Pound Declines As U.K. GDP Tumbles To 40-yr Low, European Shares Retreat

30 Juni 2020 - 8:43AM

RTTF2

The pound dropped against its major counterparts in the European

session on Tuesday, as the U.K. economy contracted more than

initially estimated in the first quarter and persistent worries

over the outbreak dampened risk sentiment.

Revised data from the Office for National Statistics showed that

the UK economy contracted at the joint fastest pace since 1979 as

measures taken to reduce the spread of coronavirus weighed on all

sectors.

Gross domestic product fell 2.2 percent sequentially instead of

2 percent decrease estimated initially and followed a nil growth in

the fourth quarter of 2019. The latest drop was the joint largest

contraction since the third quarter of 1979.

On a yearly basis, GDP was down 1.7 percent in the first

quarter, revised down from 1.6 percent estimated in May.

European stocks fell as fears about a surge in coronavirus cases

around the world offset encouraging factory activity data from

China.

World Health Organization chief Tedros Adhanom Ghebreyesu warned

Monday that "the worst is yet to come."

The pound weakened to 1.2258 against the greenback, after rising

to 1.2317 at 7:30 pm ET. The next possible support for the pound is

seen around the 1.19 level.

The pound depreciated to 132.02 against the yen, from a high of

132.64 set at 10:00 pm ET. If the pound drops further, it may find

support around the 129.00 area.

Data from the ministry of Internal Affairs and Communications

showed that Japan jobless rate came in at a seasonally adjusted 2.9

percent in May.

That missed expectations for 2.8 percent and was up from 2.6

percent in April.

The pound reversed from an early high of 1.1713 against the

franc, with the pair trading at 1.1669. The pound is likely to

challenge support around the 1.14 level.

In contrast, the pound was mildly firmer against the euro, at

0.9129. The pound is seen finding resistance around the 0.90

level.

Preliminary data from Eurostat showed that Eurozone inflation

accelerated in June as prices of energy decreased at a slower

pace.

Inflation rose to 0.3 percent from 0.1 percent in May.

Economists had forecast the rate to remain unchanged at 0.1

percent.

Looking ahead, Canada GDP data and U.S. S&P/Case-Shiller

home price index for April and consumer confidence for June are set

for release in the New York session.

Federal Reserve Chairman Jerome Powell will testify before the

House Financial Services Committee in Washington DC at 12:30 pm

ET.

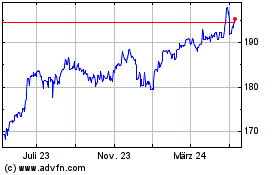

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

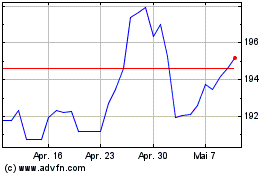

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Apr 2023 bis Apr 2024