Coca-Cola Expects Growth in China Even as Global Sales Slide -- Update

22 Oktober 2020 - 4:26PM

Dow Jones News

By Jennifer Maloney

Coca-Cola Co. said it expects to see growth this year in China,

even as its global sales continue to decline because of the

closures of restaurants, bars, movie theaters and sports stadiums

elsewhere around the world.

In China, where the coronavirus originated, consumers are "more

or less back to where they were" before the pandemic started,

though away-from-home sales aren't quite back to where they were,

Coke's finance chief, John Murphy, said in an interview.

China, South Korea, Hong Kong, Singapore, Australia and New

Zealand "are all in a bucket that have demonstrated that taking a

very disciplined set of measures and applying them consistently has

allowed them to emerge faster." In the U.S., which has the highest

number of confirmed coronavirus infections and deaths in the world,

people are "pushing the boundaries a bit more in terms of trying to

live a more normal life," Mr. Murphy said.

The company reported improved sales at U.S. convenience stores

and quick-service restaurants in the third quarter. "The consumer,

I think, has been trying to adapt to a new normal," Mr. Murphy

said.

Coca-Cola reported revenue of $8.65 billion in the quarter, a

decline of 9% from a year earlier but an improvement over the

second quarter, when its revenue fell by 28%.

The company has said it thinks the biggest challenges of the

pandemic are behind it. About half of Coca-Cola's business comes

from away-from-home venues that were largely closed around the

world during the second quarter.

"It's important to remember the world is in a fragile state,"

Coke Chief Executive James Quincey said on a call with analysts

Thursday, noting the new restrictions recently announced in several

countries. More lockdowns could come as winter approaches in the

Northern Hemisphere, he said. "We are prepared for setbacks."

Coca-Cola said Thursday that it plans to cut its 430 "master

brands" by about half, to 200, accelerating a culling effort in

response to the coronavirus pandemic. Among the brands on the

chopping block are Tab cola and Zico coconut water, The Wall Street

Journal has reported. The plan is part of a restructuring that

includes layoffs and a revamped marketing strategy.

The company's global sales volume declined 4% in the third

quarter. They also fell 4% in Asia, primarily because of

coronavirus-related restrictions in India and Japan. That was

partially offset by growth in carbonated soft drinks in China, the

company said.

The beverage company said profit for the third quarter was $1.74

billion, or 40 cents a share. A year earlier, net income was $2.59

billion, or 61 cents a share. The company logged adjusted earnings

of 55 cents a share in the latest quarter.

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

October 22, 2020 10:11 ET (14:11 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

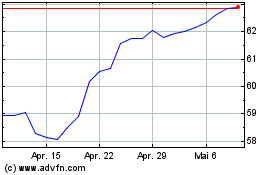

Coca Cola (NYSE:KO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

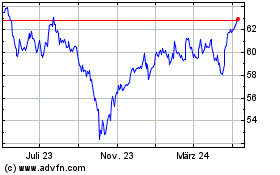

Coca Cola (NYSE:KO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024