Current Report Filing (8-k)

25 August 2020 - 7:48PM

Edgar (US Regulatory)

0000773141false00007731412020-05-222020-05-2200007731412020-05-212020-05-210000773141us-gaap:CommonStockMember2020-05-222020-05-220000773141mdc:SeniorNotesSixPercentDueJanuary2043Member2020-05-222020-05-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

_________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): August 20, 2020

M.D.C. Holdings, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

1-8951

|

84-0622967

|

(State or other

jurisdiction of

incorporation)

|

(Commission file number)

|

(I.R.S. employer

identification no.)

|

4350 South Monaco Street, Suite 500, Denver, Colorado 80237

|

|

|

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) (Zip code)

|

|

Registrant’s telephone number, including area code: (303) 773-1100

Not Applicable

|

|

|

|

|

|

|

|

|

|

|

|

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

, $.01 par value

|

|

552676108

|

|

New York Stock Exchange

|

|

6% Senior Notes due January 2043

|

|

|

552676AQ1

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

(e) On August 20, 2020 the Compensation Committee (the "Committee") of M.D.C. Holdings, Inc. (the “Company”) took the action described below with respect to compensation of executive officers.

Executive Long Term Performance Share Unit Awards

The Committee granted long term performance share unit (PSU) awards to Larry A. Mizel, Chief Executive Officer, David D. Mandarich, Chief Operating Officer, and Robert N. Martin, Chief Financial Officer, under the terms of the Company’s 2011 Equity Incentive Plan. The awards will be earned based upon the Company’s performance, over a three year period, measured by increasing home sale revenues over the corresponding base period, while maintaining a minimum average gross margin from home sales percentage (excluding impairments). The “Performance Period” for the awards is a three year period commencing January 1, 2020 and ending December 31, 2022. The “Base Period” for the awards is January 1, 2019 to December 31, 2019. The awards are conditioned upon the Company achieving an average gross margin from home sales percentage (excluding impairments) of at least fifteen percent (15%) over the Performance Period (the “Precondition”).

The Target Goal was established for each award based on the Company’s three year average increase in home sale revenues (“Revenue”) over the Base Period of at least 10%. The Threshold Goal was based on a three year average increase in Revenue over the Base Period of at least 5%. The Maximum Goal was based on a three year average increase in Revenue over the Base Period of 20% or more.

Upon the Company satisfying the Precondition, the following shares of Company stock would be awarded:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Target

|

|

Threshold

|

|

Maximum

|

|

|

Mr. Mizel

|

120,000 shares

|

|

50% of Target

|

|

200% of Target

|

|

|

Mr. Mandarich

|

120,000 shares

|

|

50% of Target

|

|

200% of Target

|

|

|

Mr. Martin

|

30,000 shares

|

|

50% of Target

|

|

200% of Target

|

|

The number of shares to be awarded shall be adjusted to be proportional to the partial performance between Threshold and Target and between Target and Maximum amounts. The awards are subject to the executive’s continuous employment through December 31, 2022. The PSU will become 100% vested upon the executive’s death or disability prior to such date. If the executive’s employment is terminated without cause, the PSU will vest to the same extent as if the executive had been employed through the Performance Period. The PSUs will become 100% vested upon a “change of control event” of the Company, as defined in the respective executive’s employment or change of control agreement. The PSU awards are evidenced by the form of Performance Share Unit Grant Agreement filed with this report.

The foregoing PSU awards are subject to the Clawback Policy adopted by the Company’s Corporate Governance/Nominating Committee on January 14, 2015.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data file (formatted in Inline XBRL)

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

_________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M.D.C. HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

Dated:

|

August 25, 2020

|

By:

|

/s/ Joseph H. Fretz

|

|

|

|

|

|

Joseph H. Fretz

|

|

|

|

|

|

Secretary and Corporate Counsel

|

|

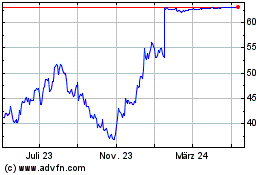

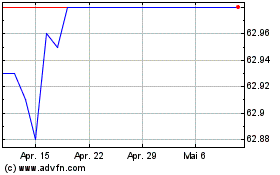

M D C (NYSE:MDC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

M D C (NYSE:MDC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024