore the

disinflation process, the bank said in the statement. Moreover, the

bank said the tightness of monetary policy will be decisively

sustained until a permanent fall in inflation is achieved.

The bank said it will attain the main objective of achieving and

maintaining price stability by adopting transparency,

predictability and accountability principles of the inflation

targeting regime.

The committee noted that partial restrictions to curb the

Covid-19 spread heightened uncertainties on the short-run outlook

of economic activity.

Besides, strengthening domestic demand, due to the lagged

effects of strong credit impulse during the pandemic, affects the

current account balance adversely through the imports channel, the

bank added.

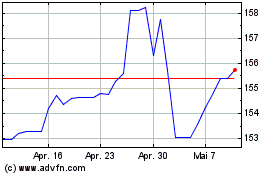

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

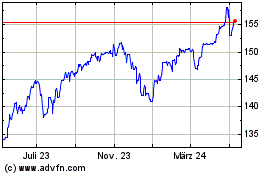

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024