After Yearslong Cleanup, Italian Banks Brace for More Bad Loans

06 Mai 2020 - 3:22PM

Dow Jones News

By Giovanni Legorano

ROME -- Italian banks have spent years cleaning up the bad loans

on their books. The coronavirus downturn leaves them with more work

to do.

Italy's lenders came into the crisis as one of the weaker parts

of the European banking landscape, still suffering from some of the

effects of the region's sovereign debt crisis and struggling with

sluggish economic growth and low rates. After two months of

lockdown imposed by the Italian government, uncertainty hangs over

how the induced economic coma and its aftermath will translate into

losses for local banks as the companies they lend to inevitably

default on loan repayments.

Senior management at Italian banks are displaying cautious

confidence about the resilience of their businesses and of the

nation's economy. However clear signs that pain lies ahead were

visible as the country's largest banks reported first-quarter

earnings this week.

"It's clear the first issue Italian banks will face in the next

months will be a rise in bad loans," said Angelo Baglioni, an

economics professor at Milan's Catholic University.

UniCredit SpA, Italy's largest bank by assets, posted a EUR2.71

billion ($2.94 billion) net loss, compared with a net profit of

EUR1.18 billion in the same period last year. The loss was driven

by EUR1.26 billion in provisions for bad loans, up from EUR467

million a year earlier and a number of one-off costs.

The bank, which unveiled a new strategic plan last December,

said it would update that plan at the end of this year or early in

2021, in light of the conditions brought about by the pandemic.

"European economies have only very recently and gradually begun

to reopen. It's too early to quantify the pace and shape of any

recovery," UniCredit's Chief Executive Jean Pierre Mustier said.

"[The pandemic] will have a profound impact on the global economy.

This is true also for UniCredit and its stakeholders."

Next year's net profit will likely be between EUR3 billion to

EUR3.5 billion, or 75% to 80% of what the bank targeted in its last

strategic plan, Mr. Mustier said.

Banking results for the first quarter are offering an initial

test on the effects of the lockdown measures the Italian government

-- and other European governments -- imposed to contain the spread

of the novel coronavirus.

Since March 10, Rome has gradually shut down most nonessential

economic activity to contain the pandemic. It only started

rebooting its economy on Monday, allowing factories, construction

sites and wholesale commerce to reopen.

Much of the consumer economy remains suspended. Most shops can

reopen from May 18. Restaurants, bars and hairdressers will have to

wait until June 1. Economic normalcy could take much longer to

achieve.

Italy's lockdown has been one of the strictest and longest

outside of Asia and the impact on the country's economy will be

huge. The International Monetary Fund predicts that Italy's gross

domestic product will shrink 9.1% in 2020.

The Italian government has so far launched a program of

guarantees for bank loans and liquidity available for businesses

and households of EUR750 billion.

However, while supporting economic recovery, increased lending

and the moratoria on existing loans will further expose Italian

banks to the economic downturn, after years in which they went

through a painful cleanup of their balance sheet and rebuilt

capital buffers.

Many Italian lenders like UniCredit and Intesa Sanpaolo SpA have

been selling nonperforming loan portfolios to investors hungry for

good returns. They account for 7% of total loans, still high by

international standards, but down from 17% in 2015. With such a

significant downturn this year, bad loans are likely to start

piling up again.

After a painful cleanup and strengthening plan carried out in

recent years, UniCredit's plan of share buybacks and dividend

increases to remunerate its shareholders forms part of a four-year

plan that also includes cuts in jobs and costs.

However, it decided to withdraw its dividend payment proposal

for 2019 and to postpone its share-buyback program, following a

request to European lenders by the European Central Bank.

Rival Intesa Sanpaolo also suspended its proposed cash dividend

for 2019 and its entire 2019 net profit allocated to reserves.

On Tuesday, Intesa said it expected to reach a profit of at

least EUR3 billion this year, compared with EUR4.2 billion in

2019.

However, the bank posted a surprise 10% rise in net profit for

the first quarter and said it still plans to pay 75% of its net

profit as dividend this year, if regulators allow it.

Besides booking EUR403 billion in loan-loss provisions, Intesa

said it set aside an additional EUR300 million to cover risks

related to the pandemic and that it could use the proceeds of the

recent sale of its merchant-acquiring business to cover for

additional EUR1.2 billion of pandemic-related losses during the

year, if needed.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

May 06, 2020 09:07 ET (13:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

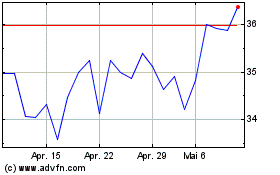

Unicredit (BIT:UCG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024