Crédit Agricole S.A. Announces Maximum Tender Amount and Results of

its Tender Offer for EUR Perpetual Notes

NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES

OR ANY JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS

ANNOUNCEMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION

ONLY AND IS NOT AN OFFER TO PURCHASE OR A SOLICITATION OF OFFERS TO

SELL ANY SECURITIES.

Montrouge 9 April 2020

Crédit Agricole S.A. Announces Maximum

Tender Amount and Results of its Tender Offer for EUR Perpetual

Notes

____________________

On 2 April 2020, Crédit Agricole S.A. announced

the launch of an offer to purchase its EUR CMS Floater Undated

Deeply Subordinated Notes set forth in the table below (the

“Notes”) (the “Offer”) up to an

amount equal to EUR300 million less the euro equivalent of the

aggregate principal amount accepted for purchase pursuant to a

separate offer to purchase any and all of its currently outstanding

USD 6.637% Undated Deeply Subordinated Notes (the “USD

Notes”) (the "USD Tender Offer") made

pursuant to the terms of an offer to purchase dated 2 April 2020

(the “Maximum Tender Amount”). The Offer was

made upon the terms and subject to the conditions set forth in the

Tender Offer Memorandum dated 2 April 2020 relating to the Offer

(the “Tender Offer Memorandum”). Capitalized terms

used in this announcement but not defined herein have the meanings

given to them in the Tender Offer Memorandum.

Maximum Tender

Amount of the Offer

Crédit Agricole S.A. announced today the results

of the USD Tender Offer, which expired at 5:00 p.m., New York City

time/11:00 p.m., Central European Summer time, on 8 April 2020. As

disclosed in the announcement, USD25,914,000 of aggregate principal

amount of the USD Notes was validly tendered.

On the basis of the results of the USD Tender

Offer and the applicable EUR/USD exchange rate obtained as

described in the Tender Offer Memorandum, the Maximum Tender Amount

will be EUR276,164,459.16.

Results of the

Offer

The Offer expired at 4:00 p.m., Central European

Summer time, on 8 April 2020 (the “Expiration

Date”). The aggregate principal amount of Notes that were

validly tendered at or prior to the Expiration Date is

EUR67,630,000.

Because the aggregate principal amount of the

Notes validly tendered at or prior to the Expiration Date does not

exceed the Maximum Tender Amount, Crédit Agricole S.A. will accept

for purchase all Notes validly tendered. No Notes tendered after

the Expiration Date will be accepted pursuant to the Offer.

The table below sets forth information with

respect to the aggregate principal amount of the Notes that were

validly tendered at or prior to the Expiration Date.

|

Title of Notes |

CUSIP / ISIN No. |

Principal Amount Tendered |

Principal Amount Accepted |

Offer Price(1) |

Principal Amount Outstanding after the Offer |

|

EUR CMS Floater Undated Deeply Subordinated Notes |

ISIN:FR0010161026 |

EUR67,630,000 |

EUR67,630,000 |

EUR780.00 |

EUR183,146,000 |

(1) Per EUR1,000 in principal amount of

the Notes purchased pursuant to the Offer.

Payment of the aggregate consideration for the

Notes accepted for purchase is expected to be made on 14 April

2020, on which date Crédit Agricole S.A. will deposit with CACEIS

Corporate Trust S.A., as Tender Agent (for tendering holders that

hold their Notes through Euroclear, Clearstream or Euroclear

France), the amount of cash necessary to pay the Offer Price plus

any Accrued Interest in respect of the Notes accepted for purchase

in the Offer.

For further details about the terms and

conditions of the Offer, please refer to the Tender Offer

Memorandum.

Further Information

Copies of the Tender Offer Memorandum and other

documentation may be obtained by contacting the Information Agent

at the address and telephone number set forth below.

Questions and requests for assistance in connection with the

Offer may be directed to:

The Sole Structuring Bank and Sole Dealer

Manager for the Offer

Crédit Agricole Corporate and Investment

Bank

12, place des Etats-Unis, CS 7005292547 Montrouge

CedexFranceAttn: Liability Management Tel: +44 207 214 5733 Email:

liability.management@ca-cib.com

Credit Agricole Securities (USA) Inc.Attn: Debt

Capital Markets/Liability Management1301 Avenue of the AmericasNew

York, New York 10019Collect: 212-261-7802U.S. Toll Free: (866)

807-6030

Questions and requests for assistance in connection

with the tenders of Notes including requests for a copy of the

Tender Offer Memorandum may be directed to:

The Tender Agent and the Information

Agent for the Offer

|

CACEIS Corporate Trust S.A.1-3, Place

Valhubert75013 ParisAttn: David PASQUALETel: +33 (6) 37 41 17

79Email: david.pasquale@caceis.com /

LD-F-CT-OST-MARCHE-PRIMAIR@caceis.com |

Disclaimer

Holders must make their own decision as to

whether to tender any of their Notes pursuant to the Offer, and if

so, the principal amount of Notes to tender. Holders should

consult their own tax, accounting, financial and legal advisors as

they deem appropriate regarding the suitability of the tax,

accounting, financial and legal consequences of participating or

declining to participate in the Offer.

