Bayer to Cut More Costs as Farm Business Hurts

01 Oktober 2020 - 12:01AM

Dow Jones News

By Ruth Bender

BERLIN -- Bayer AG unveiled on Wednesday billions in new costs

cuts to offset falling demand in agricultural products -- the

market on which it had made a huge bet with its acquisition of

Monsanto.

The German chemicals and pharmaceuticals company said the

coronavirus pandemic would hit its crop-science business harder

than anticipated as prices for various crops fell, consumption of

biofuel decreased and competition in the soy market

intensified.

Bayer, which spent $63 billion on Monsanto in 2018, said that it

didn't expect market conditions to improve considerably in the

near-term and that this would likely reduce the value of its

crop-science business through impairment charges in the

"mid-to-high single-digit billion-euro" range.

The company said it wouldn't meet its 2021 sales and cash-flow

targets as the savings wouldn't completely offset declining sales.

Bayer now expects sales to be flat next year instead of growing at

roughly 4%, and sales this year to grow between 0% and 1% to

between EUR43 billion and EUR44 billion, equivalent to between

$50,4 billion and $51,6 billion, excluding currency effects.

Bayer's strategic expansion into agriculture has been mired in

setbacks from the start. The acquisition of Monsanto exposed the

German company to tens of thousands of plaintiffs suing the maker

of Roundup weedkillers, alleging the herbicide causes cancer.

Bayer in June said it had reached deals to settle the bulk of

cases before talks on finalizing these settlements stalled. Bayer

said earlier this month it was making progress on a final deal.

The company is reworking a complex but crucial part of the

settlement that would address future Roundup cases. Bayer says

Roundup is safe and doesn't cause non-Hodgkin lymphoma.

The legal woes have weighed on Bayer's share price and sparked a

shareholder revolt last year, but the company's board has stood

behind Chief Executive Werner Baumann, the main architect of the

Monsanto deal. Earlier this month, the board extended his contract

until 2024.

Bayer said the pandemic-induced weakness in the agricultural

market hadn't weakened its commitment to that part of the

business.

"Despite the difficult market environment, the urgent need for

innovative healthcare and agriculture solutions has never been more

evident," Mr. Baumann said.

Bayer said the need for additional savings might lead to more

job cuts. They come on top of existing plans to cut $2.6 billion in

annual costs from 2022, which include a 10% cut to its

workforce.

Additional cash generated through these savings would be

invested in innovation, improving margins and bringing down debt,

Bayer said. The company said it was still seeking opportunities to

boost its pharmaceuticals division with bolt-on acquisitions or

deals to license products in development. Bayer also said it would

seek small acquisitions in its consumer-care division, a unit that

had been struggling in the past but which Bayer said had performed

strongly recently.

Write to Ruth Bender at Ruth.Bender@wsj.com

(END) Dow Jones Newswires

September 30, 2020 17:46 ET (21:46 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

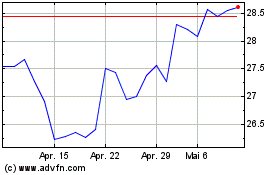

Bayer (TG:BAYN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

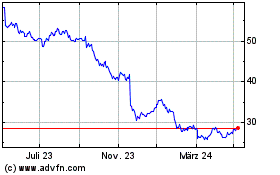

Bayer (TG:BAYN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024