TIDMJET

RNS Number : 3948N

Jefferies International Limited.

19 May 2020

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, CANADA, JAPAN, AUSTRALIA OR SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH ITS DISTRIBUTION OR RELEASE WOULD BE

UNLAWFUL.

THIS ANNOUNCEMENT IS NOT A PROSPECTUS AND DOES NOT CONSTITUTE AN

OFFER TO SELL OR ISSUE OR THE SOLICITATION OF AN OFFER TO BUY,

SUBSCRIBE FOR OR OTHERWISE ACQUIRE THE SECURITIES REFERRED TO

HEREIN IN THE UNITED STATES, CANADA, JAPAN OR AUSTRALIA OR ANY

OTHER JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD

BE UNLAWFUL.

PRESS RELEASE, 19 May 2020

Proposed placing of 5.6 million ordinary shares in Just Eat

Takeaway.com N.V.

Jefferies International Limited ("Jefferies" or the "Manager")

today announces the intention to sell 5.6 million existing ordinary

shares in Just Eat Takeaway.com N.V. ("Just Eat Takeaway" or the

"Company") on behalf of SM Trust (the "Transaction"). The proposed

share sale represents approximately 3.75% of the Company's issued

share capital and the entirety of SM Trust's holding in Just Eat

Takeaway.

The price per ordinary share will be determined through an

accelerated bookbuilding process to institutional investors. The

bookbuilding process will commence with immediate effect following

this announcement and may close at any time on short notice. The

results of the Transaction will be announced as soon as practicable

thereafter.

Jefferies is acting as sole global coordinator on the

Transaction. A further announcement will be made following

completion of the bookbuilding and pricing of the Transaction.

Following the Transaction, SM Trust will no longer hold any

securities in Just Eat Takeaway.

The Company will not receive any proceeds from the

Transaction.

Enquiries:

Jefferies +44 (0)20 7029 8000

Luca Erpici / Oliver Berwin / Damian Harniess

IMPORTANT NOTICE

This announcement is for information purposes only and shall not

constitute or form part of an offer to buy, sell, issue, acquire or

subscribe for, or the solicitation of an offer to buy, sell, issue,

acquire or subscribe for any securities, nor shall there be any

sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful. Any failure to comply with

these restrictions may constitute a violation of the securities

laws of such jurisdictions.

The distribution of this announcement and the offer and sale of

the securities referred to herein may be restricted by law in

certain jurisdictions and persons into whose possession any

document or other information referred to herein comes should

inform themselves about and observe any such restriction. The offer

and sale of securities referred to herein has not been and will not

be registered under the US Securities Act of 1933, as amended (the

"Securities Act"), and may not be offered or sold in the United

States absent registration under the Securities Act, except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act. The securities

referred to herein have not been registered under the applicable

securities laws of Australia, Canada, Japan or South Africa and,

subject to certain exceptions, the securities referred to herein

may not be offered or sold in Australia, Canada, Japan or South

Africa. There will be no public offer of the securities in the

United States, Australia, Canada, Japan, South Africa or any other

jurisdiction.

In member states of the European Economic Area, this

announcement and any offer if made subsequently is directed

exclusively at persons who are "qualified investors" within the

meaning of the Prospectus Regulation ("Qualified Investors"). For

these purposes, the expression "Prospectus Regulation" means

Regulation (EU) 2017/1129. In the United Kingdom, this announcement

is directed exclusively at Qualified Investors: (i) who have

professional experience in matters relating to investments falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended (the "Order"); or (ii)

who fall within Article 49(2)(A) to (D) of the Order; or (iii) to

whom it may otherwise lawfully be communicated.

No prospectus or offering document has been or will be prepared

in connection with the Transaction. Any investment decision to buy

securities in the Transaction must be made solely on the basis of

publicly available information. Such information is not the

responsibility of and has not been independently verified by either

SM Trust or Jefferies and/or any of their respective

affiliates.

This announcement does not represent the announcement of a

definitive agreement to proceed with the Transaction and,

accordingly, there can be no certainty that the Transaction will

proceed.

Jefferies, which is authorised and regulated by Financial

Conduct Authority in the United Kingdom, is acting exclusively for

SM Trust and no-one else in connection with the offering. Jefferies

will not regard any other person as its clients in relation to the

offering and will not be responsible to anyone other than SM Trust

for providing the protections afforded to its clients, nor for

providing advice in relation to the offering, the contents of this

announcement or any transaction, arrangement or other matter

referred to herein.

In connection with any offering of the securities, Jefferies and

any of its affiliates acting as an investor for their own account

may take up as a proprietary position any securities and in that

capacity may retain, purchase or sell for their own accounts such

securities. In addition, Jefferies may enter into financing

arrangements and swaps with investors in connection with which they

may from time to time acquire, hold or dispose of securities. They

do not intend to disclose the extent of any such investment or

transactions otherwise than in accordance with any legal or

regulatory obligation to do so.

Jefferies, nor any of its respective directors, officers,

employees, affiliates, alliance partners, advisers and/or agents

accepts any responsibility or liability whatsoever for or makes any

representation or warranty, express or implied, as to the truth,

accuracy or completeness of the information in this announcement

(or whether any information has been omitted from this

announcement) or any other information relating to Just Eat

Takeaway.com N.V. or SM Trust or any of their respective

subsidiaries or associated companies, whether written, oral or in a

visual or electronic form, and howsoever transmitted or made

available or for any loss howsoever arising from any use of this

announcement or its contents or otherwise arising in connection

therewith.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEGPUBWAUPUGAB

(END) Dow Jones Newswires

May 19, 2020 11:41 ET (15:41 GMT)

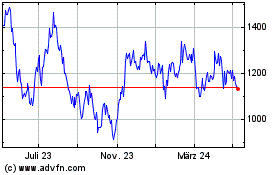

Just Eat Takeaway.com N.v (LSE:JET)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

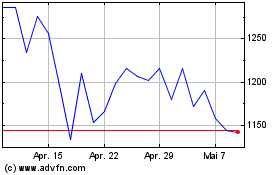

Just Eat Takeaway.com N.v (LSE:JET)

Historical Stock Chart

Von Apr 2023 bis Apr 2024