By Gunjan Banerji, Avantika Chilkoti and Stuart Condie

The technology heavyweights that powered the recent market

rebound stumbled Friday, dragging down the broader stock

market.

A busy week of corporate earnings and economic data drove big

stock swings in recent days as investors parsed a flood of

information highlighting the intense toll of the coronavirus

pandemic on the economy.

One of the biggest warning signs for investors: the tech giants

that appeared almost untouchable even during a global pandemic

showed signs of faltering as their quarterly results streamed

in.

Amazon.com posted record revenue late Thursday but disappointed

on profits as coronavirus-related costs such as employee testing

and higher wages added to expenses. Lawmakers have also called on

Chief Executive Jeff Bezos to testify on the company's

private-label practices. A Wall Street Journal investigation found

the company's employees used data about independent sellers on its

platform to develop products.

Apple, meanwhile, held off providing guidance for the current

quarter for the first time since late 2003.

"It's a warning shot across the bow that no company is immune

from this even if you're able to raise your top-line revenues,"

said Brian O'Reilly, head of market strategy for Mediolanum

International Funds.

Major U.S. indexes fell for the second consecutive week. The

S&P 500 dropped 81.72 points, or 2.8% to 2830.71 on Friday as

losses accelerated midday. The Dow Jones Industrial Average shed

622.03 points, or 2.6% to 23723.69. The tech-heavy Nasdaq Composite

lost 284.60 points, or 3.2%, to 8604.95, lagging behind its peers

after outperforming in recent weeks.

All three indexes fell less than 0.5% for the week.

Adding to the sting, tech heavyweights have led markets higher

in recent weeks, helping major indexes recover from their March

lows and pushing them toward historic gains in April. Shares of

Amazon fell $187.96, or 7.6%, to $2286.04 on Friday. Apple shares

slipped $4.73, or 1.6%, to $289.07.

U.S. stock benchmarks clocked their largest percentage gains

since 1987 last month, with the S&P 500 up 13% and the Dow

Jones Industrial Average gaining 11%.

Highlighting the peculiar market environment of in recent weeks,

as U.S. stocks finished April with big gains, other economic data

this week revealed the distressing impact of the coronavirus across

the country.

Consumer spending, the U.S. economy's key driver, posted its

biggest monthly decline on record in March. Meanwhile, the U.S.

economy shrank in the first quarter at its fastest pace since the

last recession. On Friday, fresh data showed U.S. manufacturing

contracting.

Several investors said the latest releases highlighted the

mammoth challenge that lawmakers and policy makers face in getting

the domestic economy back on a strong footing.

"For people that would be considering investing, it was a

reality check, " said Don Dale, managing partner at investment firm

Equity Risk Control Group.

Earlier in the week, the Federal Reserve warned of greater

economic deterioration ahead but said it would use its tools to

support the economy.

Additionally, there are concerns that an economic recovery could

take longer than many have been expecting. Data released in coming

weeks would likely be as bad, or worse, analysts said.

"We're going to get these constant reminders that the economy is

suffering," said Adam Phillips, director of portfolio strategy at

EP Wealth Advisors. "It serves as a much-needed wake-up call for

the entire stock market."

Next week, for example, investors will be watching the monthly

jobs report, after recent data showed that millions of Americans

have filed for unemployment benefits.

Adding to investors' jitters Friday were concerns about fresh

tensions between the U.S. and China. In an unusual public

statement, a U.S. intelligence agency said Thursday that it was

investigating whether the coronavirus may have escaped from a

laboratory in Wuhan, China.

"The important thing for investors is that these tensions around

trade, these tensions around technology and technology transfers,

and tensions around geopolitics more broadly, these issues are

going to persist and maybe even heighten as we go forward," said

Joseph Little, chief global strategist at HSBC Global Asset

Management.

Corporate earnings news drove swings in individual stocks.

Shares of Exxon Mobil and Chevron dropped after the companies

reported a drop in demand on the back of shelter-in-place rules.

The energy companies also said they would both cut back capital

spending plans for 2020. Exxon fell $3.33, or 7.2%, to $43.14,

while Chevron edged down $2.56, or 2.8%, to $89.44.

Shares of Tesla plunged after Chief Executive Elon Musk tweeted

that the auto maker's share price was "too high." Tesla stock

dropped $80.56, or 10.3% to $701.32. Still, the shares are sitting

on gains of almost 70% this year.

Clorox shares added $6.27, or 3.4%, to $192.71 after the

household-supplies producer issued more optimistic guidance on

higher demand for cleaning supplies.

Brent crude, the global oil benchmark, slipped Friday but rose

6.6% this week to settle at $26.44 a barrel, snapping a three-week

losing streak marked by huge swings. Analysts expect demand for

fuel to rise as lockdown rules are gradually lifted and supply

eases as output cuts agreed by the Organization of the Petroleum

Exporting Countries come through.

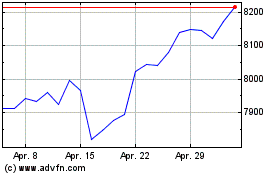

The U.K.'s FTSE 100 dropped 2.3%. Japan's Nikkei 225 closed down

2.8% and Australia's S&P/ASX 200 ended 5% lower. Markets in

China, Hong Kong and across most of Europe were closed for the May

Day holiday.

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com and Avantika

Chilkoti at Avantika.Chilkoti@wsj.com

(END) Dow Jones Newswires

May 01, 2020 17:13 ET (21:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024