UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed

by the Registrant x

Filed

by a Party other than the Registrant o

Check the appropriate box:

o Preliminary

Proxy Statement

o Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive

Proxy Statement

x Definitive

Additional Materials

o Soliciting

Material Pursuant to §240.14a-12

|

International Business Machines Corporation

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x No fee required.

|

|

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1) Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2) Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4) Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5) Total fee paid:

|

|

|

|

|

|

o

|

|

Fee paid previously with preliminary materials.

|

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1) Amount Previously Paid:

|

|

|

|

|

|

|

|

(2) Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3) Filing Party:

|

|

|

|

|

|

|

|

(4) Date Filed:

|

|

|

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

April 2020

Dear IBM Stockholder,

As the independent Lead Director and the Chairs of the Committees

of the IBM Board of Directors, we are writing to you on behalf of the entire Board to thank you for your support and your investment

in IBM. In light of Covid-19, it is unlikely that we will be able to hold our 2020 Annual Meeting of Stockholders in person in

Louisville, Kentucky on April 28, 2020 as originally planned. We are closely monitoring events and following the guidance from

various governmental entities and we will publicly announce any changes shortly, as we prepare to move to a virtual-only meeting.

In the meantime, we want to share our perspective on the Company and strongly encourage you to vote your shares by proxy.

2019: Enabling Sustainable Growth

Engaged oversight of the Company’s strategy has been a

hallmark of the IBM Board for generations and is essential for the creation of long-term sustainable value. In 2019, IBM achieved

$77.1 billion in revenue and ended the year on a strong note, returning to overall revenue growth in the 4th quarter.

Additionally, in 2019, IBM:

|

|

·

|

Grew Cloud revenues to more than $21 billion, up 11% year over year, representing 27% of overall revenue

|

|

|

·

|

Achieved strong cash generation with net cash from operating activities of $14.8 billion and free cash flow of $11.9 billion

|

|

|

·

|

Expanded full year GAAP gross margins 90 basis points and non-GAAP operating gross margins 100 basis points, reflecting a continued

shift to a higher-value business mix and improved Services productivity

|

|

|

·

|

Raised the dividend for the 24th consecutive year – IBM’s 104th straight year of providing

one

|

|

|

·

|

Received a record 9,200+ new patents, with about half in AI, cloud computing, and quantum computing, making IBM #1 in U.S.

patents for the 27th consecutive year

|

IBM sustains the digital operations of the world’s most

critical organizations. These long-term relationships are one reason why IBM has been able to weather many economic storms over

its 109-year history. The majority of IBM’s revenues are recurring and we have a strong balance sheet. Importantly, we have

the financial flexibility at this pivotal time to run and invest in our business for now and for the long run.

World-Class Succession Process

One of the Board’s most important responsibilities is

to ensure that the Company has the appropriate leadership to execute its long-term strategy. The Board meets regularly to actively

review and plan the succession of the CEO and other senior management positions. Earlier this year, we announced that after more

than eight years leading the Company, Ginni Rometty will transition to the role of Executive Chairman of the Board on April 6,

2020 before retiring from IBM at the end of the year after a nearly 40-year career with the Company. Arvind Krishna, IBM Senior

Vice President for Cloud and Cognitive Software and the principal architect of the Company’s acquisition of Red Hat, will

become the Chief Executive Officer, and James Whitehurst, Senior Vice President and CEO of Red Hat will become IBM’s President.

This transition was the result of a world-class, multi-year succession process. With the strong foundation established by Ginni

Rometty to usher in a new cloud and cognitive era, the Board is confident that Arvind Krishna has the business acumen, operational

skills and technology vision needed to lead IBM.

Historical Commitment to ESG

Commitment to ESG principles has been in IBM’s DNA for

over 100 years. It is grounded in IBM’s values: (1) dedication to every client’s success; (2) innovation that matters

for our company and for the world; and (3) trust and personal responsibility in all relationships. The Board and its committees

are proud to oversee a company that actively collaborates and engages with communities, clients, governments, shareholders, employees,

and society on environmental, social and governance issues and responsible stewardship. In our ongoing effort to enhance transparency,

IBM’s Proxy Statement contains additional disclosure on IBM’s deep history of ESG accomplishments, including a new

section on Human Capital Management detailing IBM’s industry-leading diversity and best-in-class inclusion, as well as the

oversight function by the Board and the Executive Compensation and Management Resources Committee.

