TIDMHSBA

RNS Number : 3230I

HSBC Holdings PLC

31 March 2020

HSBC HOLDINGS PLC

STATEMENT ON 2019 FOURTH INTERIM DIVIDEND AND

2020 ORDINARY SHARE DIVIDENDS

The Board of HSBC Holdings plc ('HSBC') has today received from

the Bank of England through the Prudential Regulation Authority

('PRA') a written request not to pay, in HSBC's case, the fourth

interim dividend in respect of 2019. Similar requests have been

made to other UK incorporated banking groups.

The Board recognises the current and potential material impact

on the global economy as a result of the coronavirus pandemic and

the important role that HSBC has in helping its customers to manage

through the crisis and to have resources to invest when recovery

occurs. HSBC has a strong capital, funding and liquidity position;

however, there are significant uncertainties in assessing the time

period of the pandemic and its impact.

The Board has therefore met to discuss the written request from

the PRA and, in response to the request, has cancelled the fourth

interim dividend of US$0.21 per ordinary share, which was scheduled

to be paid on Tuesday, 14 April 2020. The Board regrets the impact

this cancellation will have on our shareholders, including our

retail shareholders in Hong Kong, the UK and elsewhere.

The Board has also decided that until the end of 2020 we will

make no quarterly or interim dividend payments or accruals in

respect of ordinary shares, or undertake any share buy-backs in

respect of ordinary shares.

The Board will review the ordinary share dividend policy and

payments in respect of 2020 once the full impact of the pandemic is

better understood, and economic forecasts for global growth in

future years are clearer. These factors will be considered,

alongside analysis of our own internal financial projections and

modelling.

HSBC is committed to supporting customers in the economies in

which we serve, in particular in our two home markets of Hong Kong

and the UK. In strengthening its ability to support its customers,

the Board believes that HSBC will be better placed to grow its

business for the long term.

HSBC will announce its first quarter 2020 results on Tuesday, 28

April 2020. Group performance has been resilient in the first

quarter in difficult economic conditions and, so far, credit

performance has held up well. However, as a result of the global

impacts of COVID-19, and its impact on interest rates, market

levels and the forward economic outlook, we expect reported

revenues to be impacted in insurance manufacturing, and credit and

funding valuation adjustments in Global Banking & Markets,

alongside higher Expected Credit Losses ('ECL').

For and on behalf of

HSBC Holdings plc

Aileen Taylor

Group Company Secretary and Chief Governance Officer

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014.

Investor enquiries to:

Mark Phin +852 2822 4908 investorrelations@hsbc.com

Richard O'Connor +44 (0) 20 7991 6590 investorrelations@hsbc.com

Media enquiries to:

Heidi Ashley +44 (0) 20 7992 2045 heidi.ashley@hsbc.com

May Kek +852 2822 4940 may.y.m.kek@hsbc.com.hk

Background notes

-- In 2019, first, second and third interim dividends of US$0.10

per ordinary share each were announced and paid, out of a total of

four dividends totalling US$0.51 per ordinary share announced in

respect of that financial year (including the fourth interim

dividend of US$0.21 which was announced on 18 February 2020 and was

scheduled to be paid on 14 April 2020 prior to the decision to

cancel).

-- HSBC is introducing a range of support measures for customers

around the world. For personal customers, where appropriate, this

may include payment holidays on products such as mortgages,

personal loans and credit cards, waiving some fees and charges, and

facilitating access to physical cash. For business customers, we

will consider loan repayment holidays, extensions to trade and

working capital loans, and fee waivers on certain products. To date

we have already introduced special relief loans for some personal

customers in Hong Kong, allocated GBP8bn to support business

customers in the UK, and partnered with healthcare providers in

mainland China to offer virtual consultation services to ease the

pressure on hospitals and reduce cross-infection. HSBC announced in

February a series of proactive measures to support Hong Kong

businesses and personal customers, providing immediate liquidity

relief of more than HK$30bn for businesses of all sizes, as well as

easing short-term cash-flow pressures and enhancing insurance

protection for personal customers. We are constantly reviewing and

updating our support packages as the pandemic continues to

unfold.

-- HSBC has announced a US$25m COVID-19 charitable fund to

support the international medical response, protect vulnerable

people and ensure food security. Decisions will be made locally, in

response to local need, but we have already earmarked and donated

US$1.75m to relief efforts in mainland China, Hong Kong and India,

GBP1m to the National Emergencies Trust and the British Red Cross

in the UK and US$1m to both the International Federation of Red

Cross and Red Crescent Societies and the World Health

Organisation's COVID-19 Solidarity Campaign.Through long-standing

philanthropic partnerships in Hong Kong, we are identifying ways to

address the most pressing needs of vulnerable groups and support

the eventual recovery.

Notes to editors:

1. The Board of Directors of HSBC Holdings plc as at the date of

this announcement comprises:

Mark Tucker*, Noel Quinn, Kathleen Casey , Laura Cha , Henri de

Castries , Irene Lee , José Antonio Meade Kuribreña , Heidi Miller

, David Nish , Ewen Stevenson, Jackson Tai and Pauline van der Meer

Mohr .

* Non-executive Group Chairman

Independent non-executive Director

2. HSBC Holdings plc

HSBC Holdings plc, the parent company of the HSBC Group, is

headquartered in London. HSBC serves customers worldwide from

offices in 64 countries and territories in our geographical

regions: Europe, Asia, North America, Latin America, and Middle

East and North Africa. With assets of US$2,715bn at 31 December

2019, HSBC is one of the world's largest banking and financial

services organisations.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This communication contains both historical and forward-looking

statements. All statements other than statements of historical fact

are, or may be deemed to be, forward-looking statements.

Forward-looking statements may be identified by the use of terms

such as 'may,' 'intends,' 'plan,' 'will,' 'should,' 'potential,'

'reasonably possible' or 'anticipates' or the negative thereof or

similar expressions, or by discussions of strategy. These

forward-looking statements include statements relating to the

impact of the COVID-19 outbreak on the global markets generally and

on HSBC Holdings plc and its subsidiaries (together, the 'HSBC

Group') in particular. HSBC Holdings plc has based the

forward-looking statements on current expectations and projections

about future events. These forward-looking statements are subject

to risks, uncertainties and assumptions about us, as described

under 'Cautionary statement regarding forward-looking statements'

contained in the HSBC Holdings plc Annual Report on Form 20-F for

the year ended 31 December 2019, filed with the SEC on 19 February

2020 (the '2019 Form 20-F'), and in other reports on Form 6-K

furnished to or filed with the SEC subsequent to the 2019 Form 20-F

('Subsequent Form 6-Ks'). HSBC Holdings plc undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. In light of these risks, uncertainties and

assumptions, the forward-looking events discussed herein might not

occur. Investors are cautioned not to place undue reliance on any

forward-looking statements, which speak only as of their dates.

Additional information, including information on factors which may

affect the HSBC Group's business, is contained in the 2019 Form

20-F and Subsequent Form 6-Ks.

ends/all

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDEAFDFDSAEEAA

(END) Dow Jones Newswires

April 01, 2020 02:00 ET (06:00 GMT)

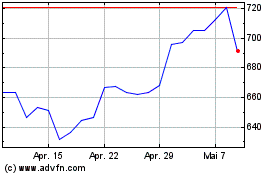

Hsbc (LSE:HSBA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

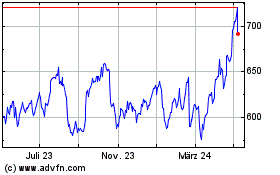

Hsbc (LSE:HSBA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024