Euro Mixed After ECB Announcement

12 März 2020 - 10:49AM

RTTF2

The euro showed mixed trading against its major counterparts in

the European session on Thursday, after the European Central Bank

kept key rates unchanged and boosted asset purchase program to

counter the economic impact of the coronavirus.

The Governing Council left the key interest rates unchanged

after the policy session in Frankfurt.

The main refi rate is currently at a record low zero percent and

the deposit rate at -0.40 percent. The marginal lending facility

rate is at 0.25 percent.

The bank expanded quantitative easing program by 120 billion

euros until the end of the year.

The ECB will conduct additional longer-term refinancing

operations temporarily to provide immediate liquidity support to

the euro area financial system.

In TLTRO III, the bank will apply more favourable terms during

the period from June 2020 to June 2021 to support bank lending to

those affected most by the spread of the coronavirus, in particular

small and medium-sized enterprises.

Data from Eurostat showed that Eurozone industrial production

expanded for the first time in five months in January.

Industrial output grew at a faster-than-expected pace of 2.3

percent on a monthly basis and in contrast to a revised 1.8 percent

drop in December.

The currency showed mixed trading against its major counterparts

in the Asian session. While it rose against the greenback and the

pound, it fell against the yen and the franc.

The euro rebounded to 1.0577 against the franc, from a 3-day low

of 1.0545 seen at 7:15 am ET. The euro is seen finding resistance

around the 1.09 mark.

The euro firmed to a 5-month high of 0.8899 against the pound,

from yesterday's closing value of 0.8785. Next key resistance for

the euro is likely seen around the 0.90 level.

Survey data from the Royal Institution of Chartered Surveyors

showed that UK house price inflation gathered momentum in February

as prices increased across all parts of the country.

The house price balance rose sharply to 29 percent in February

from 18 percent in January. This was also above economists'

forecast of 20 percent.

The euro dropped to a weekly low of 1.1198 against the

greenback, from Wednesday's closing value of 1.1269. Should the

euro falls further, it is likely to test support around the 1.105

region.

The euro remained lower against the yen, at 116.92. The EUR/JPY

pair has set a 3-day low of 116.31 at 7:30 am ET. The euro is

poised to challenge support around the 114.00 mark.

Data from the Bank of Japan showed that Japan producer prices

fell 0.4 percent on month in February.

That was shy of expectations for a decline of 0.3 percent

following the 0.2 percent increase in January.

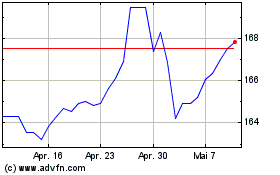

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

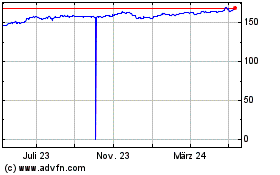

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024