SoftBank Dumps Moody's Over Rating -- WSJ

26 März 2020 - 8:02AM

Dow Jones News

By Phred Dvorak

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 26, 2020).

SoftBank Group Corp. dropped Moody's Investors Service after the

credit-ratings firm criticized the Japanese tech giant's massive

share-and-debt buyback plan and downgraded its ratings by two

notches.

Moody's questioned the "unexpected size and apparent urgency" of

SoftBank's plan, which proposes up to $41 billion in asset sales to

fund repurchases of stocks and bonds.

SoftBank said Wednesday that there was no rationale for such a

large downgrade and that the action "will cause substantial

misunderstanding among investors."

SoftBank's rating was already considered noninvestment grade, or

junk, before Wednesday's downgrade. Moody's cut, to Ba3 from Ba1,

won't force any bond redemptions or affect its loans, a SoftBank

spokesperson said.

The tit-for-tat highlights the conflict of interest underlying

credit ratings, since companies pay to be rated and can dump rating

firms that don't give them scores they like. It also suggests how

high the stakes are for SoftBank, which is pulling out the stops to

raise its share price, which had halved since February, and bolster

its balance sheet, weighed down by $70 billion in stand-alone

debt.

SoftBank, best known for the aggressive bets it made through its

$100 billion Vision Fund, has also lost the confidence of investors

following the multibillion-dollar bailout of one of its biggest

investments, the parent of office-share company WeWork. SoftBank

has halted fundraising for a successor to the Vision Fund,

substantially slowed the pace of its investments and is selling up

to a fifth of its of assets -- chiefly a stake in Chinese

e-commerce company Alibaba Group Holding Ltd. that is currently

worth more than $120 billion -- to fund the share and debt

buybacks.

SoftBank's aggressive buyback plan has been cheered by many

investors. The group's share price has shot up more than 50% since

the buyback announcement on Monday, and the price of a credit

default swap, a financial instrument that offers protection against

potential bankruptcy, has fallen more than 20%.

S&P Global Inc. on Tuesday cautiously praised the plan,

saying it could "ease the downward pressure on its credit quality"

and might show SoftBank was paying more attention to its financial

soundness, although it warned the plan may be hard to execute

during the current market turmoil.

In the statement explaining its downgrade, Moody's also pointed

out that SoftBank might not be able to sell assets during the

market downturn. It said that trying to do so could mean selling at

a discount and damaging the value of its remaining holdings. Those

investment holdings underpin SoftBank's big pile of corporate bonds

as well as a plethora of loans and credit facilities.

Moody's also noted concerns about a deterioration of the credit

quality of other companies SoftBank invests in, possible problems

in turning around WeWork and an increase in a variety of

liabilities, including margin loans.

SoftBank said that Moody's view of the markets was too

pessimistic and that the buyback plan would end up improving credit

quality, since it called for using up to $23 billion to redeem debt

and beef up cash reserves, in addition to the $18 billion for share

repurchases.

Write to Phred Dvorak at phred.dvorak@wsj.com

(END) Dow Jones Newswires

March 26, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

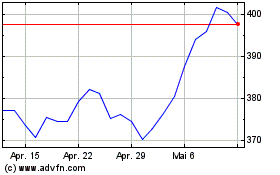

Moodys (NYSE:MCO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Moodys (NYSE:MCO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024