U.S. Dollar Weakens On Stimulus Concerns

22 Juli 2020 - 12:40PM

RTTF2

The U.S. dollar slipped against its most major opponents in the

European session on Wednesday, as concerns over the looming

stimulus spending deadlock in Washington and growing U.S.-China

tensions triggered a sell-off in the currency.

Republicans and Democrats differed significantly on stimulus

package that recommended a payroll tax cut and funding for

coronavirus tests and the CDC.

Republicans are planning to unveil a roughly $1 trillion bill, a

stance that Democrats oppose.

In a White House briefing on Tuesday, U.S. President Donald

Trump conceded that the coronavirus situation would "get worse

before it gets better."

The death toll from coronavirus in the U.S. exceeded 1,000 on

Tuesday, according to a data from Johns Hopkins University.

More than 65,000 new covid-19 cases has been recorded, adding to

a nationwide tally of more than 3,874,000 since the pandemic

began.

Tensions between the U.S. and China escalated further after the

Trump administration ordered China to close its Consulate General

in Houston.

China said that the move was unilaterally initiated by the U.S.

and it would "react with firm countermeasures" if Washington didn't

"revoke this erroneous decision."

The greenback retreated to 1.2730 against the pound, from a

2-day high of 1.2644 seen at 5:00 am ET. On the downside, 1.31 is

likely seen as its next support level.

The greenback dropped to 1.1602 against the euro, its weakest

level since October 2018. The greenback is likely to find support

around the 1.18 level.

The greenback fell to 0.9301 against the franc for the first

time since March 10. The greenback may find support around the 0.90

level.

The greenback slid to near a 7-month low of 0.6689 against the

kiwi, more than 1-year low of 0.7183 against the aussie and near a

6-week low of 1.3419 against the loonie, after rising to 0.6632,

0.7112 and 1.3483, respectively in early deals. The next possible

support for the greenback is seen around 0.68 against the kiwi,

0.74 against the aussie and 1.31 against the loonie.

In contrast, the greenback was up against the yen, at 107.15. If

the currency rises further, it may find resistance around the

109.00 level.

The latest survey from Jibun Bank showed that the manufacturing

sector in Japan continued to contract in July, albeit at a slightly

slower pace, with a manufacturing PMI score of 42.6.

That's up from 40.1 in June, although it remains well beneath

the boom-or-bust line of 50 that separates expansion from

contraction.

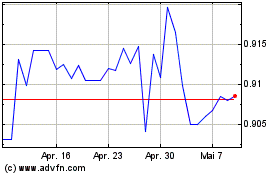

US Dollar vs CHF (FX:USDCHF)

Forex Chart

Von Mär 2024 bis Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

Von Apr 2023 bis Apr 2024