American Equity Reaches Brookfield Deal Over Takeover Offer

18 Oktober 2020 - 11:09PM

Dow Jones News

By Geoffrey Rogow

American Equity Investment Life Holding Co. on Sunday rejected a

takeover offer and instead said it reached a partnership with

Brookfield Asset Management Inc.

Brookfield will reinsure up to $10 billion of American Equity's

fixed index annuity liabilities and make a 19.9% equity investment

at $37 a share. Share of American Equity closed Friday at

$32.30.

The decision comes less than three weeks after The Wall Street

Journal reported that a pair of insurance companies --

Massachusetts Mutual Life Insurance Co. and the publicly traded

Athene Holding Ltd. -- had made a bid for the firm, a bet that the

small Iowa insurer's retirement-income products will remain popular

with conservative savers.

MassMutual and Athene's cash offer for American Equity had been

for $36 a share. At that price, the bid would amount to a value of

more than $3 billion.

Representatives for MassMutual and Athene couldn't immediately

be reached for comment.

As part of the agreement disclosed by American Equity on Sunday,

Brookfield will also receive one seat on American Equity's

board.

In its release, American Equity said it had been in discussions

with Brookfield since March as part of the firm's current strategic

plans. Among a set of factors behind the decision, the company said

the deal will give American Equity access to Brookfield's

higher-returning alternative asset strategies, which are

particularly important given the low interest rate environment.

"By partnering with a world-class asset management and

investment firm like Brookfield, we are accelerating the

implementation of our strategy to be the leading, customer-focused

annuity provider with best-in-class capabilities across the entire

insurance value chain, from distribution to asset management," said

American Equity President and Chief Executive Anant Bhalla.

Also Sunday, American Equity said its board had authorized a

repurchase program of up to $500 million shares of common stock to

be funded with the proceeds of the Brookfield investment and cash

on hand. The repurchase is expected to offset dilution from the

issuance of stock to Brookfield, according to American Equity.

"This transaction represents a meaningful investment for us in

the attractive U.S. insurance market and we believe our alternative

asset strategies can deliver long-term value to the company," said

Sachin Shah, Brookfield's chief investment officer.

Write to Geoffrey Rogow at geoffrey.rogow@wsj.com

(END) Dow Jones Newswires

October 18, 2020 16:54 ET (20:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

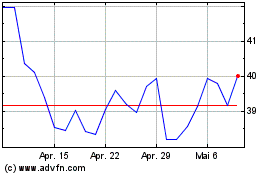

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

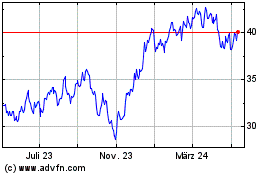

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024