Strong Leadership Structure: Vote AGAINST

Item of Business 6

The Board regularly evaluates the appropriate leadership structure

for IBM to ensure that it has the optimal structure and practices for IBM and its stockholders, recognizing that different structures

may be appropriate under different circumstances. At this time, the Board strongly believes that its leadership structure of Ginni

Rometty as Executive Chairman and Mike Eskew as the independent Lead Director is in the best interests of IBM and its stockholders.

This structure strikes the right balance by promoting a clear, unified vision for the Company’s strategy, providing the leadership

critical for effectively and efficiently implementing the actions needed to ensure strong performance over the long term, while

ensuring robust, independent oversight by the Board and the Lead Director. The Lead Director role is robust and ensures effective

independent oversight at all times. IBM’s strong, independent Board and commitment to good corporate governance adds further

support to the Board leadership structure.

Commitment to Pay for Performance: Vote

FOR Item of Business 3

Our compensation strategy, with significant pay at risk, supports

the drivers of IBM’s high value business model. Our senior executive pay is heavily weighted to IBM’s performance through

the annual and long-term incentive programs, with targets set at challenging levels consistent with IBM’s financial model

as shared with investors. Overall, Mrs. Rometty earned 85% of her total target annual compensation in 2019, and over the past 5

years, Mrs. Rometty has earned an average of 73% of her annual total target compensation.

The Board continues to incorporate valuable stockholder feedback

into ongoing executive compensation program decisions. In our discussions with investors representing more than 50% of the shares

that voted on Say on Pay at the 2019 Annual Meeting, investors reaffirmed their support for the Company’s compensation policies

and programs, which focus on long-term financial performance that drives stockholder value.

For these reasons and those discussed in more detail in our

proxy statement, the Board believes that our compensation policies and practices are aligned with the interests of our stockholders

and designed to reward for performance.

We are proud of IBM’s latest achievements, including our

world-class succession program and our human capital management initiatives. We hope to receive your support on all of the Board’s

recommendations in IBM’s 2020 Proxy Statement.

Sincerely,

|

/s/ Michael L. Eskew

|

|

/s/ Frederick H. Waddell

|

|

Michael L. Eskew

|

|

Frederick H. Waddell

|

|

IBM’s Lead Director

|

|

Chair of IBM’s Directors and Corporate

|

|

Chair of IBM’s Audit Committee

|

|

Governance Committee

|

|

|

|

|

|

/s/ Alex Gorsky

|

|

|

Alex Gorsky

Chair of IBM’s Executive Compensation

and Management Resources Committee

1 IBM Investor Update Spring 2020

2 2019 Business Highlights $77.1B Revenue Second consecutive year of revenue growth, excluding the impact of currency and divestitures Includes Cloud revenue of over $21 billion , 27% of IBM revenue Approximately 60% of IBM’s revenue is recurring Expanded gross margin 90 bps , reflecting a continued shift to higher value and improved services productivity Delivered nearly $12 billion in free cash flow with realization of 126% Enables a high level of investment to bring innovations to market Returned over $7 billion to stockholders through dividends and share repurchases Reflects growth in key areas, our high - value business model, and investments to drive sustainable growth Strategy 47.3% Gross Profit Margin $14.8B Cash from Operations Strong balance sheet and cash flow provide financial flexibility at this pivotal time and for the long run

3 IBM is uniquely positioned to move enterprise clients to the next chapter of their digital reinventions Positioned for a New Era of Technology and Business Hybrid Cloud $1.2 trillion opportunity Moving mission - critical workloads to the cloud Industry Expertise Trust and Security Innovative Technologies Artificial Intelligence from pilots to enterprise - wide adoption Transforming how businesses operate, people do their jobs, and customers engage Integrated Model Strategy

4 Strong Foundation for the Future Significant investment to transform our portfolio and workforce; acquired Red Hat, the leading hybrid cloud platform A leader in hybrid cloud, data and AI, security, blockchain, enterprise services, enterprise systems, quantum IBM has taken actions to create the portfolio, people and sense of purpose to meet today’s enterprise demands Strategy Implemented IBM Design Thinking, agile processes, and IBM Garages for clients, leading to record NPS scores Revitalized skills, with 90% of IBMers having skills of the future; employee engagement score at all time high Strategy and business decisions grounded in core values, e.g. IBM’s Principles for Trust and Transparency for the digital age 2. Portfolio : Built for the future 1. Capital : Bold shift to drive innovation 3. IBMers : Talent, skills and culture 4. Speed : Changing the way we work 5. Good tech : Responsible stewardship

