Bayer Trades Sharply Lower on Guidance Cut

01 Oktober 2020 - 11:18AM

Dow Jones News

--Bayer shares slipped after the company cut its views amid

lower demand in the agricultural sector

--The chemicals and pharma major announced billions of euros in

cost cuts, but said even that may not offset declining sales

--Bayer has had bad news every year since its mega-deal to buy

agricultural-products company Monsanto, Bryan Garnier analysts

said

By Joshua Kirby

Shares in Bayer AG plunged on Thursday morning after it set new

guidance and announced billions in cost cuts amid falling demand

for agricultural products, an area that has been hit harder than

expected by the coronavirus pandemic.

The German chemicals-and-pharmaceuticals company said late on

Wednesday that it now expects sales to be flat in 2021, having

previously guided for sales growth of around 4%. The company also

said it expects its core earnings-per-share for 2021 to be below

this year's level at constant exchange rates.

Bayer said it targets operational savings of more than 1.5

billion euros ($1.76 billion) a year as of 2024, which come on top

of existing plans to cut EUR2.6 billion a year in costs from

2022.

The cost cuts aren't expected to entirely offset declining

sales, meaning Bayer now also expects to miss its cash-flow targets

for 2021.

At 0847 GMT, Bayer shares were down 10% at EUR47.95.

Analysts at Bryan Garnier said that since Bayer acquired

crop-science business Monsanto, it "has delivered its basket of bad

news every year and it is clear now that the group will not deliver

the revenue growth expected at the time of this acquisition."

Bryan Garnier downgraded the stock to sell from neutral on

Thursday, and said the lack of visibility in Bayer's crop-science

and pharma division should weigh on the share price.

"Like most companies, the COVID-19 pandemic has led to headwinds

in the 2020 fiscal year for Bayer, with significant currency

effects presenting an additional burden on sales and earnings

growth," Bayer said.

In the crop-science division, the company said biofuel

consumption is falling amid low commodity prices for major crops,

while competition in the soy market is increasing.

Bayer said it didn't expect market conditions to improve much

near-term, and that this means it will likely reduce the value of

its crop-science business by booking impairment charges in the

"mid-to-high single-digit billion-euro" range.

Write to Joshua Kirby at joshua.kirby@dowjones.com

(END) Dow Jones Newswires

October 01, 2020 05:03 ET (09:03 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

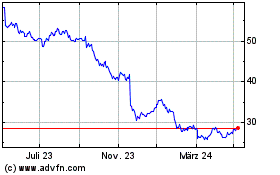

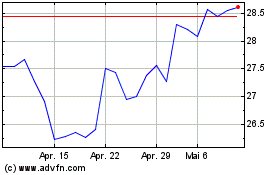

Bayer (TG:BAYN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Bayer (TG:BAYN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024