Coronavirus Pandemic Squeezes McDonald's Profit -- 2nd Update

28 Juli 2020 - 4:48PM

Dow Jones News

By Heather Haddon

McDonald's Corp. profit suffered a deeper-than-expected drop, as

the coronavirus shut restaurants around the globe and forced the

chain to spend tens of millions of dollars to help keep its

franchisees operating.

For its second-quarter ending in June, McDonald's reported

earnings per share adjusted for one-time items of 66 cents per

share, down 68% from the prior year's period. Analysts had expected

earnings of 74 cents a share.

The burger giant said Tuesday that its global same-store sales

fell 24% during the quarter, slightly worse than analysts'

expectations. The period included April and May, when the company

said consumer spending fell particularly hard compared with last

year.

McDonald's shares fell 1% to $199 in early trading Tuesday.

The coronavirus has stripped sales from companies spanning

airlines to manufacturers while also forcing them to spend on

protective equipment for workers and operation changes to continue

doing business. Uncertainty over the course of the pandemic is also

clouding corporate planning as coronavirus cases rise.

"In many markets around the world, most notably in the U.S., the

public health situation appears to be worsening," McDonald's CEO

Chris Kempczinski said in a call with investors.

McDonald's said it spent $200 million since the pandemic hit to

help franchisees advertise their restaurants to try to boost sales.

It paid $31 million for supply-chain expenses incurred by owners

and it allocated $45 million during the quarter to cover unpaid

franchisee bills.

Restaurant margins fell 25% during the period as owners spent on

personal-protection equipment for workers and free meals for first

responders, McDonald's said.

McDonald's executives have said that the spending on its

restaurant owners is a good use of its cash to help them navigate a

difficult period. It said it expected limited operations and big

changes in consumer behavior as a result of the virus to continue

to hurt sales.

The chain's shares were up 2% year-to-date as of Monday's

closing price of $201.25. The S&P 500 index for U.S.

restaurants was down 3% over the same period.

Mr. Kempczinski said that the company's sales are improving as

more of its markets reopen. As of last month, 96% of McDonald's

restaurants globally were operating, up from 75% in April.

To-go sales have helped McDonald's U.S. operations, where nearly

95% of locations have drive-throughs. Drive-throughs accounted for

nearly 90% of U.S. sales in the quarter. McDonald's reported U.S.

same-store sales declines of 9%, in line with expectations. The

international markets it runs reported the biggest same-store sales

drop at 41%, reflecting mandated closures in several European

countries after the virus first struck. McDonald's international

business also has fewer locations with drive-throughs.

McDonald's said weak breakfast sales hurt its U.S. business as

the coronavirus continues to upend commuting routines. Mr.

Kempczinski said competitors had flooded into breakfast when

McDonald's lessened its focus on the meal. The company plans to do

more breakfast-related advertising and to introduce new morning

products.

McDonald's removed dozens of menu items to simplify operations

during the pandemic. Mr. Kempczinski said that the company will add

back some items, but that others will remain off and the decisions

will vary by market.

The burger giant is likely to continue to depend on

drive-throughs for the short term. It has limited dine-in service

in about 2,000 U.S. locations, up from 1,000 in early June, but it

is holding off on reopening any more U.S. dining rooms for indoor

service for another month. For those dining rooms that are open,

McDonald's is requiring customers to wear masks when entering its

U.S. stores starting next month, joining a growing number of

businesses that are going beyond local safety requirements to try

to stop the virus's spread.

McDonald's said it expects to close roughly 200 U.S. restaurants

during its fiscal year, an acceleration of planned closings. Over

half of the U.S. closures are lower-volume restaurants in Walmart

Inc. store locations, McDonald's said. The chain expects to open

950 restaurants globally this year.

The company expects to spend $1.6 billion on capital

improvements this fiscal year, down from $2.4 billion originally

projected. Half of the spending will go to U.S. projects,

particularly store upgrades, the chain said. McDonald's didn't give

further guidance for the year.

For the quarter, McDonald's reported $3.8 billion in sales,

ahead of analysts polled by FactSet. The company said it had

earnings of 65 cents a share on $484 million in profit, down around

67% from last year's period.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

July 28, 2020 10:33 ET (14:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

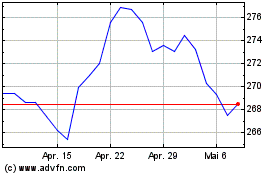

McDonalds (NYSE:MCD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

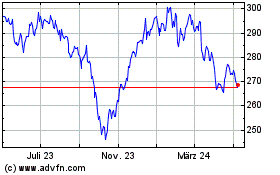

McDonalds (NYSE:MCD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024