5 • Market competitive • Operating Cash Flow (40%): Important measure of our ability to reinvest and return value to stockholders • Operating Net Income (40%): Measures our profit and operational success • IBM Revenue (20%): Measures total IBM revenue performance across the IBM portfolio of business • Maximum payout opportunity for CEO is 2X target incentive (in line with market practice) • Three - Year Performance Period • Operating Earnings Per Share (70%): Measures operating profitability on a per share basis • Free Cash Flow (30%): Important measure of our ability to reinvest and return value to stockholders over multiple years • Relative ROIC Modifier: Reaffirms high - value business model through a negative adjustment for ROIC below S&P 500 median, and a positive adjustment for ROIC above both the S&P 500 and S&P IT medians • Typically vest over four years Executive Compensation Aligns with High - Value Business Model Compensation Committee ensures that our pay programs for senior executives are closely aligned to IBM’s strategy and performance 2019 CEO Pay Mix Base Salary (8%) Annual Incentive (25%) Performance Share Units (44%) Restricted Stock Units (23%) Short - Term Long - Term Mrs. Rometty holds >30x base salary in equity, aligning her compensation with stockholders’ interests Compensation 2019 Enhancement Replaced Strategic Imperative revenue with IBM revenue as an annual incentive metric to reinforce the importance of IBM revenue attainment across the Company 69% At - Risk 5

6 Performance - Based Executive Compensation Annual and long - term incentive program target metrics are set at rigorous levels, with pay - at - risk designed to balance short - and long - term business objectives 90% 90% 99% 102% 81 % 100% 0 50 100 150 2014 2015 2016 2017 2018 2019 52% 32% 67% 99% 90 % 0 50 100 150 2013-2015 2014-2016 2015-2017 2016-2018 2017-2019 55% 54% 81% 89% 85 % 0 50 100 2015 2016 2017 2018 2019 Target (100%) Target (100%) Target (100%) CEO ANNUAL INCENTIVE AWARD AS % OF TARGET LONG - TERM PERFORMANCE SHARE UNIT PAYOUTS AS % OF TARGET CEO TOTAL ACTUAL PAYOUT AS % OF TARGET ANNUAL COMPENSATION 2019 Annual Incentive Program score reflects Mrs. Rometty’s achievements against individual objectives which have positioned IBM for sustained growth going forward. Including annual incentive awards and PSU payouts, along with the changes in IBM's stock price, total actual payout ranged from 54% to 89% of target annual compensation over the last five years, reflecting the high percentage of at risk pay and our rigorous performance goals. Compensation 6

7 MICHELLE HOWARD MARTHA POLLACK VIRGINIA ROMETTY MICHAEL ESKEW MR. THOMAS BUBERL, CEO, AXA S.A. ▪ Mr. Buberl’s experience leading AXA through a digital transformation, accelerating business innovation and leveraging data to meet customers’ rapidly evolving needs in the digital world will be valuable to IBM and its stockholders ARVIND KRISHNA Our directors, all leaders in their respective fields, have a deep understanding of our business and extensive industry expertise to contribute diverse and fresh viewpoints As part of our robust and proactive refreshment efforts we added two new independent directors since the last Annual Meetin g DAVID FARR ALEX GORSKY ANDREW LIVERIS JOSEPH SWEDISH SIDNEY TAUREL PETER VOSER FREDERICK WADDELL Lead Director Industry Expertise Key: Healthcare: Energy: Government: Financial Services: Manufacturing: Information Technology: Transport & Logistics: Research & Development: Chemicals: Chairman Emeritus, Eli Lilly and Co. Chairman, Pearson plc Retired CEO, Royal Dutch Shell plc Chairman, ABB Ltd. Retired Chairman and CEO, Northern Trust Corporation Sr. Advisor, Retired Chairman, Pres. CEO, Anthem, Inc. Chairman, Mesoblast Chairman and CEO, Emerson Electric Co. Chairman and CEO, Johnson & Johnson Retired Chairman and CEO, Dow Chemical Retired Admiral, US Navy CEO*, IBM Governance Industry Expertise Guides Strategic Transformation MR. F. WILLIAM MCNABB III, Retired Chairman and CEO, The Vanguard Group ▪ Provides valuable insight from investor perspective as a leader in corporate governance ▪ Mr. McNabb’s experience in global investing and deep commitment to delivering long - term stockholder value make him a valuable addition to the board President, Cornell University *Executive leadership transition effective April 6, 2020 at which time Dr. Krishna will become CEO of IBM and Mrs. Rometty wi ll become Executive Chairman Retired Chairman and CEO, UPS Executive Chairman*, IBM

