Ericsson Backs Guidance as 2Q Earnings Beat Estimates -- Earnings Review

17 Juli 2020 - 2:32PM

Dow Jones News

By Dominic Chopping

STOCKHOLM--Sweden's Ericsson AB reported second-quarter earnings

Friday. Here's what we watched:

EARNINGS FORECAST: The telecoms-equipment maker reported

second-quarter net profit attributable to shareholders of 2.45

billion Swedish kronor ($269.6 million), up from SEK1.71 billion

for the year-earlier period and sharply higher than the SEK1.67

billion expected in a consensus provided by FactSet.

REVENUE FORECAST: Sales rose 1.4% to SEK55.58 billion, driven by

its key networks unit. Analysts polled by FactSet had expected

sales of SEK55.16 billion.

WHAT TO WATCH:

5G PROGRESS: Ericsson's networks unit grew strongly in North

America and Northeast Asia while sales declined in Latin America

and India. It said momentum in North America remains strong and the

market is estimated to grow 4% in 2020. Momentum is supported by

the closing of the Sprint-T Mobile merger, upcoming spectrum

auctions and an overall demand for 5G. "As we prepare to exit the

crisis caused by Covid-19, there is a need to restart economies and

make strategic, forward-looking investments which we suggest must

include the future digital infrastructure," CEO Borje Ekholm said.

"We see many regions around the world increasing investments in

this space and as a European company we are concerned that Europe

will fall behind."

MARGINS: Gross margins at the networks unit slipped to 40.2%

from 41.4% as it booked a previously announced SEK900 million

write-down on inventory in China and took more lower-margin

strategic contracts in the country to build market position. The

company has previously said that it was taking an increasing share

of strategic contracts--which hurt profits in the short term but

should boost margins over the long term--to boost market share.

GUIDANCE: Ericsson backed its full-year guidance after

experiencing limited impact from Covid-19 in the second quarter,

but cautioned that while some customers are accelerating their

investments, others are temporarily cautious. Ericsson still

targets 2020 sales of between SEK230 billion and SEK240 billion

with an operating margin excluding restructuring charges at more

than 10% of sales. The 2022 margin target is 12%-14%, excluding

restructuring charges.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

July 17, 2020 08:17 ET (12:17 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

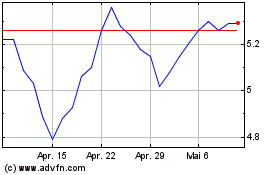

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024