Amended Statement of Beneficial Ownership (sc 13d/a)

31 März 2020 - 12:04PM

Edgar (US Regulatory)

CUSIP No. 69331C108

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the

Securities Exchange Act of 1934

(Amendment No. 10)*

PG&E Corporation

(Name of Issuer)

Common

Stock, no par value

(Title of Class of Securities)

69331C108

(CUSIP Number)

David C. Abrams

c/o Abrams Capital Management, L.P.

222 Berkeley Street, 21st Floor

Boston, Massachusetts 02116

(617) 646-6100

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 30, 2020

(Date of Event Which Requires Filing of This Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 69331C108

Explanatory Note

This

Amendment No. 10 amends the statement on Schedule 13D filed with the Securities and Exchange Commission by (i) Abrams Capital, LLC, (ii) Abrams Capital Management, LLC, (iii) Abrams Capital Management, L.P., (iv) Great

Hollow Partners, LLC and (v) David Abrams (together with each of the foregoing, the “Reporting Persons”) on August 7, 2019 (the “Schedule 13D”), as amended on August 8, 2019, September 11, 2019,

September 13, 2019, November 18, 2019, December 11, 2019, December 17, 2019, December 27, 2019, January 23, 2020 and March 2, 2020 with respect to common stock of PG&E Corporation (the “Company”).

Capitalized terms used but not defined in this Amendment No. 10 have the meanings set forth in the Original Schedule 13D.

As

reported in the Schedule 13D, Abrams CM LP may have been deemed to be a member of a group with the Other Shareholder for purposes of SEC Rule 13d-3.

This Amendment No. 10 is being filed to amend and supplement Item 4 of the Schedule 13D as set forth below.

|

Item 4.

|

Purpose of Transaction.

|

On March 30, 2020, Abrams CM LP and the Other Shareholder terminated the Investor Agreement pursuant to its terms as well as their status

as a “group” with respect to the Shares for purposes of Section 13(d)(3) of the Act and Rule 13d-5(b)(1) thereunder.

CUSIP No. 69331C108

Page 3 of 3 Pages

SIGNATURES

After

reasonable inquiry and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: March 30, 2020

|

|

|

|

|

ABRAMS CAPITAL MANAGEMENT, L.P.

|

|

|

|

|

By:

|

|

ABRAMS CAPITAL MANAGEMENT, LLC,

its General Partner

|

|

|

|

|

By:

|

|

/s/ David Abrams

|

|

|

|

Name: David Abrams

Title: Managing Member

|

|

|

|

ABRAMS CAPITAL MANAGEMENT, LLC

|

|

|

|

|

By:

|

|

/s/ David Abrams

|

|

|

|

Name: David Abrams

Title: Managing Member

|

|

|

|

ABRAMS CAPITAL, LLC

|

|

|

|

|

By:

|

|

/s/ David Abrams

|

|

|

|

Name: David Abrams

Title: Managing Member

|

|

|

|

GREAT HOLLOW PARTNERS, LLC

|

|

|

|

|

By:

|

|

/s/ David Abrams

|

|

|

|

Name: David Abrams

Title: Managing Member

|

|

|

|

DAVID ABRAMS

|

|

|

|

|

By:

|

|

/s/ David Abrams

|

|

|

|

Name: David Abrams

Title: Individually

|

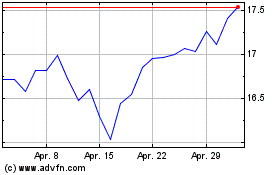

PG&E (NYSE:PCG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

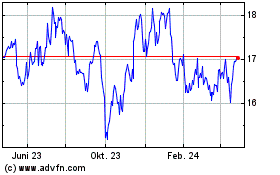

PG&E (NYSE:PCG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024