8 World - class, multi - year succession process resulting in a proven technical and business - savvy leadership team Leadership Transition Arvind Krishna Chief Executive Officer and Director* • Deep experience running key IBM businesses, with a track record of bold transformations and proven business results • Principal architect of the Red Hat acquisition • Played a significant role in developing IBM key technologies: artificial intelligence, cloud, quantum computing & blockchain Jim Whitehurst President* • Former CEO of Red Hat • Positioned Red Hat as the world's leading provider of open source enterprise IT software solutions and services • During tenure at Red Hat, grew revenue 8X and market capitalization 10X • Successfully repositioned IBM for the future, investing in high - value segments of the IT market • Reinvented more than 50% of IBM's portfolio • Built a $21 billion hybrid cloud business • Established IBM's leadership in AI, quantum computing and blockchain • Solidified IBM as the industry's leading voice in technology ethics and data stewardship Mrs. Rometty continues as Executive Chairman of the Board through the end of the year, when she will retire after almost 40 years with the company Ginni Rometty Executive Chairman of the Board* *effective April 6, 2020 Governance

9 Key insight into IBM’s regulatory environment Optimal Mix of Skills and Experience for Director Nominees Public Company Board 11 Organizational Leadership and Management 14 Global Business Operations 12 Finance/Public Company CFO 7 Tech, Cybersecurity, or Digital 14 Government / Public Policy 14 Highly Qualified Director Nominees with Diverse Experiences Building the Right Board for IBM: Key Director Attributes Industry leaders with deep executive and oversight experience Global experience necessary to oversee a business of IBM’s scale, scope and complexity Critical skill given industry trends and transformation Emphasis on Diversity Balanced Mix of Tenures Business Operation, Innovation, Transformation, and Digital Experience • 100% of IBM Directors have led complex organizations • Key to Board’s oversight of company’s innovation and transformation Global Perspective • Every IBM Director has international experience • Board’s diverse and international experience is crucial for IBM, which operates in more than 175 countries worldwide Industry Experience • IBM’s Directors have experience leading organizations in a variety of industries, enhancing the Board’s knowledge and perspectives on contemporary business issues The Board is committed to ongoing, proactive refreshment and maintaining a diversity of backgrounds, talents and perspectives Governance 9 7 Directors 4 Directors 3 Directors Average Tenure is 5.7 years Less Than 5 Years 5 - 10 Years More Than 10 Years 2 of 4 independent directors added since 2019 are women

10 Commitment to Governance Best Practices The table below highlights practices that IBM embraces in support of strong governance Stockholder Rights and Governance Best Practices Compensation Governance Best Practices x Execution of world - class succession process x Two new independent directors added in last year x Annual election of directors x Robust independent lead director role x Stockholder special meeting right x Proxy access x Majority voting for directors x Annual Board self - evaluation x 12 of 14 director nominees are independent x Signatory of Commonsense Principles 2.0 x Endorser of Investor Stewardship Group Principles x Signatory to the Business Roundtable Statement on the Purpose of a Corporation × No supermajority voting provisions × No stockholder rights plan or poison pill x Tie a significant portion of pay to Company performance x Maintain robust clawback provisions x Stock ownership guidelines for Chair, CEO, EVP and SVPs x Utilize noncompetition and non - solicitation agreements x Remove impact of share repurchase on executive incentives × No individual severance or change - in - control agreements for executive officers × No excise tax gross - ups for executive officers × No dividend equivalents on unearned RSUs/PSUs × No hedging or pledging of IBM stock × No stock option repricing, exchanges or options granted below market value × No guaranteed incentive payouts for executive officers × No accelerated vesting of equity awards for executive officers NEW Governance NEW NEW

