Kushner Cos. Moving to General Motors Building

19 Mai 2020 - 2:31PM

Dow Jones News

By Peter Grant

Kushner Cos., the real-estate business owned by the family of

senior White House adviser Jared Kushner, is moving its

headquarters out of the office tower at 666 Fifth Ave., the tower

at the center of the Kushners' push into the Manhattan real-estate

market just before the 2008 crash.

Kushner Cos. is moving to the top floor of the General Motors

Building on the southeast corner of Central Park, one of the most

coveted office addresses in the city, according to people familiar

with the matter. The family has been looking for new Manhattan digs

following its distressed sale of control of 666 Fifth Ave. to

Brookfield Asset Management in the summer of 2018.

Brookfield, which valued the deal at $1.29 billion, last year

launched a $400 million overhaul of the 39-story building which was

built in the 1950s. As part of that overhaul Brookfield has been

vacating 666 Fifth of tenants including Kushner Cos., which

occupies about 15,000 square feet in the tower.

The move comes as the commercial real-estate industry, like most

businesses, has been in upheaval as a result of the Covid-19

pandemic. Tenants are falling behind on rent payments, landlords

are defaulting on loans and investors are looking for steeply

discounted prices.

Kushner Cos. has closed one discounted acquisition. In April,

the company purchased a $30 million loan backed by a Brooklyn

apartment building sold by SL Green Realty Corp., New York's

largest office building owner. The real-estate investment trust has

been trying to shore up its balance sheet in the wake of a

collapsed Manhattan property sale. Kushner paid about 90 cents on

the dollar, according to people familiar with the matter.

Kushner Cos. is subleasing 20,500 square feet of space on the

50th floor of the General Motors Building for 10 years from Itaú

Unibanco Holding SA, Brazil's largest bank. Kushner is paying about

$100 a square foot, about half of what Itaú is paying, according to

people familiar with the matter. A representative for Itaú didn't

respond to a request for comment.

Kushner Cos. was based in New Jersey before it purchased 666

Fifth Ave. in 2007 for what was then a record price of $1.8

billion. The highly leveraged deal ran into trouble when the global

financial crisis hit, sending Manhattan rents and occupancies

plummeting.

The Kushner family's efforts to salvage their investment in 666

Fifth Ave. became a lightning rod for critics of the Trump

administration. They alleged that some of the investors that showed

an interest in investing in the troubled property, such as Anbang

Insurance Group Co. of China, may be doing so to curry favor with

Jared Kushner, who is the husband of Mr. Trump's daughter, Ivanka,

and his father-in-law.

Mr. Kushner sold his stake in 666 Fifth and other assets to a

trust controlled by other family members to avoid potential

conflicts after joining the Trump administration.

The financial problems facing the building were solved by the

Kushners' sale of a 99-year lease of the property to a venture

controlled by Brookfield. The Kushners retained an interest in that

venture but Brookfield is in charge of the building's redevelopment

and is changing its name to 660 Fifth Avenue.

Write to Peter Grant at peter.grant@wsj.com

(END) Dow Jones Newswires

May 19, 2020 08:16 ET (12:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

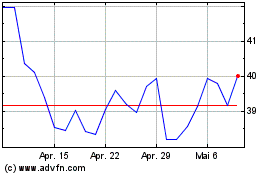

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024