Drop in Travel Hurts Airlines -- Earnings at a Glance

31 Juli 2020 - 6:09PM

Dow Jones News

Airlines, one of the first sectors hit by the coronavirus

pandemic, are seeing higher cargo revenue although travel

restrictions and passengers' worries about Covid-19 continue to

weigh on results.

International Consolidated Airlines Group SA, the owner of

British Airways and other carriers, posted its biggest half-year

loss on record and outlined lower capacity plans for the remainder

of the year.

IAG said it doesn't expect passenger demand to recover to 2019

levels until at least 2023.

In the second quarter, a drop in commercial bookings was partly

offset by a 31% increase in cargo revenues.

Air Canada also turned a second-quarter loss as demand slumped

amid the pandemic. The total passengers carried dropped 96%

year-over-year, though Air Canada said cargo revenue was up 52% in

the quarter.

Big oil companies endured one of their worst quarters ever and

are positioning themselves for prolonged pain as the pandemic saps

global demand for fossil fuels.

Exxon Mobil Corp. posted its second consecutive quarterly loss

for the first time this century. Exxon, the largest U.S. oil

company, hadn't reported back-to-back losses for at least 22 years,

according to Dow Jones Market Data, whose figures extend to

1998.

Chevron Corp. lost $8.3 billion in the second quarter, down from

$4.3 billion in profits during the same period last year, its

largest loss since at least 1998. The U.S. company wrote down $5.7

billion in oil and gas properties, including $2.6 billion in

Venezuela, citing uncertainty in the country ruled by strongman

Nicolás Maduro. Chevron also said it lowered its internal estimates

for future commodity prices.

Other earnings reported Friday:

BNP Paribas SA: The investment bank arm of France's

largest-listed bank by assets said heavy client activity boosted

the performance of its markets operations, which helped absorb a

sharp increase in provisions against potential losses from

borrowers also seen at many peers.

BT Group PLC: The U.K. telecommunications company's

first-quarter revenue fell 6.7%, following other operators that

have struggled to capitalize on increased reliance on their service

during coronavirus lockdowns. BT attributed the decline to lower

revenue from BT Sport following cancellation of live sporting

events and a reduction in business activity in its enterprise

unit.

CBOE Global Markets Inc.: The Chicago-based company, which runs

financial exchanges, recorded stronger revenue and a higher profit

in the latest quarter as financial turbulence during the pandemic

led to greater trading volumes.

Caterpillar Inc.: The maker of equipment for mining companies

and builders said its revenue in the U.S. dropped more than 40% in

the second quarter, but Caterpillar sought to reassure investors

with the pile of cash it has amassed to ride out the coronavirus

crisis.

Colgate-Palmolive Co.: The consumer-goods company reported a

roughly 1% rise in net sales in the latest quarter as demand for

soap and cleaners remained elevated during the pandemic.

Fiat Chrysler Automobiles NV: The Italian-American car maker

swung to a net loss for the second quarter, putting pressure on

Fiat Chrysler to improve its performance or risk a renegotiation of

the terms of its merger with Peugeot maker PSA Group.

Goodyear Tire & Rubber Co.: The tire company swung to a

second-quarter loss as tire volumes declined during the

pandemic.

Japan Tobacco Inc.: The company's first-half net profit fell 24%

from a year earlier, reflecting sharply reduced domestic sales as a

result of restrictions on movement to contain the spread of

coronavirus.

Murata Manufacturing Co.: The Japanese electronics-parts maker's

first-quarter net profit fell 15% due partly to weaker demand for

smartphones and cars amid the pandemic.

Nokia Corp.: The Finnish company said its key networks unit saw

a 10% fall in sales as coronavirus disruptions hit sales, but

overall profitability rose amid stronger margins from a favorable

product mix, an increase in sales to North America and a lower

proportion of sales in China.

Pinterest Inc.: The photo-sharing platform said its

second-quarter net loss narrowed as it gained customers spending

more time at home because of the pandemic.

ProSiebenSat.1 Media SE: The German broadcaster swung a net loss

for the second quarter, mainly due to declines in the company's

advertising business amid the pandemic.

Swiss Re AG: The Swiss reinsurer turned a loss in the first half

of the year due to coronavirus-related claims and reserves but said

it is confident about the rest of 2020.

Under Armour Inc.: The sportswear retailer's sales declined

significantly in the second quarter because of the pandemic but

weren't as bad as Under Armour was expecting.

Write to Rose Manzo at rose.manzo@wsj.com

(END) Dow Jones Newswires

July 31, 2020 11:54 ET (15:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

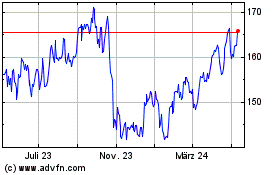

Chevron (NYSE:CVX)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

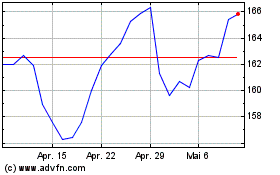

Chevron (NYSE:CVX)

Historical Stock Chart

Von Apr 2023 bis Apr 2024