11 Social ▪ 220 P - TECH schools across 24 countries with 600 industry partners where students are learning new collar skills ▪ Industry - leading diversity , best - in - class inclusion and record employee engagement ▪ Preparing a workforce for the 21 st century , through apprenticeship programs, returnships for women reentering the workforce, veterans programs and skills - building sessions for more than 3.2 million students worldwide ▪ Ethisphere’s 2020 World’s Most Ethical Companies list ▪ Deploying IBM Cloud & AI technology to collect, analyze, and share data to stop human trafficking Environment ▪ 29th annual IBM and the Environment Report in 2019 ▪ Founding member of the Climate Leadership Council ▪ Supporting a carbon tax to reduce emissions ▪ On track to achieve a 40 percent reduction of our carbon dioxide emissions by 2025 ▪ Developed breakthrough method of recycling PET plastic (polyethylene terephthalate) helping to reduce the 8 million tons of plastics that enter our oceans each year ▪ First and only company to win the Climate Leadership Award 7 times in the program's 8 - year history Our approach to corporate responsibility embodies IBM’s values: (1) Dedication to every client’s success; (2) Innovation that matters for our company and the world; and (3) Trust & personal responsibility in all relationships Pursuing the Highest Standards of Trust & Responsibility Corporate Responsibility Governance ▪ Execution of a world - class CEO succession process ▪ Thoughtful and proactive Board and Committee refreshment with a focus on the optimal mix of diversity of skills and experience ▪ Best - in - class year - round stockholder engagement program recognized by Corporate Secretary Magazine as the " Best Shareholder Engagement " in 2019 ▪ Extensive stockholder rights , including annual election of directors, majority voting standard and no supermajority voting provisions ▪ The Board has oversight of economic, environmental and societal performance and leadership, which are an integral part of IBM’s long - term strategy

12 IBM is marshalling resources and bringing together communities to manage through the COVID - 19 outbreak Confronting COVID - 19 Corporate Responsibility • Spearheading, with the White House Office of Science & Technology and the U.S. Department of Energy, the COVID - 19 High Performance Computing Consortium o Will provide unprecedented computing power to help researchers better understand COVID - 19, its treatments and potential cures o IBM SUMMIT supercomputer has already identified at least 77 compounds that could be used as new drugs against the coronavirus , currently under peer review • Helping states and government agencies respond to COVID - 19 - related questions from residents with IBM’s Watson Assistant for Citizens • Providing a hub with the latest trusted data on COVID - 19 available on weather.com and The Weather Channel app with an Incidents Map that allows researchers and data scientists to conduct a deeper analysis of regional data o More than 31 million visitors in the first week • Providing free online education resources to foster remote learning by students and educators around the world o IBM Skills, Open P - TECH and IBM AI Education series, with a special focus on under - served populations • Focusing IBM’s 2020 Call for Code Global Challenge on Covid - 19 o Calls on developers to build open source solutions to address: (1) crisis communication; (2) enhanced remote learning; and (3) stronger community cooperation • Hosting a Scripps Research project to evaluate chemical compounds for the treatment of COVID - 19 on IBM's World Community Grid , a crowdsourced volunteer computing platform • Providing volunteer hours and financial aid to support COVID - 19 - related relief activities globally For more information, please visit: www.ibm.com/covid19

13 Voting Item 4: Stockholder Proposal on Right to Remove Directors The Board recommends a vote AGAINST this proposal because stockholders already have the right to remove directors “for cause” through existing corporate governance practices and under New York state law Proposals ▪ IBM has a long history of incorporating stockholder feedback into its governance practices ▪ The proposal is unnecessary in light of New York state law as well as existing practices contained in the company’s governing documents – IBM stockholders already have the right , including between annual meetings, to remove any or all directors “for cause” – Furthermore, IBM stockholders currently have the right to vote on the election of each director once every year at the Annual Meeting of Stockholders , which the Board believes is the appropriate time for stockholders to evaluate directors and vote on the composition of the Board ▪ IBM has demonstrated its commitment to being responsive to stockholder feedback and upholding sound principles of corporate governance ▪ If this right is adopted, removal campaigns not related to “for cause” events has the potential to be costly and distracting to IBM, the Board, and our stockholders

