Bayer Posts Third-Quarter Loss on Agriculture Woes--Update

03 November 2020 - 10:16AM

Dow Jones News

By Ruth Bender

BERLIN -- Bayer AG on Tuesday posted a loss in the third-quarter

as the coronavirus pandemic compounded problems the German chemical

and drug giant has been facing since its acquisition of agriculture

giant Monsanto just over two years ago.

Bayer also said it would need an extra $750,000 on top of a

settlement worth up to $10.9 billion it announced over the summer

to resolve a legal battle with U.S. plaintiffs alleging the Roundup

weedkillers inherited from Monsanto cause cancer. Bayer has

consistently denied that Roundup or its ingredients cause

cancer.

Bayer, the inventor of aspirin, bet big on agriculture with its

$63 billion acquisition of Monsanto in 2018. The move was supposed

to help the German company tap into rising demand driven by rapid

population growth. Instead, it exposed Bayer to open-ended legal

liabilities and a market that has been severely disrupted by the

coronavirus pandemic.

The legal battle with plaintiffs claiming that Roundup and its

active ingredient glyphosate cause cancer sent its share price

falling to record lows. The planned settlement hasn't so far been

finalized. And now the pandemic is hurting a crops-science business

that since the Monsanto integration has grown to just under half

the group's total sales.

Last month, Bayer issued a profit warning for 2021, blaming low

prices for major crops, falling demand for biofuel and tougher

competition in the soy market. Bayer then said it expected to write

down the value of assets in the agricultural business in the "mid

to high-single-digit billion euros" range.

Bayer swung to a net loss of EUR2.74 billion (equivalent to

about $3.2 billion) in the three months ended Sept. 30 from a net

profit of EUR1.04 billion. The company said it had to make non-cash

impairment charges of EUR9.3 billion on various assets in its

agriculture unit, including goodwill. Sales fell 14% to EUR8.51

billion, dragged down mostly by the crops-science unit.

"The impact of the pandemic is placing additional strain on our

Crop Science Division," said finance chief Wolfgang Nickl in a

statement.

In the second quarter, problems related to the Monsanto purchase

had already pushed Bayer to a net loss of nearly $11 billion as the

company set aside money to cover its proposed Roundup settlement

deal.

But the settlement has hit snags. In July, Bayer scrapped a

crucial part of the deal -- a $1.25 billion proposal for resolving

possible future lawsuits since the weedkillers continue to be sold

-- after a federal judge voiced concerns about its structure.

Bayer on Tuesday said finalizing a new proposal protecting it

from future lawsuits would require more time but that a new

solution would probably cost in the range of $2 billion, instead of

$1.25 billion. Investors have been keen to see Bayer finalize the

deal.

In further bad news for Bayer, the California Supreme Court

declined last month to hear an appeal by Bayer seeking to reverse

the first jury Roundup jury verdict that ruled in favor of a former

groundskeeper who said it gave him cancer.

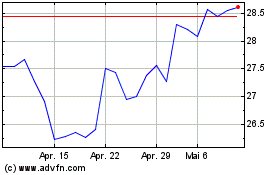

In early morning trade, Bayer shares were trading down 2% in a

broadly higher market going into U.S. election day. Concerns over

the outcome of the settlement, the recent profit warning and

pandemic woes have pushed Bayer shares down over 40% this year so

far, the worst performer in Germany's bluechip DAX index.

Write to Ruth Bender at Ruth.Bender@wsj.com

(END) Dow Jones Newswires

November 03, 2020 04:01 ET (09:01 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

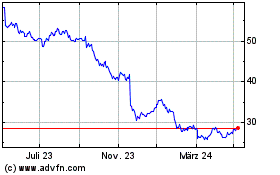

Bayer (TG:BAYN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Bayer (TG:BAYN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024