This announcement is not an offer to purchase or

a solicitation of offers to sell any securities.

This announcement is not an invitation to

participate in the Offer. Such an invitation will only be extended

by means of documents (the Tender Offer Memorandum) that will be

provided only to those investors to whom such an invitation may be

legally addressed. The distribution of this announcement in certain

countries may be prohibited by law.

Offer Restrictions

United States. The Offer is not

being made and will not be made directly or indirectly in or into,

or by use of the mails of, or by any means or instrumentality

(including, without limitation, facsimile transmission, telex,

telephone, email and other forms of electronic transmission) of

interstate or foreign commerce of, or any facility of a national

securities exchange of, or to beneficial owners of the Notes who

are located in the United States, or who are U.S. Holders (each a

“U.S. Holder”) as defined in Rule 800 under the

U.S. Securities Act of 1933, as amended (the “Securities

Act”), and the Notes may not be tendered by any such use,

means, instrumentality or facility from or within the United

States, by persons located or resident in the United States or by

U.S. Holders. Accordingly, this press release, copies of the Tender

Offer Memorandum and any other documents or materials related to

the Offer are not being, and must not be, directly or indirectly,

mailed or otherwise transmitted, distributed or forwarded in or

into the United States or to any such person. Any purported tender

in response to the Offer resulting directly or indirectly from a

violation of these restrictions will be invalid, and tenders made

by a person located in the United States or any agent, fiduciary or

other intermediary giving instructions from within the United

States or any U.S. Holder will not be accepted.

Each holder of Notes participating in the Offer

will represent that it is not a U.S. Holder, is not located in the

United States and is not participating in the Offer from the United

States. For the purposes of this and the above paragraph, “United

States” has the meaning given to it in Regulation S under the

Securities Act and includes the United States of America, its

territories and possessions (including Puerto Rico, the U.S. Virgin

Islands, Guam, American Samoa, Wake Island and the Northern Mariana

Islands), any state of the United States of America and the

District of Columbia.

United Kingdom. This

announcement and the Tender Offer Memorandum are only being

distributed to and is only directed at (i) persons who are outside

the United Kingdom or (ii) investment professionals falling within

Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (the “Order”) or

(iii) high net worth companies, and other persons to whom it may

lawfully be communicated, falling within Article 49(2)(a) to (d) of

the Order (all such persons together being referred to as

“relevant persons”). The Notes are only

available to, and any invitation, offer or agreement to subscribe,

purchase or otherwise acquire such Notes will be engaged in only

with, relevant persons. Any person who is not a relevant

person should not act or rely on this announcement or on the Tender

Offer Memorandum or any of its contents.European Economic

Area and United Kingdom. In any European Economic

Area (“EEA”) Member State and in the United

Kingdom (each, a “Relevant State”), this

announcement and the Tender Offer Memorandum are only addressed to

and are only directed at qualified investors within the meaning of

Regulation (EU) 2017/1129 (the “Prospectus

Regulation”), in that Relevant State. Each person in a

Relevant State who receives any communication in respect of the

Offer contemplated in this announcement and the Tender Offer

Memorandum will be deemed to have represented, warranted and agreed

to and with the Dealer Manager and Crédit Agricole S.A. that it is

a qualified investor within the meaning of Article 2(e) of the

Prospectus Regulation.

Italy. None of the Offer,

this announcement, the Tender Offer Memorandum or any other

documents or materials relating to the Offer have been or will be

submitted to the clearance procedure of the Commissione Nazionale

per le Società e la Borsa (“CONSOB”) pursuant to

applicable Italian laws and regulations.

The Offer is being carried out in the Republic

of Italy (“Italy”) as an exempted offer pursuant

to Article 101-bis, paragraph 3-bis of Legislative Decree No. 58 of

February 24, 1998, as amended (the “Consolidated Financial

Act”) and article 35-bis, paragraph 4 of CONSOB Regulation

No. 11971 of May 14, 1999, as amended.

Holders or beneficial owners of the Notes that

are resident and/or located in Italy can tender the Notes for

purchase through authorized persons (such as investment firms,

banks or financial intermediaries permitted to conduct such

activities in Italy in accordance with the Consolidated Financial

Act, CONSOB Regulation No. 20307 of February 15, 2018, as amended,

and Legislative Decree No. 385 of September 1, 1993, as amended)

and in compliance with any other applicable laws and regulations

and with any requirements imposed by CONSOB or any other Italian

authority. Each intermediary must comply with the applicable

laws and regulations concerning information duties vis-à-vis its

clients in connection with the Notes or the Offer.

- Crédit Agricole S.A. Announces Maximum Tender Amount and

Results of its Tender Offer for EUR Perpetual Notes

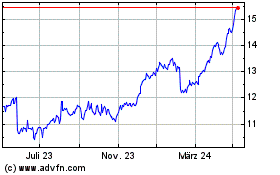

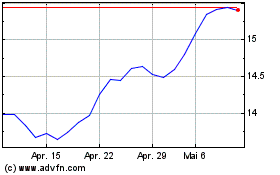

Credit Agricole (TG:XCA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Credit Agricole (TG:XCA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024