14 ▪ The Board does not believe that majority written consent is an appropriate corporate governance model for a widely - held public company like IBM ▪ Majority written consent would allow a bare majority of stockholders to act without a meeting , let alone notice to the other IBM stockholders ▪ By contrast, IBM’s current practices, including proxy access and a special meeting right, guarantee that notice and an opportunity to be heard is given to all stockholders prior to a stockholder vote ▪ This allows for meaningful discourse and deliberation to occur before important decisions are made affecting IBM ▪ This transparency and fairness for all stockholders would be negated with a majority written consent provision Voting Item 5: Stockholder Proposal on Written Consent The Board recommends a vote AGAINST this proposal and believes that action by written consent without prior notice to all stockholders is not in the best interest of stockholders Proposals

15 ▪ IBM’s Lead Director role is robust and ensures effective independent oversight at all times ▪ The full Board reviews our leadership structure annually to ensure the allocation of responsibilities remains appropriate ▪ The Board’s flexibility to determine the appropriate Board leadership structure is essential ▪ IBM’s current leadership structure is optimal for the Company at this time , particularly in light of the recent CEO succession ▪ IBM stockholders have continuously supported the current leadership structure during stockholder engagement and by voting against this proposal multiple times ▪ Consistent, unified leadership to execute and oversee the Company’s strategy is essential to IBM’s long - term success ▪ The overall Board is strong and highly independent Voting Item 6: Stockholder Proposal on Independent Chairman The Board recommends a vote AGAINST this proposal because the Board’s flexibility to determine the appropriate leadership structure is essential and IBM has a robust Lead Director role ensuring effective independent oversight The Board believes the Company’s current leadership structure is in the best interests of IBM stockholders: Proposals

16 FOR Election of all Fourteen Director Nominees Ratification of PricewaterhouseCoopers LLP as IBM’s Independent Registered Public Accounting Firm FOR Advisory Vote on Executive Compensation AGAINST Stockholder Proposal on Shareholder Right to Remove Directors AGAINST Stockholder Proposal on the Right to Act by Written Consent AGAINST Stockholder Proposal to Have an Independent Board Chairman x x x We Request Your Support at the 2020 Annual Meeting of Stockholders The Board asks that you vote: For all management proposals Against all stockholder proposals To express our appreciation for your participation in our annual meeting, IBM will make a $1 charitable donation to Jobs for the Future, Inc. on behalf of every stockholder account that votes this year. JFF accelerates the alignment and transformation of the American workforce and education systems to ensure access to economic advancement for all. Proposals FOR

17

18 Appendix

19 Forward - Looking Statements, Non - GAAP and Other Information Certain comments made in this presentation may be characterized as forward looking under the Private Securities Litigation Re for m Act of 1995. Forward - looking statements are based on the company’s current assumptions regarding future business and financial performa nce. Those statements by their nature address matters that are uncertain to different degrees. Those statements involve a number o f f actors that could cause actual results to differ materially. Additional information concerning these factors is contained in the Company’ s f ilings with the SEC. Copies are available from the SEC, from the IBM web site, or from IBM Investor Relations. Any forward - looking statement mad e during this presentation speaks only as of the date on which it is made. Except as requested by law, the company assumes no obligati on to update or revise any forward - looking statements. These charts and the associated remarks and comments are integrally related, and are inte nded to be presented and understood together. In an effort to provide additional and useful information regarding the company’s financial results and other financial infor mat ion, as determined by generally accepted accounting principles (GAAP), these materials contain certain non - GAAP financial measures on a continuing operations basis, specifically free cash flow. The rationale for management’s use of this non - GAAP information and its reconcili ation are included on pages 58 and 59, respectively, of the Company’s Annual Report, which is Exhibit 13 to the Form 10 - K submitted to the SEC on February 25, 2020. Note: ROIC equals net operating profits after tax (GAAP net income from continuing operations plus after - tax interest expense) d ivided by the sum of the average debt and average total stockholders’ equity. It is computed excluding current period U.S. Tax reform charg es and goodwill associated with the Red Hat acquisition. Note: In November 2019, Mr. Thomas Buberl was elected to the IBM Board, effective April 28, 2020.

[E-MAIL]

Dear IBM Senior Leaders:

Re: Voting Your IBM Shares for the 2020 Annual Meeting

I hope you and your family are staying healthy and safe in this

extraordinary time. With this note, I am writing to remind you to make sure to vote all of your IBM shares for the 2020 Annual

Meeting. By now you should have received a copy of IBM’s 2020 Proxy Statement along with the proxy card or notice of Internet

availability of proxy materials. If you hold IBM shares in “street name” (i.e., through a bank or broker), you will

have received a voter instruction form from your bank or broker. We expect that many of you will receive multiple copies of the

proxy materials, reflecting different ownership accounts you may have. Please make sure to vote all of the proxy voting cards that

you receive or follow the instructions on the notice of Internet availability of proxy materials, if applicable.

