By Paul Ziobro

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 13, 2020).

FedEx Corp. Chief Executive Fred Smith has cut ties with

Amazon.com Inc., is phasing out the U.S. Postal Service and is

fully embracing online shopping, part of the most sweeping changes

ever at the shipping giant he launched nearly 50 years ago.

The reason: his faith in Raj Subramaniam, a marketing executive

from India tapped as Mr. Smith's likely successor.

The latest moves were inspired by strategic reports that Mr.

Subramaniam, who turned 54 years old Wednesday, produced for Mr.

Smith and the company's board. Hundreds of pages long, the reviews

outlined a new playbook for FedEx, including going all-in on

shipping online orders, and discussed how far the company had to go

to be a real player in the e-commerce economy.

"We had to adapt, change and be ready for the market that's

evolving," said Mr. Subramaniam, who was appointed chief operating

officer last year and joined the FedEx board in January. "And so we

made some very, very bold steps."

FedEx began reducing its reliance on the U.S. Postal Service,

which for years had delivered millions of the carrier's packages to

homes each week. The company also started making deliveries seven

days a week, up from six, to satiate the never-ending schedule of

online shopping. It launched new services to quickly ship packages

from stores to homes. It forged ties with retailers to add

thousands of new stores, including in rural areas, to a network of

locations to pick up and drop off packages.

"He did all of the research and foundational planning for the

strategy that we are executing today," Mr. Smith said in a recent

interview. "For all intents and purposes, Raj is the architect of

that."

Last month Mr. Subramaniam, a three-decade veteran of FedEx,

unveiled the company's latest break from longstanding practice with

his plan to mix some packages between the company's two main

divisions: Express, which ships critical parcels using aircraft and

often guarantees deliveries by a certain time, and Ground, a slower

service that uses a network of trucks and targets deliveries to

arrive by a certain date. FedEx will hand off some of its Express

packages to Ground if it can meet promised delivery times. Mr.

Smith for years has resisted investor calls to integrate the two

units to save money, saying keeping them separate was vital to

maintaining the promise of speedy delivery by Express.

Analysts and investors cheered the move, saying it could save

FedEx hundreds of millions of dollars a year at a time when profits

have shrunk and its share price has tumbled -- nearly 30% over the

past year.

Mr. Subramaniam didn't dream of working at a global shipping

company during his typical middle-class childhood in India. His

father was a police chief and his mother a doctor, and they

instilled in him a focus on education. His forte was math.

"Either you're good at math or good at biology," Mr. Subramaniam

said. "You're either going to become an engineer or a doctor."

After graduating with a chemical engineering degree, he left the

country for the first time on a scholarship to Syracuse University,

where he earned a master's degree, and later finished an M.B.A. at

the University of Texas during the early 1990s recession. He went

months without a job offer. He got the phone number of a FedEx

interviewer from a roommate who had decided to return home instead

of applying for a job at the delivery company.

Mr. Subramaniam started with FedEx as an associate marketing

analyst. Six months in, Mr. Smith spoke at a quarterly staff

meeting about the international opportunities at FedEx, saying the

company needed marketing minds to help develop the network and

service to sell to customers. "I said, 'Hey, I get this. Put me

in,' " Mr. Subramaniam recalled.

He rose through the marketing ranks and later held high-profile

international posts.

FedEx's approach to e-commerce is new. Until recently the

company stuck to its core businesses of charging companies premium

rates to move priority shipments long distances by plane or truck.

It took most e-commerce orders only as far as the local post

office, where mail carriers would deliver them to homes for a fee.

FedEx was happy to cede the less-profitable residential business to

rival United Parcel Service Inc.

The explosion of e-commerce, financial woes of the Postal

Service and lower demand in the Express air business led FedEx to

rethink its strategy.

FedEx's reinvention also includes the divorce with Amazon, the

largest player in e-commerce. FedEx believes there is a universe of

online retailers outside of Amazon that is growing fast enough to

fill up its delivery network. FedEx also was wary of tying too much

of its business to a company increasingly delivering more of its

own packages.

"We like to have a much more diversified customer base," Mr.

Subramaniam said. Not having Amazon as a customer opens up

conversations with retailers that increasingly compete with the

online giant. "It's the right long-term strategy for FedEx."

UPS, which last year received nearly 12% of its overall revenue

from Amazon, said the relationship is "mutually beneficial" and

that the company is building up its delivery services to serve a

broad base of merchants.

Mr. Subramaniam's profile rose quickly starting in late 2018

with two abrupt retirements. First, the CEO of FedEx's legacy

Express business stepped down, and Mr. Subramaniam was promoted to

that role. A few months later, Chief Operating Officer David

Bronczek retired shortly after being named to the board, leading to

another promotion.

His election to FedEx's board in January cemented Mr.

Subramaniam as next in line to succeed the 75-year-old Mr. Smith,

who said he has no plans to step down soon. "To the best of my

knowledge, I'm in good health," Mr. Smith said, adding he won three

sets of tennis playing with a regular group. "I don't have any

ailments that would prevent me from doing my job."

Mr. Subramaniam and FedEx still have other challenges to manage,

including ongoing trade disruption, slack industrial production and

expected fallout from the coronavirus, which analysts expect to

dent international air shipments. He also is overseeing the

drawn-out integration of the acquisition of the European

parcel-delivery company TNT.

The tasks are far weightier than the ones that Mr. Subramaniam

envisioned he would be leading at FedEx when he first started. "I

thought I'd have a better chance to play Center Court in July at

Wimbledon," he said.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

March 13, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

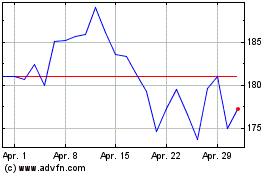

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

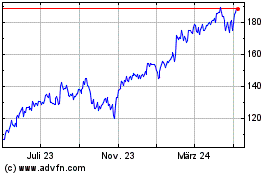

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024