Travelers Reports Loss as Catastrophe Costs Climb--Update

23 Juli 2020 - 9:59PM

Dow Jones News

By Leslie Scism and Allison Prang

Travelers Cos. swung to a second-quarter loss as the insurance

firm recorded catastrophe charges from severe storms in the U.S.

and the civil unrest sparked by George Floyd's death at the hands

of Minneapolis police.

The firm, one of the nation's biggest property-casualty

insurers, said its Covid-19 costs remained modest.

Travelers, typically the first of the big insurers to post

quarterly results, is a bellwether for the group. On Thursday, it

reported a loss of $40 million, or 16 cents a share, compared with

a year-earlier profit of $557 million, or $2.10 a share.

The company's stock was down 3.7% in afternoon trading.

Travelers recorded catastrophe charges of $854 million before

taxes, net of reinsurance. The firm's catastrophe costs were $367

million in last year's second quarter.

The coronavirus-related losses helped push its quarterly results

into the red, but analysts said the cost is easily manageable for

an insurer of Travelers' size. Travelers said before taxes it

tallied $114 million in second-quarter insurance losses attributed

to the pandemic, an impact blunted by favorable trends tied to

lockdowns, such as a reduction in driving activity and fewer

wrecks.

Industrywide pandemic-related losses could be significant, "but

they won't be borne evenly across insurers," said Travelers CEO

Alan Schnitzer, in an earnings call Thursday. Travelers executives

cited terms and conditions in policies as limiting the firm's

exposure.

Estimates put total insured claims for property-casualty

carriers at $50 billion to $100 billion, according to RBC Capital

Markets. At the low end, the damage would be equivalent to the

nation's costliest hurricane, Katrina in 2005, with about $53

billion of insured damages in 2019 dollars, according to trade

group Insurance Information Institute.

Covid-19 claims industrywide are rolling in from an array of

policyholders. Some examples are hospitals whose workers have

become infected and are collecting workers' compensation benefits;

restaurants and other nonessential businesses stung by the

lockdowns and seeking payments under "business-interruption" policy

provisions; and sporting events that had cancellation coverage.

At the same time, carriers have benefited during the pandemic as

the stay-at-home orders kept millions of cars off the street,

sharply reducing wreck claims. Employees working from home also are

less likely to generate workers' compensation claims. Among other

muted claims activity, Travelers noted that restrictions on dine-in

services at restaurants meant fewer slip-and-fall accidents

Mr. Schnitzer said the pandemic's impact on Travelers' workers'

comp business was limited because health-care workers and first

responders don't represent a significant part of the carrier's book

of business.

The company noted that workers' comp claims appeared to have

stabilized, possibly because more hospital and emergency workers

obtained better protective clothing and gear.

Travelers said that although its business-interruption coverage

typically excludes virus-related claims, it has booked an

unspecified amount for litigation as some policyholders look to

challenge rejections of their claims.

Car insurers' windfall from a sharp drop in miles driven under

stay-at-home orders may be diminishing. Travelers executives said

that the reduction in auto claims may be moderating as economic

activity picks up and policyholders resume driving.

Travelers, one of the biggest U.S. sellers of car insurance to

individuals and families by premium volume, provided 15% refunds of

premiums during the spring to its personal-auto policyholders, to

share its windfall. It said it doesn't plan future personal-auto

rebates, and will address changes in auto-accident trends through

rate adjustments.

All total, the nation's 10 largest car insurers have announced

plans to slash more than $6.5 billion in premium, according to

figures compiled by A.M. Best Co.

Travelers' net investment income before tax was $268 million,

down from $648 million. The drop is tied to a sliver of alternative

investments that are generally reported with a one-quarter lag and

follow the broader equity markets. U.S. stock markets plummeted in

March then surged in the second quarter.

Travelers said that due to PG&E Corp.'s emergence from

bankruptcy, it expects to release in the third quarter about $400

million before taxes of previously booked reserves tied to

reimbursement to insurers of losses they incurred for the

California wildfires in 2017 and 2018.

Write to Leslie Scism at leslie.scism@wsj.com and Allison Prang

at allison.prang@wsj.com

(END) Dow Jones Newswires

July 23, 2020 15:44 ET (19:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

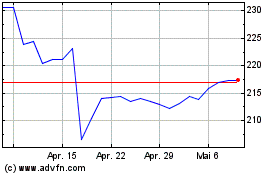

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024