Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

08 Oktober 2020 - 11:08PM

Edgar (US Regulatory)

FREE WRITING PROSPECTUS

Filed Pursuant to Rule 433

Registration Nos. 333-249132 and 333-249132-01

October 8, 2020

This document does not provide full disclosure of all material facts relating to the securities offered. Investors should read the registration statement, any amendment and any applicable prospectus supplement for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

BROOKFIELD FINANCE INC.

US$400,000,000 4.625% Subordinated Notes due October 16, 2080

Fully and unconditionally guaranteed, on a subordinated basis, by Brookfield Asset Management Inc.

Class A Preference Shares, Series 50 of Brookfield Asset Management Inc.

Issuable Upon Automatic Exchange

|

Issuer:

|

|

Brookfield Finance Inc. (“BFI”)

|

|

|

|

|

|

Guarantor:

|

|

Brookfield Asset Management Inc. (“BAM” or the “Company”)

|

|

|

|

|

|

Guarantee:

|

|

The Notes will be fully and unconditionally guaranteed, on a subordinated basis, as to payment of principal, premium (if any) and interest and certain other amounts by Brookfield Asset Management Inc.

|

|

|

|

|

|

Security:

|

|

4.625% Subordinated Notes due October 16, 2080 (the “Notes”).

|

|

|

|

|

|

Expected Ratings *:

|

|

Baa3 / BBB / BBB / BBB (Moody’s / S&P / Fitch / DBRS)

|

|

|

|

|

|

Ranking:

|

|

Subordinated unsecured

|

|

|

|

|

|

Pricing Date:

|

|

October 8, 2020

|

|

|

|

|

|

Settlement Date**:

|

|

October 16, 2020 (T+5)

|

|

|

|

|

|

Maturity Date:

|

|

October 16, 2080

|

|

|

|

|

|

Principal Amount of Notes:

|

|

US$400,000,000

|

|

|

|

|

|

Denominations:

|

|

US$25 and integral multiples of US$25 in excess thereof

|

|

Price to Public:

|

|

100% (US$25 per Note)

|

|

|

|

|

|

Use of Proceeds:

|

|

The Company intends to allocate an amount equal to the net proceeds from this offering to the financing and/or refinancing of recently completed and future Eligible Green Projects, including the development and redevelopment of such projects.

|

|

|

|

|

|

Interest Rate:

|

|

4.625%

|

|

|

|

|

|

Interest Payment Dates:

|

|

January 16, April 16, July 16 and October 16, commencing January 16, 2021

|

|

|

|

|

|

Redemption Right:

|

|

On or after October 16, 2025, BFI may, at its option, redeem the Notes, in whole at any time or in part from time to time, on any Interest Payment Date at a redemption price per US$25 principal amount of the Notes equal to 100% of the principal amount thereof, together with accrued and unpaid interest to, but excluding, the date fixed for redemption.

|

|

|

|

|

|

Redemption on Tax Event or Rating Event:

|

|

At any time, after the occurrence of a Tax Event, BFI may, at its option, redeem all (but not less than all) of the Notes at a redemption price per US$25 principal amount of the Notes equal to 100% of the principal amount thereof, together with accrued and unpaid interest to, but excluding, the date fixed for redemption.

|

|

|

|

|

|

|

|

At any time, within 120 days following the occurrence of a Rating Event, BFI may, at its option, redeem all (but not less than all) of the Notes at a redemption price per US$25 principal amount of the Notes equal to 102% of the principal amount thereof, together with accrued and unpaid interest to, but excluding, the date fixed for redemption.

|

|

|

|

|

|

Automatic Exchange:

|

|

The Notes, including accrued and unpaid interest thereon, will be exchanged automatically (“Automatic Exchange”), without the consent of the holders of the Notes, into shares of a newly-issued series of Class A Preference Shares of BAM, being Class A Preference Shares, Series 50 (the “Exchange Preference Shares”) upon the occurrence of: (i) the making by BFI and/or the Company of a general assignment for the benefit

|

|

|

|

of their creditors or a proposal (or the filing of a notice of their intention to do so) under the Bankruptcy and Insolvency Act (Canada), (ii) any proceeding instituted by BFI and/or the Company seeking to adjudicate them as bankrupt (including any voluntary assignment in bankruptcy) or insolvent or, where BFI and/or the Company are insolvent, seeking liquidation, winding up, dissolution, reorganization, arrangement, adjustment, protection, relief or composition of their debts under any law relating to bankruptcy or insolvency in Canada, or seeking the entry of an order for the appointment of a receiver, interim receiver, trustee or other similar official for BFI and/or the Company or any substantial part of their property and assets in circumstances where BFI and/or the Company are adjudged as bankrupt (including any voluntary assignment in bankruptcy) or insolvent, (iii) a receiver, interim receiver, trustee or other similar official is appointed over BFI and/or the Company or for any substantial part of their property and assets by a court of competent jurisdiction in circumstances where BFI and/or the Company are adjudged as bankrupt (including any voluntary assignment in bankruptcy) or insolvent under any law relating to bankruptcy or insolvency in Canada; or (iv) any proceeding is instituted against BFI and/or the Company seeking to adjudicate them as bankrupt (including any voluntary assignment in bankruptcy) or insolvent or, where BFI and/or the Company are insolvent, seeking liquidation, winding up, dissolution, reorganization, arrangement, adjustment, protection, relief or composition of their debts under any law relating to bankruptcy or insolvency in Canada, or seeking the entry of an order for the appointment of a receiver, interim receiver, trustee or other similar official for BFI and/or the Company or any substantial part of their property and assets in circumstances where BFI and/or the Company are adjudged as bankrupt or insolvent under any law relating to bankruptcy or insolvency in Canada, and either such proceeding has not been stayed or dismissed within 60 days of the institution of any such proceeding or the actions sought in such

|

|

|

|

proceedings occur (including the entry of an order for relief against BFI and/or the Company or the appointment of a receiver, interim receiver, trustee, or other similar official for them or for any substantial part of their property and assets) (each, an “Automatic Exchange Event”).

