Japanese Yen Higher Amid Rising Risk Aversion

03 April 2020 - 5:36AM

RTTF2

The Japanese yen climbed against its major counterparts in the

Asian session on Friday amid rising risk aversion, as oil prices

retraced gains and a private survey showed that China's services

sector contracted further in March.

Survey data from IHS Markit showed that China's services

activity contracted in March due to the impact of the COVID-19

outbreak on demand and supply chains.

The Caixin services Purchasing Managers' Index rose to 43.0 in

March from 26.5 in February. However, a score below 50 indicates

contraction.

Oil prices fell after soaring on Thursday following President

Donald Trump's comment that he expects Russia and Saudi Arabia to

co-operate on output reduction.

The United States reported a record 6.648 million jobless claims

last week led by shut downs to contain the virus.

Investors await the March payroll data due at 8:30 am ET.

Economists are expecting a drop of 100,000 jobs last month, while

the unemployment rate is seen rising to 3.8 percent.

The number of confirmed coronavirus cases crossed the 1 million

mark globally with a death toll of 53,030, according to the new

tally from Johns Hopkins University.

Around 1,015,403 people have been diagnosed with the novel

coronavirus across the world.

The latest survey from Jibun Bank showed that the services

sector in Japan continued to contract in March, and at a much

steeper rate, with a services PMI score of 33.8.

That's down sharply from 46.8 in February, and it moves further

beneath the boom-or-bust line of 50 that separates expansion from

contraction.

The yen rebounded to 107.80 against the greenback, from a 3-day

low of 108.20 hit at 7:15 pm ET. The currency is likely to locate

resistance around the 105.00 level.

The yen rose to 116.84 against the euro and 133.45 against the

pound, from an early low of 117.39 and a 3-day low of 134.09,

respectively. If the yen rises again, it may test resistance around

112.00 against the euro and 128.00 against the pound

Reversing from an early low of 111.02 against the franc, the yen

ticked up to 110.66. Next immediate resistance for the yen is seen

around the 109.00 level.

The yen gained to 63.64 against the kiwi, 65.29 against the

aussie and 76.08 against the loonie, off its early lows of 64.02

and 65.61 and a 3-day low of 76.63, respectively. The yen is seen

finding resistance around 60.00 against the kiwi, 60.00 against the

aussie and 72.00 against the loonie.

Looking ahead, PMI reports from major European economies and

Eurozone retail sales for February are due in the European

session.

The U.S. jobs data and ISM services PMI for March are scheduled

for release in the New York session.

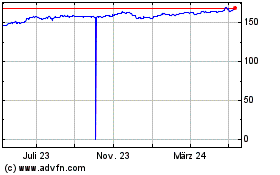

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

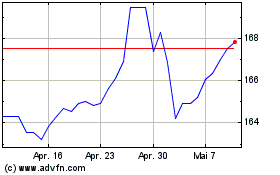

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024