Pound Falls On Brexit Uncertainty, U.S.-China Worries

24 Juli 2020 - 9:51AM

RTTF2

The pound declined against its major counterparts in the

European session on Friday, as Brexit talks made little progress on

the free trade agreement and U.S.-China tensions intensified after

China ordered the closure of the U.S. consulate in the southwestern

city of Chengdu.

European Union negotiator Michel Barnier said that "no progress"

has been made over key proposals of state aid and fisheries and the

two sides remained "far away."

Barnier added that the EU would not seal an agreement that would

damage its fishing industry.

David Frost, the U.K. negotiator, said that the bloc's proposals

failed to meet the government's demand to be treated as an

independent country.

Global stock markets fell after Beijing ordered Washington to

shut down its consulate in the city of Chengdu. That came days

after the U.S. ordered the closure of the Chinese consulate in

Houston following allegations of spying.

Data from the Office for National Statistics showed that UK

retail sales logged a double-digit growth in June as non-food and

fuel stores continued their recovery from the sharp falls

experienced since the start of the coronavirus pandemic.

Retail sales volume advanced 13.9 percent on month, faster than

the 12.3 percent rise in May and bigger than economists' forecast

of 8 percent.

The pound retreated to 1.2717 against the greenback, from a

1-1/2-month high of 1.2773 hit at 9:15 pm ET. On the downside, 1.23

is possibly seen as its next support level.

The pound was down against the yen, at a 4-day low of 135.11.

Next immediate support for the pound is seen near the 134

region.

The pound weakened to a 10-day low of 1.1754 against the franc,

from yesterday's closing value of 1.1790. The pound is poised to

challenge support around the 1.16 level.

In contrast, the pound rose to 0.9088 against the euro, after

falling to 0.9125 at 4:30 pm ET. If the pound rises further, 0.88

is likely seen as its next possible resistance level.

Flash survey data from IHS Markit showed that the euro area

private sector grew at the fastest pace in just over two years in

July due to the relaxation of the coronavirus containment

measures.

The composite output index rose to a 25-month high of 54.8 from

48.5 in June. This was also above economists' forecast of 51.1.

Looking ahead, U.S. new home sales for June will be featured in

the New York session.

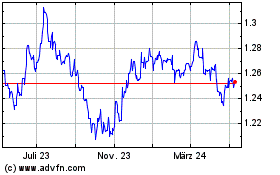

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Mär 2024 bis Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Apr 2023 bis Apr 2024