|

|

|

|

|

|

|

|

The Automatic Exchange shall occur upon an Automatic Exchange Event (the ‘‘Exchange Time’’). As of the Exchange Time, noteholders will have the right to receive one Exchange Preference Share for each $25 principal amount of Notes previously held together with the number of Exchange Preference Shares (including fractional shares, if applicable) calculated by dividing the amount of accrued and unpaid interest, if any, on the Notes, by $25. Such right will be automatically exercised, and the Notes shall be automatically exchanged, without the consent of the holders of the Notes, into a newly issued series of fully-paid Exchange Preference Shares. At such time, all outstanding Notes shall be deemed to be immediately and automatically surrendered without need for further action by noteholders, who shall thereupon automatically cease to be holders thereof and all rights of any such holder as a debtholder of BFI or as a beneficiary of the subordinated guarantee of the Company shall automatically cease. Upon an Automatic Exchange of the Notes, the Company reserves the right not to issue some or all of the Exchange Preference Shares to any person whose address is in, or whom the Company or its transfer agent has reason to believe is a resident of, any jurisdiction outside of the United States to the extent that: (i) the issuance or delivery by the Company to such person, upon an Automatic Exchange of Exchange Preference Shares, would require the Company to take any action to comply with securities or analogous laws of such jurisdiction; or (ii) withholding tax would be applicable in connection with the delivery to such person of Exchange Preference Shares upon an Automatic Exchange (‘‘Ineligible Persons’’). In such circumstances, the Company will hold all Exchange Preference Shares that would otherwise be delivered to

|

|

|

|

Ineligible Persons, as agent for Ineligible Persons, and will attempt to facilitate the sale of such shares through a registered broker or dealer retained by the Company for the purpose of effecting the sale (to parties other than the Company, its affiliates or other Ineligible Persons) on behalf of such Ineligible Persons of such Exchange Preference Shares.

|

|

|

|

|

|

Deferral Right:

|

|

So long as no event of default has occurred and is continuing, BFI may elect, at its sole option, at any date other than an Interest Payment Date, to defer the interest payable on the Notes on one or more occasions for up to five consecutive years. There is no limit on the number of Deferral Periods that may occur. Such deferral will not constitute an event of default or any other breach under the Indenture and the Notes. Deferred interest will accrue, compounding on each subsequent Interest Payment Date, until paid. A Deferral Period terminates on any Interest Payment Date where BFI pays all accrued and unpaid interest on such date. No Deferral Period may extend beyond the Maturity Date.

|

|

|

|

|

|

Dividend Stopper Undertaking:

|

|

Unless BFI has paid all accrued and payable interest on the Notes, subject to certain exceptions, the Company will not (i) declare any dividends on the Dividend Restricted Shares or pay any interest on any Parity Indebtedness, (ii) redeem, purchase or otherwise retire Dividend Restricted Shares or Parity Indebtedness, or (iii) make any payment to holders of any of the Dividend Restricted Shares or any Parity Indebtedness in respect of dividends not declared or paid on such Dividend Restricted Shares or interest not paid on such Parity Indebtedness, respectively.

|

|

|

|

|

|

CUSIP:

|

|

11271L102

|

|

|

|

|

|

ISIN:

|

|

US11271L1026

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

J.P. Morgan Securities LLC

BofA Securities, Inc.

RBC Capital Markets, LLC

Wells Fargo Securities, LLC

|

|

Co-Managers

|

|

Citigroup Global Markets Inc.

SMBC Nikko Securities America, Inc.

Barclays Capital Inc.

BMO Capital Markets Corp.

Deutsche Bank Securities Inc.

HSBC Securities (USA) Inc.

Mizuho Securities USA LLC

MUFG Securities Americas Inc.

|

Capitalized terms used and not defined herein have the meanings assigned in the BFI’s and the Company’s Preliminary Prospectus Supplement, dated October 8, 2020.

* Note: A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

** We expect that delivery of the Notes will be made against payment therefor on or about the settlement date specified in this communication, which will be the fifth business day following the date of pricing of the Notes (this settlement cycle being referred to as “T+5”). Under Rule 15c6-1 of the U.S. Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes prior to the delivery of the notes hereunder will be required, by virtue of the fact that the notes initially will settle in T+5, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of notes who wish to trade notes prior to their date of delivery hereunder should consult their own advisor.

The Notes will not be offered or sold, directly or indirectly, in Canada or to any residents of Canada. The Issuer and the Guarantor have filed a joint registration statement (including a short form base shelf prospectus) and a preliminary prospectus supplement with the SEC for the offering to which this communication relates. Before you invest, you should read the short form base shelf prospectus in that registration statement, the preliminary prospectus supplement and other documents the Guarantor has filed with the SEC for more complete information about the Issuer, the Guarantor and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov.

Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling J.P. Morgan Securities LLC at 1-212-834-4533; BofA Securities, Inc. toll-free at 1-800-294-1322; RBC Capital Markets, LLC toll-free at 1-866-375-6829; or Wells Fargo Securities, LLC at 1-800-645-3751.

Not for retail investors in the EEA. No PRIIPs key information document (KID) has been prepared as not available to retail in EEA.

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

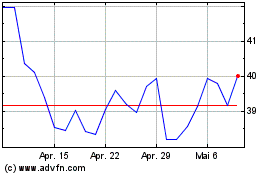

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024