Global Stocks Slip Ahead of U.S. Economic Data

30 Juli 2020 - 11:37AM

Dow Jones News

By Anna Hirtenstein

Global stocks fell Thursday ahead of data that is likely to show

that the U.S. economy shrank during the second quarter at the

steepest pace since World War II, providing fresh insight into the

damage wrought by the coronavirus pandemic.

Futures tied to the S&P 500 traded down 0.8%, suggesting

that U.S. stocks may decline after the opening bell. The

pan-continental Stoxx Europe 600 slipped 0.6%. Most major Asian

stock benchmarks dropped by the close of trading.

Investors will get a view into the disruption to the economy in

the months with the most stringent lockdowns when the Commerce

Department releases initial estimates on how much gross domestic

product shrank in the three months ended June 30 at 8:30 a.m. ET.

Economists project second-quarter GDP fell at a seasonally adjusted

annual rate of 34.7% during the period, when states imposed

lockdowns across the country to contain the virus and then lifted

restrictions.

"It will give us a sense of how bad the situation was," said

Sebastien Galy, a macro strategist at Nordea Asset Management. "The

sense of the catastrophe and the realization around what happened

is a powerful force. It may have some impact on consumption and

politics."

The scope of the economic damage may also force U.S. lawmakers

to come together faster on the terms of a fresh stimulus bill, he

said.

The latest tally of weekly unemployment claims, also due out at

8:30 a.m., is likely to show an uptick in people who filed for

benefits in the week ended July 25, suggesting that the recovery in

the labor market may be faltering. The rise in infection rates

across parts of the U.S. has forced some states and businesses to

introduce fresh restrictions on commercial activity, which is

expected to lead to a rise in unemployment.

Treasurys rose, with the yield on the benchmark 10-year bond

slipping to 0.556%, from 0.578% on Wednesday. The U.S. dollar edged

up 0.3%, but continued to hover near a 2-year low.

Among European stocks, Volkswagen declined about 5% in German

trading after the automotive company posted a net loss for the

second quarter and cut its dividend. Lloyds Banking Group dropped

almost 9% in London after the lender unexpectedly posted a loss for

the first half and increased the amount of money set aside to cover

losses stemming from the pandemic's impact on the economy.

The string of U.S. companies scheduled to report earnings ahead

of the opening bell on Thursday include Carlyle Group, Procter

& Gamble and Mastercard.

Technology giants will take center stage after markets close,

with Apple, Facebook, Amazon.com and Google's parent company

Alphabet set to release their latest financial results. Those

reports will show how tech companies are weathering the economic

downturn and may even be benefiting from the lockdown measures, and

offer insights into whether the Nasdaq Composite Index's recent

rally may be sustained.

"We would say that the results will look more positive than the

rest of the market, but a caveat is that expectations are higher as

a result," said Raj Shant, a portfolio specialist at an affiliate

of PGIM Group. "One overriding factor benefiting tech names is that

the digitization of society has been pulled forward by at least a

couple of years due to the lockdowns."

Gold edged down after notching a record on Wednesday, ending an

eight-day rising streak. It slipped 0.3%, trading at $1,947.20 per

troy ounce.

In Asia, Hong Kong's Hang Seng Index fell 0.7% by the end of

trading, and Japan's Nikkei 225 closed down 0.3%.

Write to Anna Hirtenstein at anna.hirtenstein@wsj.com

(END) Dow Jones Newswires

July 30, 2020 05:22 ET (09:22 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

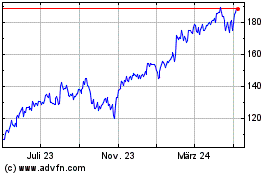

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

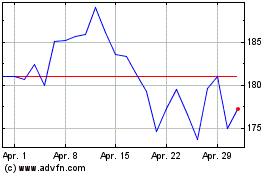

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024