In 2019, IBM generated more than $77 billion in revenue and

ended the year on a strong note, returning to overall revenue growth in the 4th quarter. Cloud revenue increased 11

percent year to year and represented 27% of our overall revenue. We also achieved strong cash generation with net cash from operating

activities of $14.8 billion and free cash flow of $11.9 billion. We returned $7.1 billion to you, our stockholders, including $5.7

billion of dividends. We increased our dividend for the 24th consecutive year, and 2019 was IBM’s 104th

straight year of providing one. With help from IBM, our clients are now entering Chapter 2 of their digital reinventions. IBM is

helping them to modernize and move their mission-critical workloads to the cloud, and infuse AI deep into the decision-making workflows

of their businesses.

As you know, earlier this year, we announced that after eight

years leading the Company, Ginni Rometty will transition to the role of Executive Chairman of the Board on April 6, 2020 before

retiring after nearly 40 years with IBM. Arvind Krishna, the principal architect of the Company’s acquisition of Red Hat

will become the Chief Executive Officer, and James Whitehurst, Senior Vice President and CEO of Red Hat will become IBM’s

President. We are well-positioned to lead our clients into the next chapter of the cloud and cognitive era and your Board has elected

a proven technical and business-savvy leadership team.

IBM sustains the digital operations of the world’s most

critical organizations. There long-term relationships are one reason why IBM has been able to weather many storms over its 109-year

history. The majority of our revenues are recurring and we have a strong balance sheet. We also have the financial flexibility

at this pivotal time to run and invest in our business for now and for the long run.

It is important that you show your support for IBM and vote

your shares. In particular, we are asking you to support management and the Board of Directors by casting your vote:

|

|

·

|

FOR Item of Business 1: Election of our Directors

|

|

|

·

|

FOR Item of Business 2: Ratification of our Independent Accounting Firm

|

|

|

·

|

FOR Item of Business 3: Say on Pay Proposal

|

|

|

·

|

AGAINST Item of Business 4: Stockholder Proposal on the Right to Remove Directors

|

|

|

·

|

AGAINST Item of Business 5: Stockholder Proposal on the Right to Act by Written Consent

|

|

|

·

|

AGAINST Item of Business 6: Stockholder Proposal to Have

an Independent Board Chairman

|

For the reasons explained in our Proxy Statement, we believe

that such votes are in the best interests of our Company and its stockholders.

|

|

·

|

If

you hold your shares in record name (i.e., directly through our transfer agent, Computershare)

and need assistance regarding your record accounts, please contact Bob Wilt at infoibm@us.ibm.com.

|

|

|

·

|

If you hold your shares in street name (e.g., Morgan Stanley, Bank

of America Merrill Lynch, Charles Schwab, or another financial institution), IBM cannot access your account or provide you with

a replacement voting instruction form. In this case, you will need to contact your broker directly in order to obtain a replacement

voting instruction form.

|

If you have already voted all of your shares, there is no need

to contact us and no further action is required on your part. In case you have not received or have misplaced your proxy voting

card, IBM periodically sends a follow-up mailing that includes a proxy voting card.

You may also find additional information at http://www.ibm.com/investor/proxyinformation.

If you do not receive a copy of the Proxy Statement or notice of Internet availability of proxy materials by Thursday, April

16, 2020, please contact Bob Wilt at infoibm@us.ibm.com. Please do not hesitate to call me at 914-499-xxxx or email me

at xxxxxx@us.ibm.com if you have questions or comments.

Sincerely,

|

/s/ Frank Sedlarcik

|

|

|

|

|

|

Frank Sedlarcik

|

|

|

Vice President and Secretary

|

|

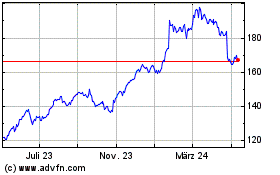

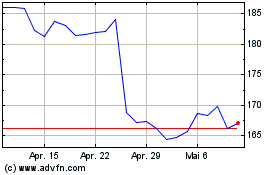

International Business M... (NYSE:IBM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024