Deutsche Bank Beats Expectations but Coronavirus Clouds Outlook--Update

29 April 2020 - 9:34AM

Dow Jones News

By Patricia Kowsmann

Deutsche Bank AG weathered the first weeks of the coronavirus

pandemic better than expected as customers rushed to reposition

their investments, boosting the German bank's investment-banking

revenue.

But the bank warned a sharp slowdown in the global economy will

hurt its loan book, and possibly its ability to sell unwanted

assets.

Deutsche Bank said it has set aside EUR506 million ($547

million) to cover credit losses, including EUR260 million directly

related to the virus. It said its liquidity reserves dropped 8% to

EUR205 billion in the quarter due to heavy client drawdowns on

committed credit facilities. The bank said it is still EUR43

billion above regulatory requirements. The capital cushion it has

to absorb future losses is also shrinking. Building it back up will

be difficult.

"This changed environment will impact Deutsche Bank's results of

operations, capital ratios and the capital plan that underlies our

targets," the bank said in a statement.

It said revenue is expected to be slightly lower in 2020

compared with last year, adding the outperformance in the first

quarter is offset by lowered expectations later in the year.

Provisions for credit losses, it said, are expected to increase

significantly from low levels.

The Frankfurt-based bank earlier this week disclosed its profit

for the three months ended March 31 fell 67% to EUR66 million, from

EUR201 million a year ago. The results, however, beat analysts'

expectations, thanks to a higher-than-expected revenue of EUR6.35

billion. Compared with the year-ago period, revenue was flat.

Shares in the bank soared after the announcement. Despite the

bank's shares falling 7% this year, it is still one of the best

performers among European lenders.

On Wednesday, the bank provided details behind those figures as

it officially reported its financial performance for the quarter.

It said revenue in its investment-banking business rose 18% from a

year-ago period to EUR2.3 billion. Its fixed-income trading

business did particularly well, as customers shifted their assets

around to better weather the virus storm, resulting in big fees and

commissions. Revenue at its corporate bank unit, which caters to

clients like midsize German companies, fell 1%. It rose 2% at its

private and retail banking.

Mark Fedorcik, head of the investment bank, said the unit was

doing well before the virus spread in Europe in March, with revenue

growth and market-share gains. Once the virus hit Europe and the

U.S., he said corporate clients focused on getting liquidity

through credit lines, issuance of debt in the markets and in some

cases loan waivers. Institutional investors, meanwhile,

repositioned their investment portfolios based on their risk

appetite.

"We are seeing some fixed-income markets normalize and stabilize

as we move to the end of April," Ram Nayak, head of fixed income,

said.

The bank remained on track with its cost-cutting drive, a key

part of a plan it launched last year meant to make it a leaner and

profitable bank focused on European companies and retail-banking

customers. Deutsche Bank reported costs fell 5% in the first

quarter.

Controlling costs is key for Deutsche Bank and other European

lenders given low and negative interest rates across the region

making it difficult to make money. Germany's banking system is also

the least profitable in the eurozone due to its overcrowded market

of more than 1,500 banks. Adding to the bank's woes is a massive

portfolio of unwanted assets, including derivatives, that it piled

up over several years of risky bets and that it is now trying to

sell or wind down. Excluding that unit, the bank said it expects

revenue to be flat this year.

Dealing with both cutting costs and controlling risk has become

even more challenging because of the coronavirus pandemic.

It could be difficult for the bank to continue slashing jobs in

Germany as the country enters what is expected to be a deep

recession. Mr. Sewing has promised to cut 18,000 of its

approximately 92,000 jobs by 2022. Last month, the bank paused

layoffs until some stability returns.

The risk in its loan portfolio is also rising, as borrowers

begin to struggle with the downturn. Germany's gross domestic

product is expected to shrink 7% this year, according to the

International Monetary Fund. The EUR506 million the bank has set

aside to cover credit losses is lower compared to U.S. peers, whose

profitability is much higher. But James von Moltke, Deutsche Bank's

financial chief, said he is comfortable with the quality of its

loan portfolio.

Investors are also paying close attention to the bank's capital

cushion to absorb future losses. Earlier this week, the bank said

because it was boosting lending to customers in need, its

capital-buffer ratio -- known as CET1 -- could "modestly and

temporarily" fall below its target of at least 12.5%. It was 12.8%

at the end of the quarter.

While still higher than the 10.4% regulatory minimum, analysts

say building the capital back up could be a challenge for the bank.

For one, shareholders may have little appetite to put more money

into a bank whose shares have been trading at historic lows since

last year.

"Deutsche Bank should try to maintain CET1 close to its previous

target of 12.5% for the market to remain comfortable in the current

challenging macro environment," JP Morgan analyst Kian Abouhossein

said.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com

(END) Dow Jones Newswires

April 29, 2020 03:19 ET (07:19 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

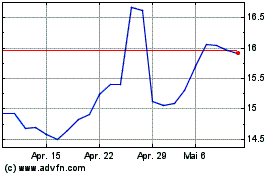

Deutsche Bank (TG:DBK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Deutsche Bank (TG:DBK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024