Euro, Pound Advance On U.S. Stimulus Optimism

25 März 2020 - 8:45AM

RTTF2

The euro and the pound appreciated against their major

counterparts in the European session on Wednesday, as the U.S.

Senate reached a deal on a $2 trillion stimulus package to mitigate

the fallout from the coronavirus crisis.

European shares rose after U.S. senators and White House

officials have agreed on the stimulus bill following days of tense

negotiations between Republicans and Democrats.

The proposal include payments to Americans, aid to small

businesses, unemployment insurance, tax deference and other

measures.

The Senate is expected to vote later in the day.

In economic releases, final survey data from ifo Institute

showed that German business sentiment logged its steepest fall ever

recorded since German reunification, as the spread of coronavirus

weighed on economic activity.

The business confidence index fell to 86.1 in March from 96.0 in

February. This was the biggest fall since German reunification and

reached its lowest level since July 2009. The preliminary reading

for March was 87.7.

Data from the Office for National Statistics showed that U.K.

consumer price inflation slowed marginally in February.

Consumer prices advanced 1.7 percent from last year in February,

as expected, after gaining 1.8 percent in January.

The pound rose to 5-day highs of 1.1973 against the dollar and

0.9055 against the euro, from its early lows of 1.1742 and 0.9180,

respectively. The pound is seen facing resistance around 1.30

against the dollar and 0.86 against the euro.

Reversing from its early lows of 130.40 against the yen and

1.1527 against the franc, the pound moved up to near a 2-week high

of 133.40 and a 9-day high of 1.1718, respectively. The pound is

likely test resistance around 135.00 against the yen and 1.24

against the franc.

The euro drifted higher to a fresh 2-week high of 1.0628 against

the franc and a fresh 3-week high of 120.90 against the yen, after

falling to 1.0581 and 119.51, respectively. Next key resistance for

the euro is seen around 1.10 against the franc and 123.00 against

the yen.

The euro was up at 1.0850 a greenback, following a decline to

1.0760 at 8:45 pm ET. Should the euro rises further, 1.10 is likely

seen as its next resistance level.

Looking ahead, U.S. durable goods orders for February and FHFA's

house price index for January will be featured in the New York

session.

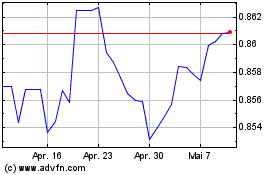

Euro vs Sterling (FX:EURGBP)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs Sterling (FX:EURGBP)

Forex Chart

Von Apr 2023 bis Apr 2024