Centric Likely to Become Private Company After Restructuring Deal

18 Mai 2020 - 1:00PM

Dow Jones News

By Matt Grossman

Centric Brands Inc. has filed for chapter 11 bankruptcy

protection and expects to become a private company after reaching a

restructuring agreement with its creditors, the company said

Monday.

The New York City-based brands collective said it had a deal

with lenders Blackstone, Ares Management Corp. and HPS Investment

Partners to recapitalize and provide it with $435 million of

debtor-in-possession financing.

As part of the agreement, Centric filed for chapter 11

protection in the U.S. Bankruptcy Court for the Southern District

of New York.

Centric will likely emerge from the restructuring as a private

company, it said, when its lenders receive equity interests in the

company as part of the restructuring deal.

The brands Centric licenses for apparel, accessories and

entertainment products include Calvin Klein, Timberland, Under

Armour and Disney.

The company's shares declined more than 36% in pre-market

trading Monday morning after closing Friday at 94 cents.

Write to Matt Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

May 18, 2020 06:45 ET (10:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

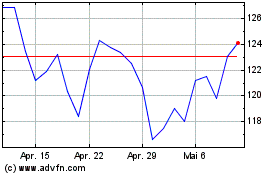

Blackstone (NYSE:BX)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Blackstone (NYSE:BX)

Historical Stock Chart

Von Apr 2023 bis Apr 2024