Caterpillar Expects Reduced Demand to Persist

31 Juli 2020 - 2:23PM

Dow Jones News

By Austen Hufford

Caterpillar Inc. said its revenue in the U.S. dropped more than

40% in the second quarter, but the machinery giant sought to

reassure investors with the pile of cash it has amassed to ride out

the coronavirus crisis.

The maker of equipment for mining companies and builders around

the world said Friday that revenue fell by at least 10% globally in

its latest quarter in each of its three segments -- selling

machinery to customers in construction, resources and energy and

transportation industries.

"With the uncertainty out there with the economic environment,

they are delaying making capital expenditures," Andrew Bonfield,

Caterpillar's financial chief, said in an interview.

Caterpillar also said it was well-positioned to weather the

crisis, with $8.8 billion of cash and $18.5 billion of available

liquidity at the end of its second quarter. The company's shares

rose 1.7% in premarket trading to $138.99.

Caterpillar, which makes sales through a network of independent

dealers, said dealers cut their inventories by $1.5 billion, as

they prepared for lower demand, compared with a $500 million

increase in the same quarter last year.

Caterpillar said demand from final customers fell around 22% in

the quarter, and the company expects a similar decline for its

third quarter. Machinery sales to dealers dropped by nearly

one-third globally.

While the company said some road-building customers reported

faster construction times because of much lower road traffic,

demand from them was more than offset by other customers delaying

projects. The company also saw lower parts sales in some of its

divisions, an indicator that customers were using their equipment

less.

The company said it cut costs, including by using less

temporary, contract labor at some of its facilities. The company's

financial arm had set aside $515 million for credit losses,

compared with $457 million at the end of the first quarter. The

company said more customers were past-due on their payments, even

as it worked with them to extend terms and offer temporary

relief.

"Customers were in pretty good financial health when they came

into the crisis," Mr. Bonfield said.

In all, revenue declined 31%, falling to $10 billion, from $14.4

billion in the same quarter a year before. Profit declined 72% to

$458 million, dropping to 84 cents a share from $2.83 in the same

quarter a year before.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 31, 2020 08:08 ET (12:08 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

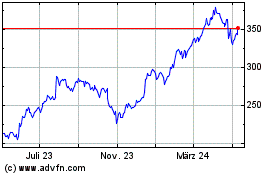

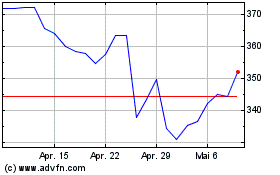

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024