Biotech Properties Draw Billions of Dollars as Other Real Estate Languishes

14 Juli 2020 - 2:29PM

Dow Jones News

By Peter Grant

Covid-19 is clobbering hotels, shopping centers and senior

housing communities. But the pandemic is providing an extra boost

to landlords leasing to biotechnology, pharmaceutical and other

life-sciences businesses.

Those owners were already doing a lot of business with companies

working on health problems like diabetes and cancer. Now, they are

seeing strong demand from companies working to find a cure for

Covid-19. And while work-from-home policies are crimping demand for

office space, life-science lab work can't be as easily replicated

remotely.

"One of the disruptive forces to office space was that we all

went home and figured out how to use Zoom," said Steven Binswanger,

a director at real-estate investment banking firm Eastdil Secured.

"No one in their house has a lab set up."

Billions of dollars are flooding into the sector from

governments, venture capitalists and other private sources.

Alexandria Real Estate Equities Inc., the largest life-sciences

real-estate investment trust in the U.S., last week raised $1.1

billion through a new share offering. Shares were priced at a

discount of only about 2.6% below the existing share price. Past

secondary offerings by Alexandria have offered discounts in the

range of 3% to 8%, said Joel Marcus, the company's founder and

executive chairman.

"It was the largest equity offering in the company's history,

the tightest pricing [in the last ten years] and massively

oversubscribed," he said.

Other big real-estate companies with life-sciences businesses

are adding more. BioMed Realty, which was taken private by

Blackstone Group Inc. in a close to $9 billion deal in 2016, is

moving ahead with a development pipeline that will add 2.5 million

square feet to its existing portfolio of 11 million square feet in

such markets as Boston, San Diego and Seattle.

In April, Toronto-based Brookfield Asset Management closed on

its purchase of a 50% stake in Harwell Campus, a 700-acre

life-sciences campus near the University of Oxford, for more than

GBP200 million ($251 million). The owners are now looking at a

range of expansion possibilities including adding a hospital to the

campus to boost its research and development businesses.

Since the pandemic hit, Brookfield has been taking a measured

approach on developing other types of commercial property, said

Zachary Vaughan, the head of Brookfield's European real-estate

business. "But as it relates to life sciences, we're going to

continue because the demand is there and it's only going to

grow."

One of the biggest concerns in the industry is the possibility

of developers and investors creating too much supply.

"This has been the institutional focus du jour," said Jason

Kaufman, senior vice president at Silverstein Properties Inc.,

which is planning to expand the life-sciences business it has

created in New York to other cities. "Now everyone who operates a

loft-style building in New York City thinks they have a

life-sciences building."

Developers warn that there are high costs and hidden

complexities of building space for scientific and medical research.

Buildings need sophisticated ventilation and gas and water delivery

systems.

"If you don't know what you're doing, you blow yourself up,"

said Mr. Marcus, of Alexandria.

Still, it isn't hard to see the appeal of life-sciences property

especially when comparing its post-Covid-19 performance with other

types of commercial real estate. While office leasing markets are

moribund in many cities, Alexandria reported that it leased more

than one million square feet in the second quarter with an average

rental-rate increase of 37%.

While many hotels have yet to reopen and some retail landlords

are reporting as many as 50% of their tenants have missed some rent

payments, landlords like Alexandria, Brookfield and Blackstone say

almost all of their life-sciences tenants are current.

In some cities without major life-sciences hubs, developers are

trying to change that. In Chicago, a venture led by Trammell Crow

Co. closed in June on the purchase of a site for the $250 million

development of a 16-story life-sciences center named Fulton Labs.

Construction has begun.

Write to Peter Grant at peter.grant@wsj.com

(END) Dow Jones Newswires

July 14, 2020 08:14 ET (12:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

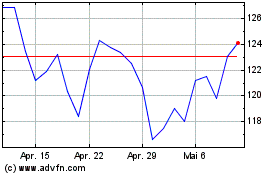

Blackstone (NYSE:BX)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Blackstone (NYSE:BX)

Historical Stock Chart

Von Apr 2023 bis Apr 2024