Adidas, Puma Shares Fall on Warnings of Murky Visibility on Virus Shortfall

11 März 2020 - 2:14PM

Dow Jones News

-Adidas expects first-quarter sales in Greater China to fall by

up to $1.14 billion

-Puma warned its 2020 view was based on expectations now proving

to be too optimistic as the virus spreads

-Both companies said the situation is too unpredictable to say

what it means for their full-year results

By Cristina Roca

Shares in adidas AG traded sharply lower on Wednesday after the

company warned its sales in Greater China could fall by more than

$1 billion during the first quarter of the year because of the

coronavirus, and that it can't calculate the impact the epidemic

will have on its full-year results.

News from the competition was also grim, with Puma SE saying

Wednesday that its 2020 guidance could be at risk. The German

sporting-goods company's earlier expectations that the situation

around the virus would quickly normalize are now proving too

optimistic with the epidemic now spreading to Europe and the U.S.,

Puma said.

At 1202 GMT, shares in adidas traded 7.9% lower at 203.70 euros

($231.1). Shares in its cross-town rival Puma were down 4.4% at

EUR56.05.

Adidas raised its dividend after a strong increase in

fourth-quarter net profit and sales helped boost results for 2019.

But all eyes were on 2020, Citi analysts said. Adidas said it

expects its sales to drop by more than 10% during the first quarter

due to the coronavirus, and said visibility was too low to estimate

the impact of the epidemic on its performance for the full

year.

The German company said its business in China has been

significantly affected by the virus. Due to the closure of many

stores and lower traffic in those that remained open, revenue in

the Greater China region dropped about 80% between late January and

the end of February. Since then, the situation has improved

slightly, with stores gradually reopening and traffic picking

up.

Adidas said it expects first-quarter revenue in the region to be

between 800 million euros and 1 billion euros ($908 million-$1.14

billion) lower compared to a year earlier, with operating profit

for the quarter falling between EUR400 million and EUR500

million.

In order to adjust its inventory to the drop in demand, adidas

said it cancelled all February shipments and that it could accept a

"significant amount of product takebacks, which the company plans

to clear through its own channels throughout the remainder of the

year."

The virus-caused hit to the first quarter looks worse than

feared, Jefferies analysts said. Citi analysts estimated that it

will translate into a 15%-20% hit to the company's net profit for

2020.

The company's full-year guidance didn't account for any impact

from the coronavirus. "We cannot yet reliably quantify the

magnitude of the overall financial impact in 2020," Chief Executive

Kasper Rorsted said.

Adidas said it expects revenue growth of between 6% and 8% at

constant currencies in 2020. Operating margin is seen increasing to

between 11.5% and 11.8%, while the company targets growth of

10%-13% in net income from continuing operations. The company

warned its guidance is subject to change as it could be hit by the

coronavirus.

Adidas also said it would propose a 15% increase in the dividend

to EUR3.85 a share. It said net profit for the last quarter of 2019

rose 54% to EUR167 million, while revenue grew almost 12% to

EUR5.84 billion.

However, the company's earnings before interest and taxes came

below consensus expectations, analysts at UBS and RBC said, which

probably contributed to Wednesday's negative share-price

reaction.

Separately on Wednesday, Puma, which like rival adidas is based

in the Bavarian town of Herzogenaurach, said it no longer expects a

short-term normalization of the situation around the virus--an

assumption based on which the company last month guided for

currency-adjusted sales growth of 10% as well as a strong rise in

EBIT for 2020.

Puma said it can't yet calculate what this will mean for its

full-year performance.

The sporting-goods company said it is seeing significantly lower

store traffic in Europe at the moment, even though almost all its

stores in the region are still open. In China, the company is

seeing early signs of improvement, with most stores back open and

traffic beginning to pick up.

Puma said it is so far only experiencing minor delays as far as

the impact of the virus on its global supply chain is

concerned.

"The supply side seems much less of an issue than feared" for

European sporting-goods players, Citi analysts say. Adidas also

said its global sourcing hasn't been impacted by the virus thus

far.

Write to Cristina Roca at cristina.roca@dowjones.com

(END) Dow Jones Newswires

March 11, 2020 08:59 ET (12:59 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

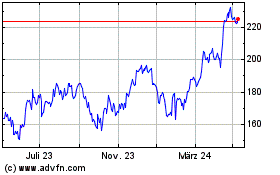

Adidas (TG:ADS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

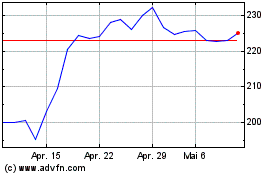

Adidas (TG:ADS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024