GE to Furlough Thousands of U.S. Aviation Workers Due to Air Travel Slump

03 April 2020 - 12:39AM

Dow Jones News

By Thomas Gryta

General Electric Co. is furloughing half of the U.S.

manufacturing workers in its jet-engine business for four weeks,

citing growing pressure on the global aviation industry from the

coronavirus pandemic.

The move, covering thousands of workers, comes just 10 days

after the division said it would lay off about 10% of its U.S.

workforce, or about 2,500 employees, in one of the first major job

cuts by a large American manufacturer. At that time, GE also said

the division would furlough up to half of its maintenance and

repair employees for three months.

"We appreciate the commitment of all our employees during this

difficult time, and we regret having to take this action," GE said

in a statement Thursday. The furloughed workers, who work on

commercial engines, will continue to get company-paid health

benefits. The exact number of people affected wasn't disclosed.

The aviation division is GE's largest and most profitable; it

makes and maintains engines for planes built by Boeing Co. and

Airbus SE. In early March, GE said it froze hiring, canceled

merit-based raises, trimmed nonessential spending and made cuts to

its contingent workforce.

Thus far, GE's moves to lower labor costs in the aviation

division have only been in the U.S., but additional moves could be

coming in its overseas operations. Last week, GE CEO Larry Culp

hinted at more cuts to come, saying the aviation division is

working "with the appropriate parties to properly address its

global workforce."

GE had about $36 billion in cash at the end of 2019, along with

$35 billion in untapped credit lines, according to its annual

report. Earlier this week, GE closed the sale of its biopharma

division to Danaher Corp. for proceeds of more than $20 billion in

cash.

GE had been restructuring its operations and trying to pull out

of a slump caused by weak demand for its power generation equipment

and troubles in its GE Capital unit. In recent years, GE had

slashed its quarterly dividend to a token penny per share.

Before the coronavirus outbreak, GE had projected improving cash

flow from its industrial operations despite a recent slowdown in

production in the aviation unit.

The division, with about 52,000 workers around the world, has

been hit by the grounding of Boeing's 737 MAX, which cut GE's cash

flow by $1.4 billion in 2019. The division is still important to

GE's turnaround as it produced $4.4 billion in cash flow last

year.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

April 02, 2020 18:24 ET (22:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

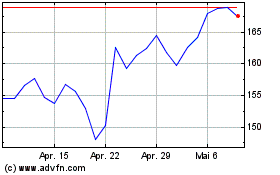

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024