U.S. Dollar Dips On Election Uncertainty

06 November 2020 - 11:12AM

RTTF2

The U.S. dollar weakened against its major counterparts in the

European session on Friday, as continued uncertainty about the

outcome of the U.S. presidential election made investors

cautious.

Democratic challenger Joe Biden gained more ground on President

Donald Trump in the battleground states of Georgia and

Pennsylvania, and expanded his lead in Nevada.

As votes continued to be counted and Democrat Biden edges closer

to victory, the Trump team is pressing legal challenges in several

states.

Biden has secured 253 electoral votes, while Trump won 214

votes.

Data from the Labor Department showed that U.S. employment rose

more than expected in October.

The report said non-farm payroll employment jumped by 638,000

jobs in October after surging up by a revised 672,000 jobs in

September.

Economists had expected employment to increase by 600,000 jobs

compared to the addition of 661,000 jobs originally reported for

the previous month.

The Labor Department also said the unemployment rate dropped to

6.9 percent in October from 7.9 percent in September. The

unemployment rate was expected to slip to 7.7 percent.

The dollar has been falling in the Asian session as investors

awaited the latest news about the U.S. presidential election.

The greenback slipped to 0.8985 against the franc, a level

unseen since January 2015. At Thursday's close, the pair was valued

at 0.9038. The dollar is seen finding support around the 0.86

region.

The greenback declined to 103.18 against the yen, its lowest

level since March 9. The pair was worth 103.45 when it ended deals

on Thursday. Should the currency extends decline, 100.00 is

possibly seen as its next support level.

Data from the Ministry of Internal Affairs and Communications

showed that Japan household spending fell 10.2 percent on year in

September - coming in at 269,863 yen.

That beat forecasts for a decline of 10.7 percent following the

6.9 percent drop in August.

The greenback dropped to near a 2-month low of 1.1891 against

the euro, compared to yesterday's closing value of 1.1821. Next key

support for the currency is likely seen around the 1.20 level.

Data from Destatis showed that German industrial production grew

at a faster pace in September.

Industrial output climbed 1.6 percent on month, bigger than the

0.5 percent rise seen in August but slower than economists'

forecast of 2.7 percent.

The U.S. currency pulled back to 1.3042 versus the loonie, after

rising to 1.3097 at 11:00 pm ET. The greenback was trading at

1.3044 per loonie at yesterday's close. On the downside, 1.29 is

possibly seen as its next support level.

In contrast, the greenback rebounded to 0.7242 versus the aussie

and 0.6770 versus the kiwi, from its early low of 0.7287 and a

1-1/2-year low of 0.6802, respectively and was steady. On the

upside, 0.70 and 0.66 are possibly seen as the next resistance for

the greenback against the aussie and the kiwi, respectively.

The greenback rose to 1.3093 versus the pound, after hitting

1.3157, which was its weakest level since October 21. The

pound-greenback pair had finished yesterday's trading session at

1.3146. Immediate resistance for the currency is likely seen around

the 1.29 level.

Data from the Lloyds Bank subsidiary Halifax and IHS Markit

showed that UK house prices increased at the fastest pace since

mid-2016.

House prices increased 7.5 percent on a yearly basis in three

months to October from the same period last year, the strongest

rise since June 2016. Prices had advanced 7.3 percent in three

months to September.

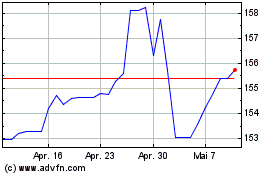

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

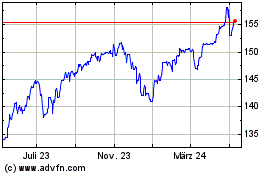

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024