HSBC Profit Slumps on Coronavirus, Trade Tensions -- Update

03 August 2020 - 8:17AM

Dow Jones News

By Simon Clark

LONDON-- HSBC Holdings PLC's net profit fell in the second

quarter as the impact of the coronavirus pandemic complicated the

bank's efforts to refocus on Asia while dealing with rising

U.S.-China political tensions.

Profit for the global bank with Asian roots fell 96% to $192

million in the three months ended June. The London-based lender set

aside $3.83 billion in provisions for losses from loans during the

quarter, almost seven times more than in the same period last year.

HSBC set aside $3 billion of provisions in the first quarter.

"Due to the Covid-19 pandemic, much of the global economy slowed

significantly," HSBC Chief Executive Noel Quinn said in a

statement. "Current tensions between China and the U.S. inevitably

create challenging situations for an organization with HSBC's

footprint. However, the need for a bank capable of bridging the

economies of east and west is acute."

Mr. Quinn said he would accelerate plans announced in February

to streamline the bank's operations by shedding 15% of its

235,000-strong workforce and cutting business lines and customer

relationships across the U.S. and Europe to refocus on its more

profitable Asian heartland. HSBC was founded in Hong Kong and

Shanghai in the 1860s and makes most of its profit in Hong Kong and

mainland China.

The bank joined other British lenders earlier this year in

canceling dividend payouts at the request of the Bank of England, a

move aimed at shoring up their capital buffers against economic

shocks stemming from the pandemic. This hit the bank's mom-and-pop

investor base in Hong Kong hard, and its shares have fallen 42%

this year.

The bank's rebalancing toward China has become more complicated

because of rising political tensions. In June, U.S. and British

politicians strongly criticized HSBC after its Asia chief publicly

signed a petition backing a security law Beijing was imposing on

Hong Kong. U.S. Secretary of State Mike Pompeo called HSBC's

support for the law a "show of fealty" that "seems to have earned

HSBC little respect in Beijing."

After supporting the law, HSBC drew strong criticism in the

world's most populous nation for its involvement in a U.S. legal

case against China's Huawei Technologies Co.

Chinese newspaper People's Daily wrote on July 24 that HSBC set

"traps" for Huawei to break U.S. sanctions against doing business

in Iran. HSBC said the U.S. Department of Justice made formal

requests for information about Huawei, a former HSBC client. HSBC

said it wasn't involved in the DOJ's decision to investigate Huawei

or to arrest Huawei finance chief Meng Wanzhou. Ms. Meng and Huawei

deny any wrongdoing.

"HSBC does not have any hostility towards Huawei and did not

'frame' Huawei," the bank said in a July 25 statement.

As HSBC strains to maintain good relations with both Washington

and Beijing, executives have become increasingly exasperated by the

rising political tensions. Sherard Cowper-Coles, HSBC's head of

public affairs and a former British ambassador to Afghanistan, in

June described the tension between the U.S. and China as "an

ideological war reminiscent on the American side of the depths of

McCarthyism."

HSBC's U.K. unit reported a pretax loss of $857 million in the

second quarter, compared with a $157 million profit in the same

period last year. HSBC is the latest bank to report weak results at

its operations in the U.K., which has recorded more deaths from

coronavirus than any other European country.

Write to Simon Clark at simon.clark@wsj.com

(END) Dow Jones Newswires

August 03, 2020 02:02 ET (06:02 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

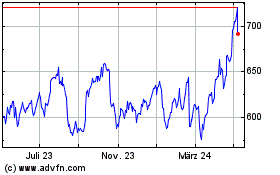

Hsbc (LSE:HSBA)

Historical Stock Chart

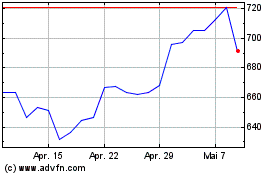

Von Mär 2024 bis Apr 2024

Hsbc (LSE:HSBA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024